Apple is one of the most successful technology companies in the world.The company has created a niche position in the consumer electronics and computer industry with many world-class products such as the iPhone, Macs, iPad, iPod, etc. Apple has established its brand to be synonymous with the highest quality and is able to charge a premium for its products.

Apple’s common stock goes for about $400 today and it commands a market cap of just over $371 billion. Apple surpassed Exxon Mobil’s(XOM) market cap in August this year making it the most valuable company in the world. From an an investment standpoint, Apple has been an a classic example for brand investing – the theory where a company’s brand plays an integral part in making investment decisions.

Credit Suisse Research Institute published an interesting report on brand investing last year. The following is a brief summary of the some key takeaways from the report:

According to Credit Suisse, most brands go through the following five unique brand lifecycle stages:

1) Emerge

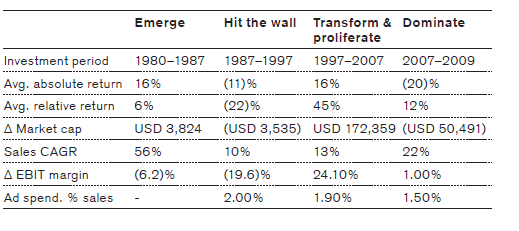

This is the phase when a brand establishes itself as a relevant new presence in a marketplace and is identified by consumers for its unique product or service proposition.This stage usually takes 5–10 years and is characterized by fast growth, an IPO and strong shareholder returns.

2) Hit the wall

In this is phase, a company has difficulty making the critical step of transforming itself from a product company to a brand company.

3) Transform and proliferate

This is the phase when a company “makes the leap” from product company to brand company, in a process that can last 10–30 years. Brands are validated in this stage by expanding distribution to new markets or product categories while simultaneously continuing product development and innovation.From an investment standpoint, this is the best phase to own brand stocks since they generate the most market value.

4) Dominate

The ultimate goal of any brand company is to reach this stage. A brand is dominant when it has the number one or two market share, the brand essence is universally understood by consumers and the company starts to generate meaningful free cash flow because it has less need to invest heavily.

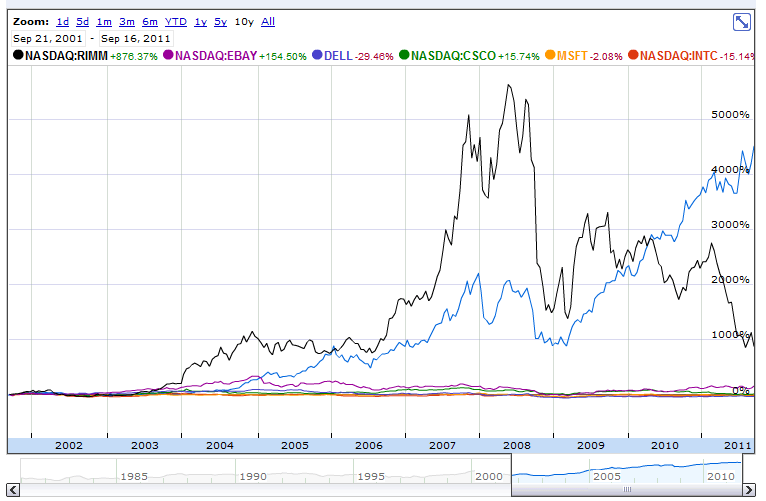

Some of the negative effects of this phase is that companies experience much slower growth and there is little margin opportunity. When brands achieve dominant status, it is usually the best time to sell the shares as they can stagnate for years once becoming dominant. Example of this phenomenon are Wal-Mart(WMT) and Sony(SNE) whose shares have remained sluggish for many years. While Wal-Mart’s shares have returned about just 14% in the past 10 years Sony’s shares have actually lost about 50%. In my opinion tech companies such as Intel, Microsoft, EBay, Cisco, Dell, etc. also fall in this category.

5) Reemerge

Sometimes a once-popular brand that faded from the marketplace can reinvent itself and emerge as a strong growth brand once again, sometimes even stronger than before. Investors can reap high-returns from companies which undergo this situation. Examples of such companies include Apple and Coach.

