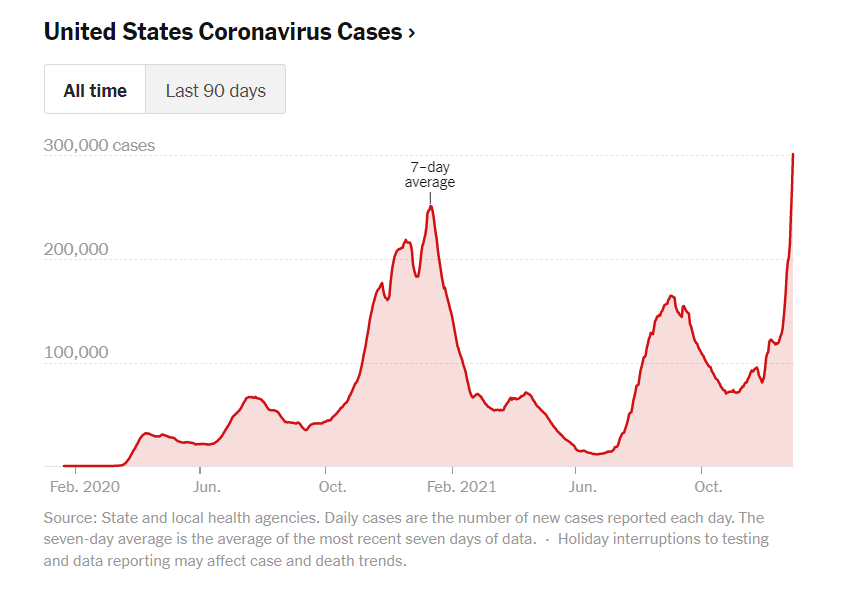

The daily average for Covid-19 cases in the US reached 301,472 yesterday according to NY Times. In the past 2 weeks, it has soared by more than 153%. All previous records are getting broken in many states across the country.

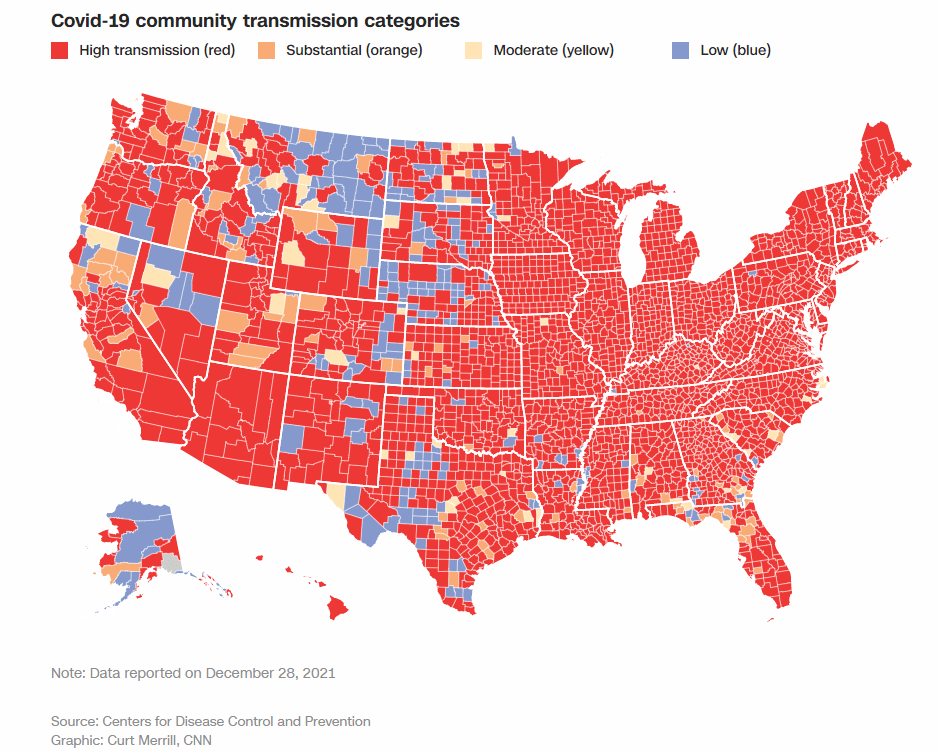

Compared to other developed and even emerging countries, the vaccination rate is still low at 62%. The following awful chart from CNN below shows the community transmission of Covid-19. Pretty much the whole country is in the red category.

Click to enlarge

Source: Omicron surge is ‘unlike anything we’ve ever seen,’ expert says, CNN

Below is all-time Covid-19 cases chart:

Source: The U.S. breaks its single-day case record, nearly doubling the highest numbers from last winter, NY Times