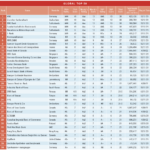

The Top 25 publicly traded U.S. banks and thrifts were published by the ABA Bank Journal in May this year. These rankings were based on data as of December 31, 2008 and covers banks with assets over $3 Billion. Other criteria used to select the top performers are Return on Average Total Equity (ROAE) and Return on Average Total Assets(ROAA).

The following table lists these top banks with their current dividend yields, year-to-date change and the ratio of non-interest income to total revenues:

[TABLE=178]

Some of the common themes followed by the banks listed above include “generating low-cost deposits, making quality loans, and focusing on serving one particular segment

extremely well (rather than trying to be all things to all people), all while keeping a sharp eye on non-interest expenses.”

I have listed the ratio of non-interest income to total revenues since non-interest income (or fee income) has become a major source of revenue for banks since the 1990s. Non-interest income i includes all revenues that banks generate outside of lending. This constitutes many fees such as monthly charges on deposit accounts, fees for mortgage servicing, sales of mutual funds, overdraft fees, etc. The two most important factors that have helped banks generate high non-interest income year over year are the use of new technologies and relaxation of regulatory constraints. For example, high speed telecommunications help banks identify and decide if a transaction from a vendor has to be approved even if the account holder does not have funds to cover the transaction. After approving the charge to go thru banks charge hefty over-draft fees to the account holder. A recent piece on the New York Times provides an excellent illustration of this scenario. From the article Overspending on Debit Cards Is a Boon for Banks:

“When Peter Means returned to graduate school after a career as a civil servant, he turned to a debit card to help him spend his money more carefully.the

So he was stunned when his bank charged him seven $34 fees to cover seven purchases when there was not enough cash in his account, notifying him only afterward. He paid $4.14 for a coffee at Starbucks and a $34 fee. He got the $6.50 student discount at the movie theater but no discount on the $34 fee. He paid $6.76 at Lowe’s for screws and yet another $34 fee. All told, he owed $238 in extra charges for just a day’s worth of activity.”

From another article titled Banks make $38bn from overdraft fees in the Financial Times last month:

“US banks stand to collect a record $38.5bn in fees for customer overdrafts this year, with the bulk of the revenue coming from the most financially stretched consumers amid the deepest recession since the 1930s, according to research. The fees are nearly double those reported in 2000.

Data from Moebs Services, a research company, show that the crisis has prompted many banks to lift charges on overdrafts and credit cards in order to boost profits.

The median bank overdraft fee has this year rose from $25 to $26, according to Moebs, the first time it has gone up in a recession for more than 40 years.”

Non-interest income is also considered to be more steady or stable compared to other types of incomes. An example of this would be a monthly service on a customer’s checking account say $7. Each month the bank can deduct $7 from the account without much effort especially if the account holder has a direct deposit into the account such as salary. That accounts to an easy $84 to the bank’s coffers each year.

Among the top 25 banks, State Street Corporation(STT),Northern Trust Corp (NTRS) and UMB Financial Corp (UMBF). The non-interest income ratio was close to 50% for US bank(USB) also last year.

The highest ranked bank for 2009 is the Bank of Hawaii Corp(BOH). Bank of Hawaii has been consistent performer for many years now. The other banks in among the top 5 are Bank of the Ozarks(OZRK), Northern Trust Corp (NTRS), First Financial Bankshares(FFIN) and S&T Bancorp (STBA).

In terms of year-to-date performance SVB Financial Group(SIVB),State Street Corporation(STT),Northern Trust Corp(NTRS), TCF Financial Corp(TCB) and BB&T Corp (BBT) are all up in the positive territory.SVB Financial Group(SIVB) is up 54.6% YTD while the worst performer S&T Bancorp(STBA) is down 62.1%.

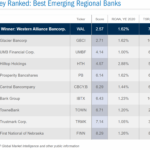

The total deposits held by a bank is another factor that some investors use to select bank stocks. With the interest offered on deposits very low at most banks, those that can acquire large deposits at low costs can make large profits by lending them to credit-worthy customers at higher rates. In the “Banks to Bank On” column in the latest Business Week, David Ellison, manager of FBR Small Cap Financial Fund (FBRSX) and FBR Large Cap Financial Fund (FBRFX) suggests this approach.

Source: Business Week

The so-called super banks present in the above list include Bank of America (BAC), Citibank(C), JP Morgan Chase(JPM) and Wells Fargo(WFC). These banks hold over 50% of all deposits in the U.S.

To download the full “Top 25 Performers” report by ABA Bank Journal click here.

Greetings David,

Thank you for bringing this article to light. I initially recommended the research of BOH back in January of this year. Although I suggested a sell recommendation of the stock after a 11% gain in 7 months (for those worried about losing “gains”), I continue to hold a substantial position in the stock.

Again, thank your for the quality of your posting. Will mention your site in my BOH update on my blog.

Regards,

Toucalit Benton

Thanks Toucalit for the comment.I appreciate it.

I have bookmarked your site.Will check it out this weekend.

Yes BOH is a good stock.I don’t have a position yet though.Good Luck !.