China became the largest car market in the world in China surpassing the U.S. Just over 40% of all car produced in China are made by domestic automakers such as Geely, Chery, Hafei, BYD, etc.

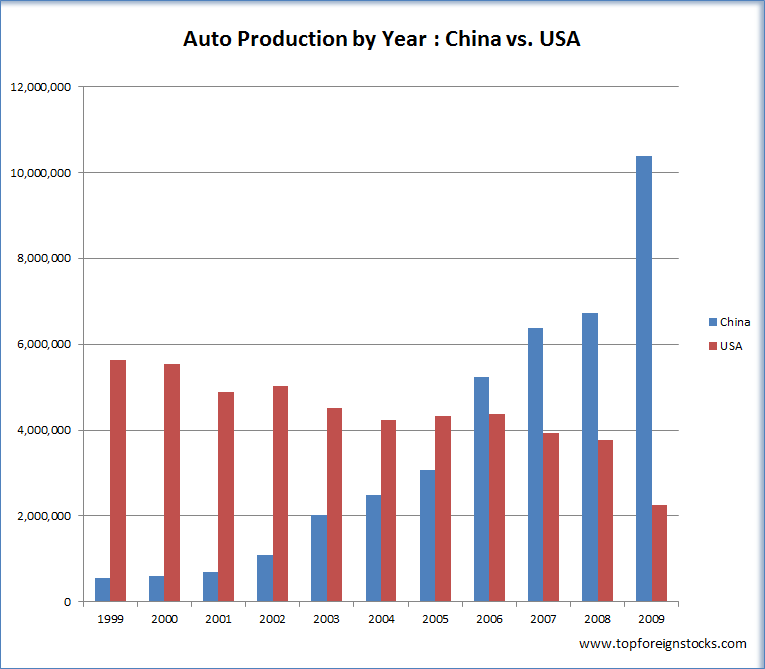

Car production in China started to increase drastically since the late 1990s due to various government incentives that encouraged auto sales. The chart below compares the annual auto production in China and the U.S.:

Click to enlarge

Source: International Organization of Motor Vehicle Manufacturers

The blue bar in the chart shows the soaring Chinese auto production numbers.Clearly the U.S. market has saturated in recent years and production volume has declined from about 5.6 million units in 1999 to 2.2 million in 2009. Since the auto industry generates hundreds of thousands of jobs both directly and indirectly the lower production numbers in the U.S. mean lesser number of jobs created. The majority of the cars produced in China is sold locally. While the growth of auto sales creates issues such as pollution, congestion, etc in major urban areas there is still a huge untapped market in rural areas. Hence Chinese auto production may continue to increase in the coming years. Rising income levels among the middle class and more state subsidies for auto makers will benefit the industry as well.

Disclosure: No Positions