Chinese I.P.O. Frenzy Raises Talk of a Bubble

Iceland’s recovery makes case for allowing banks to fail

UK: Top ten funds for income investors

‘Before you uncork the champagne,’ here’s Rosenberg’s predictions

Three top 2010 sectors to own in 2011

Share buy-backs highlight low corporate confidence

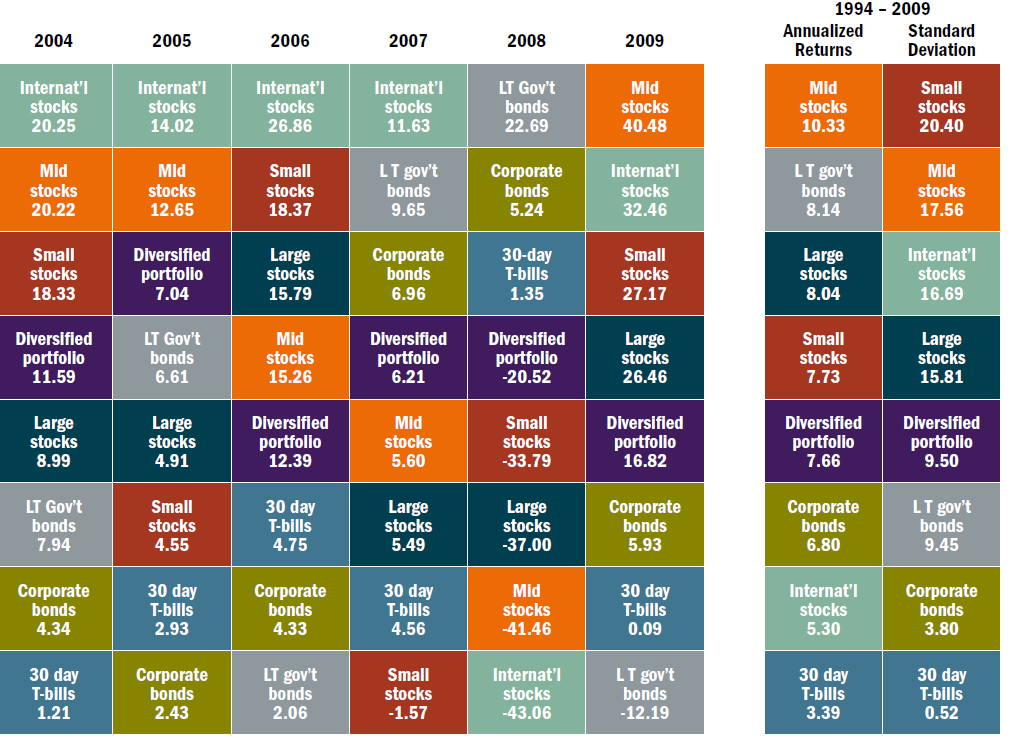

Buy-and-hold: the ‘boring’ way to healthy profits

Emerging Markets Focus: Latin America

10 metal stocks likely to outperform in a rally

Elephants in Sri Lanka