The table below lists large-cap foreign stocks trading on the NYSE that have dividend yields of over 5% as of January 6, 2011:

[TABLE=870]

Some observations:

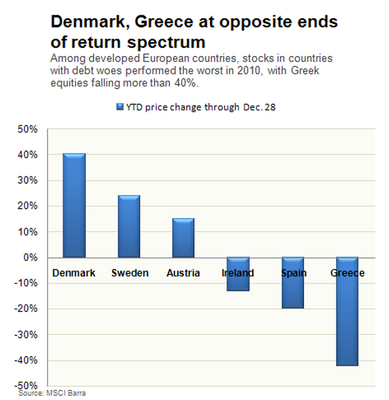

- Not surprisingly, the majority of the stocks in this list are in the utility sector with Telefonica(TEF) of Spain paying about 8% in dividends.

- Bell Canada Enterprises(BCE) is the largest telecom services provider in Canada.

- Brazil’s biggest private utility recently reported 3Q profits rose 34% relative to the same quarter last year on increased sales.

- UK-based pharmaceutical company GlaxoSmithKline plc (GSK) is the owner of many well-known brands such as Levitra, Avandia , Valtrex , Advair, etc. in the drugs category and consumer healthcare products such as Aquafresh, Nicorette, Tums, Breathe Right, etc.Originally founded in 1715, the company operates globally with a strong presence in emerging markets. For example, in 2009 GlaxoSmithKline shipped 1.9 billion vaccine doses globally out of which about 1 billion were shipped to emerging countries.

Disclosure: Long SAN