This week FinanceAsia announced the winning banks for many Asian countries for 2010. These banks were selected based on many factors. From the news report:

“The selection of the winning bank is a highly quantitative one, with each bank scored on a number of key performance metrics. Public Bank scored the highest of the 11 shortlisted banks.

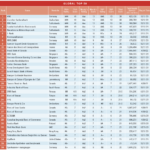

The Best Asian Bank award is given to the bank that ranks the highest among the 11 banks that have individually won our Best Bank award for each country. We ranked the banks by a series of metrics and also by their scores in Standard & Poor’s Bank Fundamental Strength Ratings. The metrics used include: return on assets, return on equity, profit per employee, total assets, percentage of net income derived from fee business, gross NPL ratio, the compound annual growth rate, price-to-book ratio and net interest margin.

The best-ranked bank for each metric got 11 points and the lowest-ranked got 1 point.”

The selection process short-listed 11 banks. The country winners for this year are listed below:

- China Construction Bank (China)

- HDFC Bank (India)

- Bank Mandiri (Indonesia)

- Public Bank (Malaysia)

- Banco de oro Unibank (Philippines)

- DBS (Singapore)

- Shinhan Bank (South Korea)

- Commercial Bank of Ceylon (Sri Lanka)

- Chinatrust Commercial Bank (Taiwan)

- Kasikornbank (Thailand)

- Asia Commercial Bank (Vietnam)

HSBC(HBC) won the Best Bank award for Hong Kong but was excluded as it is really a global bank.

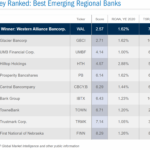

Public Bank of Malaysia won the award for the Best Asian Bank for this year. From the bank’s website:

“Public Bank is a top-tier bank in Malaysia, well-reputed for its prudent management, superior customer service, uncompromising service delivery standards and strong corporate governance and corporate culture. Public Bank remains untouched by the global financial crisis which wrecked havoc in major financial centres around the world.”

Public Bank has paid a dividend every year since 1970.

China Construction Bank (OTC: CICHY) is one of China’s “big four” banks. Currently it pays a 3.52% dividend. HDFC Bank(HDB) is one of the largest private sector banks in India.Among the BRIC countries, Indian stocks have become expensive after a strong run up in recent months.HDB’s P/E ratio is over 41 and the stock yields a tiny 0.45% dividend at current levels. Public Bank(OTC: PBLOF) has a 4.49% yield.