Some investors prefer dividend-paying stocks for long-term investment as opposed to those that pay no dividends. I believe it is better to pick not just dividend paying stocks but stocks that consistently pay dividends and also increase dividends year after after. One strategy that investors can use to identify such high quality stocks is called the Rising Dividend Strategy. In simple terms, it means that increasing dividends will ultimately will lead to higher stock prices. Or put another way, consistently increasing dividends will be followed by rising stock prices.

Statistically, in the long run price growth is highly correlated to dividend growth. To test this strategy I analyzed the five large Canadian bank stocks. This analysis proves that the rising dividend strategy is an effective idea to select wining stocks.While it is ideal to use data over many years, it must be noted that most of the Canadian banks were listed in the US markets only in the 90s. Hence data used is relatively for a smaller number of years.

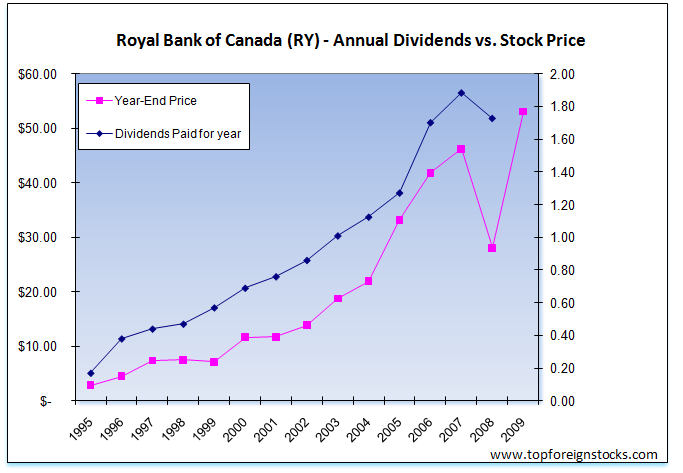

1. Royal Bank of Canada (RY)

Click to Enlarge

In 1996, the stock price of Royal Bank closed at $4.53 and the dividend amount paid was $01.7 for an yield of 3.75%. Over the years as the chart above shows Royal Bank consistently increased the dividend payments except in 2009 where it decreased due to the global credit crisis.The stock price also tracked the dividend growth going from $4.53 in 1996 to $53.06 at the end of last year. The price plunged to $28.05 in 2008 but sharply recovered in 2009 as dividends were not slashed drastically. Clearly the graph shows that long-term investors of Royal Bank of Canada have been rewarded both with dividend growth and share price appreciation.

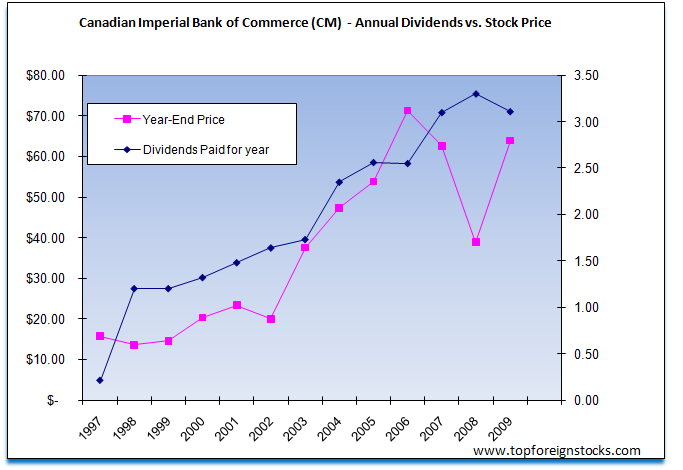

2. Canadian Imperial Bank of Commerce (CM)

Click to Enlarge

CIBC started trading on the US markets on 11/13/1997. The year-end price was $15.69 and the dividend yield was 1.34%. Unlike Royal bank of Canada, CIBC did not have a smoother dividend growth as the chart shows. However still an investment of $10,000 on 11/13/2007Â with dividends reinvested would be worth $40,352.42 as of yesterday for a return of 303.52% according to the CIBC investor relations site.