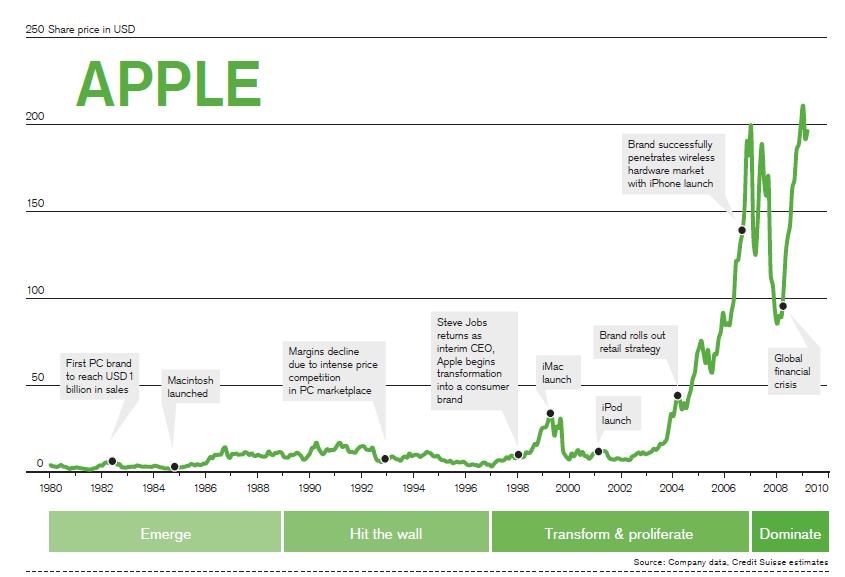

The five phases of the brand lifecycle of Apple:

Click to enlarge

Source: The Power of Brand Investing, Credit Suisse Research Institute, February 2010

Source: The Power of Brand Investing, Credit Suisse Research Institute, February 2010

Nine factors determine whether a brand moves successfully through the “transform and proliferate” phase. Some of these are required and some are optional. These factors are:

- Marketing strategy

- Reliable product/service quality

- Leadership/management

- Corporate culture

- Product innovation

- Process innovation

- Sourcing/distribution control

- Network externalities

- Unique brand intangibles

From the Credit Suisse report on Apple’s Leadership/Managment:

Steve Jobs was one of the three founders of Apple Computer in 1976 and was a leader in pushing for ground-breaking innovation and distinctive design. In 1979, while visiting Xerox PARC research facility, he saw the graphical user interface, which centered on a “mouse,” and adopted this as Apple’s platform for software development. Jobs led the team that developed the Macintosh in 1984, with its anti-establishment ad based on Orwell’s “1984.” Despite the Macintosh’s success, Jobs was forced to resign from the company in 1985 after a power struggle with new CEO John Sculley. During the next decade, Apple continued to innovate with the Powerbook, which was ground-breaking for laptop computer design. Model proliferation followed with other less successful products, such as the Newton, cameras and TV appliances, none of which were break-out hits. With the rise of Microsoft in the 1990s and its market share gains through cheaper PCs, Apple looked expensive and not as cutting-edge, while the Macintosh platform was not powerful enough.

In 1997, Jobs returned, first as an advisor and then as CEO, and in 1998, Apple returned to profitability with the iMac. Jobs led the company with his vision of breakthrough technological innovation and his passion for aesthetic design. He became the face of the brand, presenting Keynote speeches as well as product introductions, as well as embodying its anti-establishment corporate culture, going barefoot around the office. With Jobs at the helm, Apple launched the iPod, iTunes store, and the iPhone. None of these products was the first mover in its segment, but all dominated and set the industry’s direction once introduced.

Apple was lucky to have the visionary leader Steve Jobs at the helm and the other eight attributes noted above. Other companies lack one or many of these factors. For example, Cisco Systems(CSCO) lacks leadership and product innovation, EBay(EBAY) lacks leadership and process innovation, Research In Motion (RIMM) lacks in product innovation, Netflix (NFLX) suffers from a lack of marketing strategy and unique brand intangibles, etc. All these problems are reflected in the equity returns of these firms.

10-year performance of Apple and select few tech firms:

Click to enlarge

Source: Google Finance

As Apple is in the dominant phase now its shares may remain stagnant for many years unless the company is able to keep the momentum on its marketing strategy and come up with innovative products that consumers embrace.

In a recent article Der Speigel mentioned that Apple is like Sushi. From the article:

The economic victory parade of the iPad and iPhone is accompanied by a dreadful emotional letdown, a bit like with the latte macchiato before it. Something that was pleasingly different, that gave its supporters a certain feeling of hipness, has been sucked dry by its sheer ubiquity. What was once cool has now become the epitome of uncool. If everybody has something, it can no longer set you apart. The most valuable company in the world produces exactly what all the other most valuable companies in the world have produced: soulless junk. Apple is like sushi: What was once exclusive is now as common as a lower back tattoo.

Back in the day, when everything was better, the Macintosh enjoyed a reputation for being a well-designed tool for graphic designers. Apple was a protest against the evil empire embodied by Bill Gates. Its sleek devices were designed by people like Hartmut Esslinger of Frog Design, and inspired by Dieter Rams of Braun fame. They turned the brand into a statement. They combined functionality with a feeling of Californian liberalism.

Mac users basked in a feeling of belonging to a select group. Steve Jobs, the eternal hippie, was the chummy opposite of the hyper-ambitious nerd Bill Gates. People happily paid more for the products so that they could feel they were somehow on the right side. The high prices were always also a kind of donation. And it fitted perfectly that the Silicon Valley company was on the verge of going bankrupt in the 1990s.

Disclosure: No Positions