Fees is an important factor that erode a fund investor’s return. In the long run such as 10 years or more, a fee of 1% or even 0.50% on a mutual fund can cut thousands of dollar from returns due to the effect of compounding. In general, the higher the fees (or expense ratio) the lower the return can be. So investors are better off avoid funds that charge high fees and embrace passively-managed funds with low or very low fees.

Vanguard UK recently called for a fees “health warning” on funds marketed in the UK. From the Vanguard article:

Warnings on fees should receive equal prominence to those on past performance

Vanguard’s research proves high-cost funds struggle to consistently deliver outperformance

Disclosure on fees and performance can, and should, be made radically simpler

Sean Hagerty, Head of Vanguard’s European business said:

“Performance is a potential. Costs are a certainty, hence why investors should focus as much, if not more, on costs. A “health warning” on the impact of costs would be a clear sign of intent from the industry that it’s putting the needs of the investor first.”

To say Sean’s statement is profound and so true is an understatment. One of the few things that we can control is fees. So we must first make use of that power. Performance is simply a projection. Portfolio managers and fund companies can make all kinds of performance projections, comparisions, analysis reports, etc. with cool charts and graphics. But all those mean zilch since performance is just a potential while fees is a certainity. Whether a funds grows by 10% or declines by 40%, fees will be deducted from an investor’s account. Just like death and taxes, fees are a one thing that an investor cannot escape as long as they stay invested with a fund.

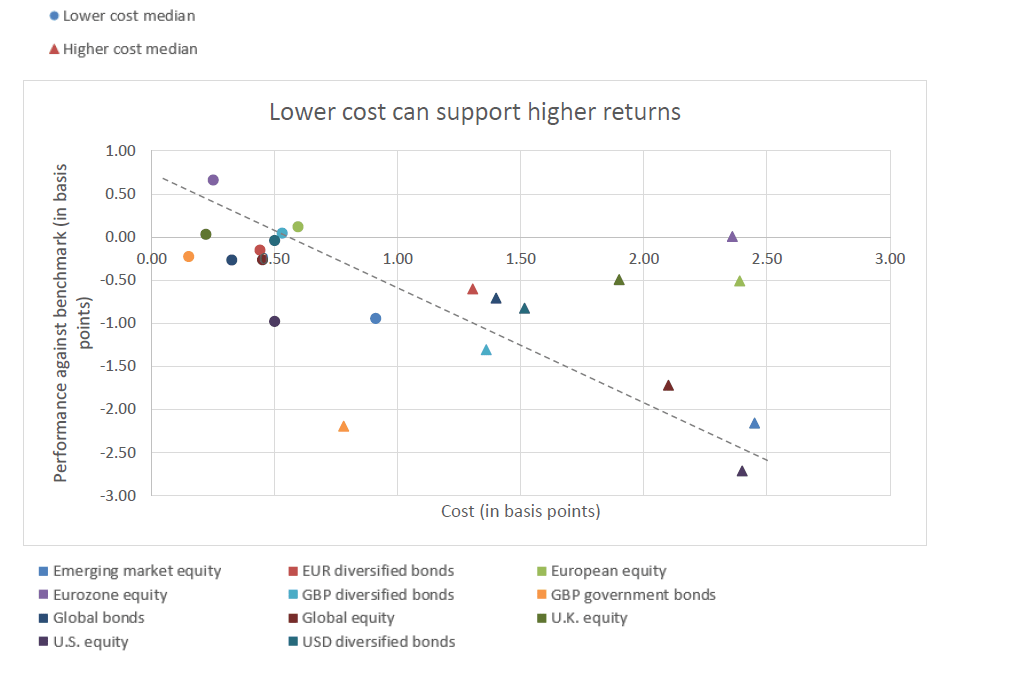

The following chart shows that low-cost funds are better than high-cost funds in terms of returns. From the report:

Vanguard examined the performance of a range of actively managed and index equity and fixed income mutual funds available to UK investors and found that, when funds are split into lower and higher cost-quartiles, the low-cost funds outperformed those with higher costs across all categories, over the past ten years (see figure below)1 .

Source: FCA ASSET MANAGEMENT REPORT: VANGUARD CALLS FOR FEES “HEALTH WARNING” ON FUNDS, Vanguard UK

The answe to my title question is an absolute yes. Many investors are woefully unaware of the adverse impact of high fees. As a result billions of dollars are lost to fees year after year. While good old warnings like “Past performance is not an indicator of future results” are helpful, the really important part is the negative effects of fees.Critical thinkers would agree that the current warning on something that is uncertain is meaningless than posting a warning that is certain.

Update:

An interesting article on fees by WSJ’s Jason Zweig today. From the article:

Daniel Goldstein and Jake Hofman are behavioral scientists at Microsoft Research, a unit of the computer giant. They have shown that numbers become much easier to grasp — and remember — when the words “to put this in perspective” are coupled with a familiar reference.

Today’s prospectuses show cumulative fees on a $10,000 investment over one, three, five and 10 years. Instead, an investor should be able to see those fee totals for any amount or time period she chooses.

If stocks gained an average of 6% annually over the next 30 years, someone who invested $25,000 and paid a 1% yearly fee would cumulatively forgo more than $35,500 in gains. “To put this in perspective,” the disclosure might say, “that difference is greater than the amount you started with.”

Source: It’s Time for a Revolution in Investor Disclosures, WSJ, Mar 10, 2017