When investing in foreign stocks one of the factors that investors should take into consideration is the tax treatment of dividends earned. To that end, earlier this year I wrote an article on Withholding Tax Rates by Country for Foreign Stock Dividends.

Similar to other countries, the U.S. also has income tax treaties with many countries to avoid double taxation of dividends and other income earned by US citizens. In addition these treaties also offer other favorable tax treatments to investors in order to stimulate investment between each countries and allow free flow of capital. In general, it is a wise idea to invest in countries with which the U.S. has tax treaties.

From the IRS site:

The United States has tax treaties with a number of foreign countries. Under these treaties, residents (not necessarily citizens) of foreign countries are taxed at a reduced rate, or are exempt from U.S. taxes on certain items of income they receive from sources within the United States. These reduced rates and exemptions vary among countries and specific items of income. Under these same treaties, residents or citizens of the United States are taxed at a reduced rate, or are exempt from foreign taxes, on certain items of income they receive from sources within foreign countries. Most income tax treaties contain what is known as a “saving clause” which prevents a citizen or resident of the United States from using the provisions of a tax treaty in order to avoid taxation of U.S. source income.

If the treaty does not cover a particular kind of income, or if there is no treaty between your country and the United States, you must pay tax on the income in the same way and at the same rates shown in the instructions for the applicable U.S. tax return.

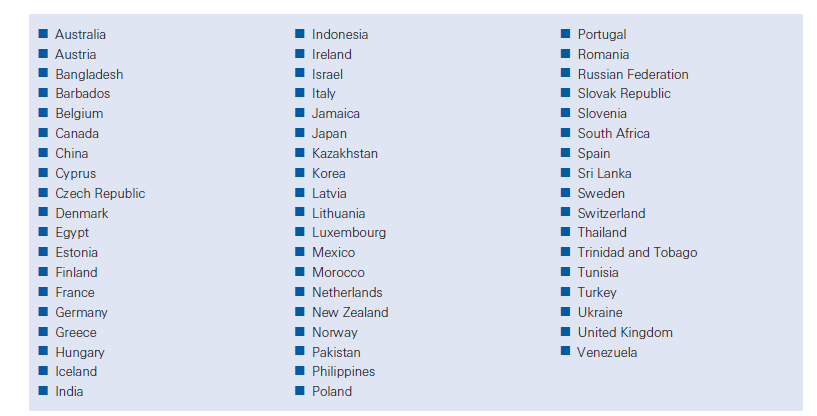

The graphic below lists countries with which the US has income tax agreements:

Note: Data shown is accurate as of 2009.

Source: US Tax Liability on 2009 Dividends, Deutsche Bank Trust Company Americas

For additional information on tax treaties between particular countries and U.S., please refer to the IRS website here.

Publication 901 (04/2011), U.S. Tax Treaties also provides the additional details.

Canadian Investors: The list of countries with which Canada has tax treaties can be found here.

Australian Investors: The list of countries with which Australia has tax treaties can be found here.

I want o transfer my assets from India to us

M

Need to know us income tax treaty with I’m

Ndia

Unfortunately I do not know the answer to your question. Please do some research online.