The top five banks of Chile based on assets held at the end of 2009 are noted below in descending order:

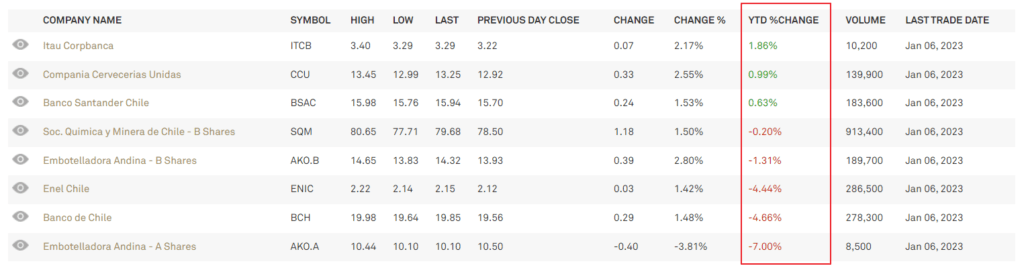

1. Banco Santander Chile (SAN)

Current Dividend Yield: 2.91%

2. Banco de Chile (BCH)

Current Dividend Yield: 4.53%

3. BCI

BCI does not trade on the U.S. markets.

4. BBVA – Chile

BBVA-Chile does not trade on the U.S. markets.

5. CorpBanca (BCA)

Current Dividend Yield: 3.93%

Note: Dividend yield is as of Dec 10, 2010

Chile has been one of the best performing markets this year primarily due to rising commodity prices especially copper and also fluctuations of the peso against the dollar. As of December 9, 2010 Chile is up over 35.0% compared to about 10% for the S&P 500.

Among the three Chilean bank ADRs listed above, CorpBanca has been the best performer in terms of returns over the last five years. A $10K in BCA 5 years ago would have been worth about $42,000 with dividends reinvested as of this month. All the three banks have had strong runs this year and are now trading near their 52-week highs. Hence from an investment standpoint it is better to wait for some pullbacks and add new positions in small increments.

Disclosure: Long BCH