The Credit Suisse Global Investment Returns Yearbook is the definitive record on long-run market returns. The 2011 edition provides 111 years of data on market returns in 19 countries from 1900 to date. These 19 countries represent 90% of the global stock market value. The following are two of the takeaways from this report:

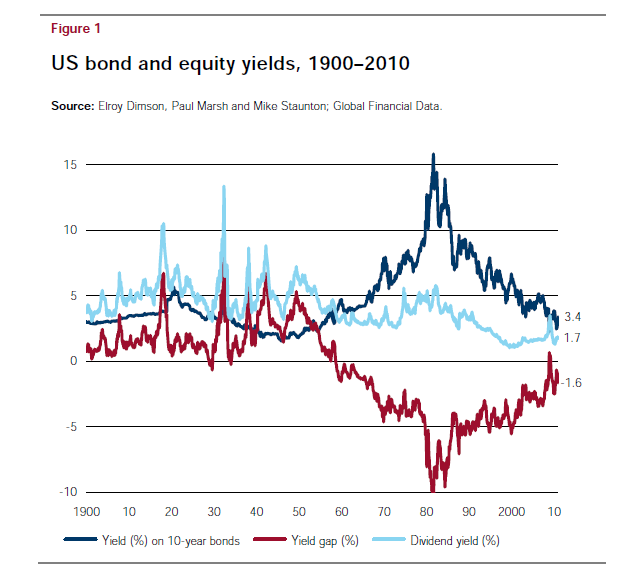

1. The chart below shows that the US yield gap was mostly positive (i.e. equities yielded more than long bonds) until the mid-1950s, while since then it has been mostly negative. The main reason for this has been inflation and inflationary expectations.

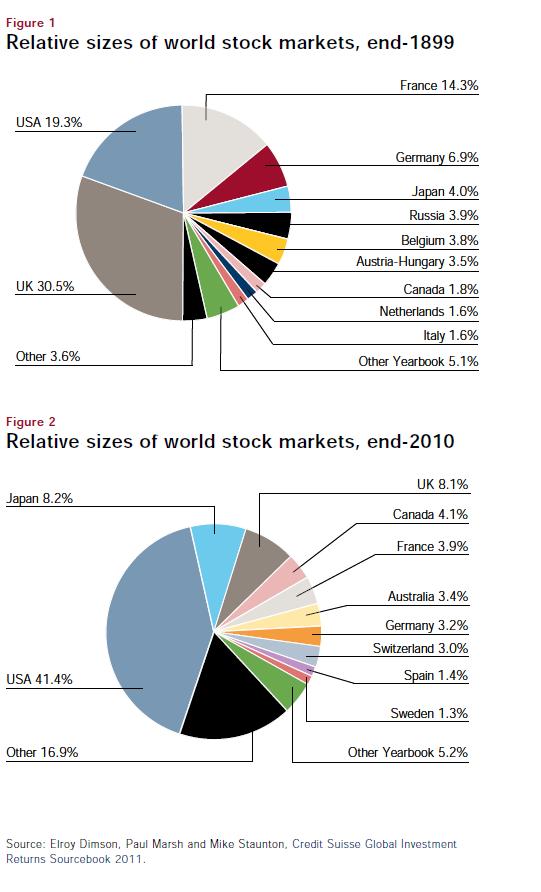

2.The following figure shows the relative sizes of world equity markets at the end of 1899 and how they had changed by end-2010.

This year’s yearbook is filled with many other interesting facts. To download the complete report in pdf format click:Â Credit Suisse Global Investment Returns Yearbook 2011.