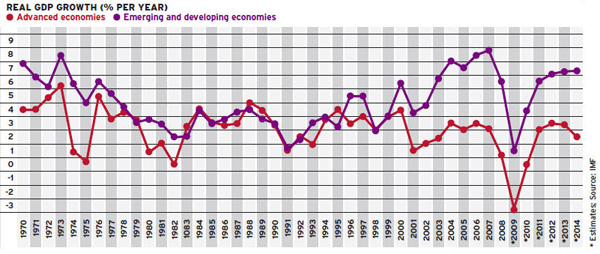

An interesting chart of Real GDP Growth by Year (%) from 1970 for Advanced Vs. Emerging Economies from Global Finance magazine. Emerging markets are projected to have the best growth moving forward as per estimates from IMF.

Source: Global Finance Magazine