In addition to the dividend yields, the dividend growth rate is also one important factor when selecting stocks with the potential for strong growth in both dividends and price appreciation over the long-term.

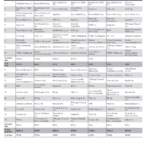

The table below lists 11 U.S. large caps that have grown their dividends at high rates over the past 10 years together with the current dividend yields:

[TABLE=557]

Source:Â PSG Alphen Asset Management

All the stocks noted above have 10-yr dividend growth rates of above 10% with McDonalds(MCD) and United Healthcare (UNH) exceeding 20%. Cigarette maker Reynolds American (RAI) and defense contractor (LMT) pay dividends of over 6% and 4% respectively and have had decent dividend growth in the last decade. New Jersey-based Becton Dickinson(BDX)Â is a global medical technology company engaged in the development, manufacture and sale of medical supplies, devices and reagents.The company has a strong presence in markets outside of the U.S. For example while revenues in the U.S. for the 3rd quarter were $830 million, revenues from outside of the U.S. totaled $1.049 billion.

Nice article. Let me get this straight though. Are you saying that LMT above had its dividend grow an average of 10.3% a year each year for the last ten years. If so doesn’t that mean in the next seven years at the current yield it would be more like you were getting an 8% yield.

KGW

Yes.I am saying that LMT grew its dividend by an average of of 10.3% each year. However the current yield of 4.10% is just the dividend yield now based on current price. It could be an 8% in the future based on your scenario of 7 years. Thanks.