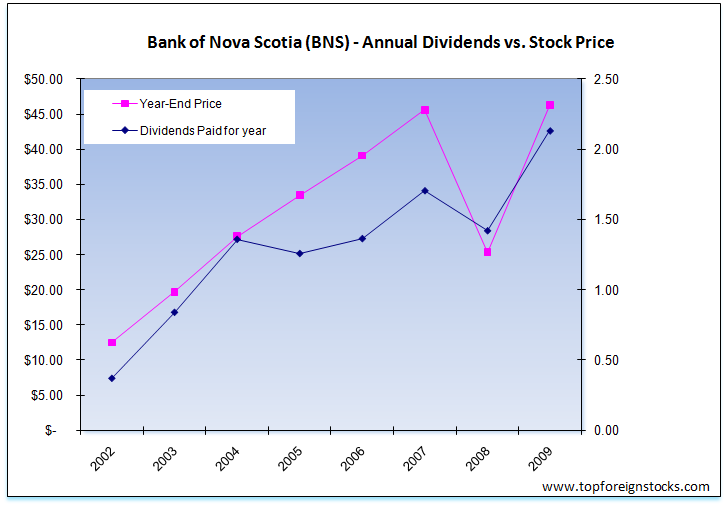

3. The Bank of Nova Scotia (BNS)

Click to Enlarge

Just eight years of data is available for Bank of Nova Scotia’s US-listed stock. The stock price closed at $12.48 at the end of 2002. The last year’s closing price was $46.29. In eight years, dividends was reduced in only two.

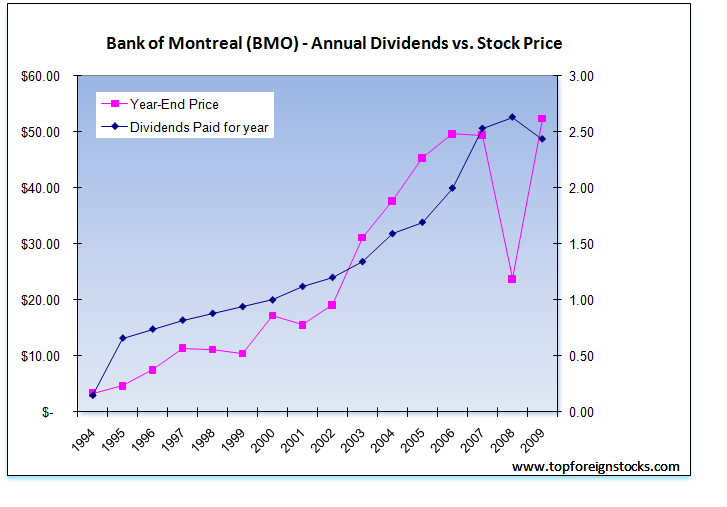

4. Bank of Montreal (BMO)

Click to Enlarge

Bank of Montreal has increased dividends consistently from 1994 thru 2008. The year-end dividend yield in 1994 was 4.49%. At the current price per share of $61.37, the yield is 4.44%.

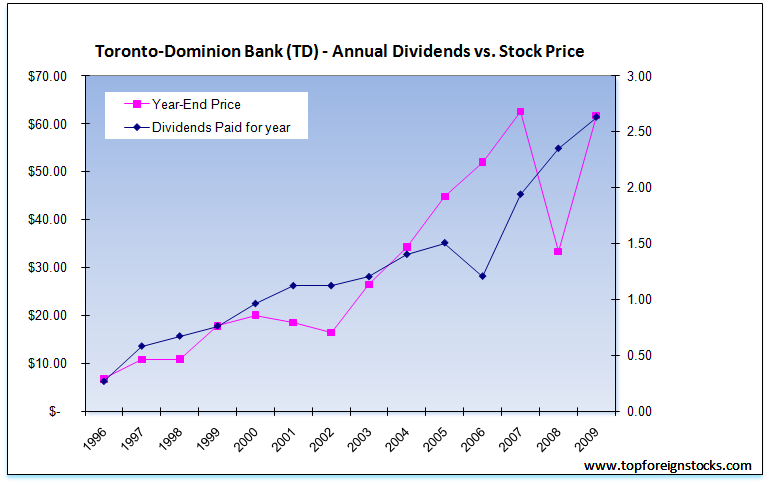

5. Toronto-Dominion Bank (TD)

Click to Enlarge

Since 1996, TD Bank has also increased dividends for most of the years. After closing at $33.27 in 2008 the price sharply rebounded in 2009 and closed the year at $61.64. The average dividend yield in the last 14 years is 4.73%. Except for 2006, TD Bank’s dividend yield was at least 3% each year.

Note: Data used is known to be accurate from sources used. Please do your own research before making any investment decisions.

Disclosure: Long all five stocks mentioned above.