In an increasingly globalized world, the dominance of the US over the global economy is declining. For example, in the past six years the U.S. share of total global market capitalization has fallen from an average of 57% in 2003 to 49% currently according to a report by Morgan Stanley. Much of this weight has swung to the BRIC countries which now account for about 7.6% of world market cap. These countries are on an almost equal footing with the might of France and Germany combined.

While emerging markets are growing faster and account for a larger portion of the global GDP, their market capitalization has not grown proportionately. Emerging countries contribute about 33% of the world’s total economic output (in nominal current terms), yet they account for just 14% of the world’s total market capitalization as measured by the MSCI All Country World (ACWI) index. The market cap of emerging markets will expand over time due to economic growth.

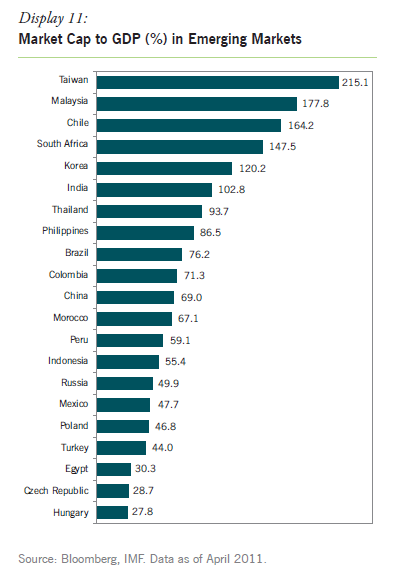

Significant disparities exist in the valuation of various emerging markets. The following chart shows the market cap to GDP of some emerging markets:

Source: Investment Management Journal, Volume 1, Issue 2, Morgan Stanley

The stock markets of Chile, Taiwan, Malaysia and South Africa are more mature and are valued higher than other countries due to large investments by foreign investors and domestic pension funds. In contrast the markets of Indonesia, Poland, Mexico and Turkey do not reflect their full economic size and have further room to grow.

The current crisis in the developed world is dragging down the emerging markets whose fundamentals are relatively strong. Hence investors can consider increasing their exposure to emerging markets.

Related ETFs:

iShares MSCI Emerging Markets Index (EEM)

Vanguard Emerging Markets ETF (VWO)

iShares MSCI South Africa Index Fund (EZA)

iShares MSCI Brazil Index (EWZ)

Disclosure: No Positions

Bloomberg Article: Emerging Equity Bears Buyers on BRIC Retreat