The following are some of the key takeaways from a review of the 2010 performance of equity markets around the world:

1. Stock markets can rise despite low or poor economic growth. The U.S. market was a perfect example of this scenario. While the US economy continued to struggle last year with high unemployment rates, slowing demand, more bank failures and other negative events, corporate profits rose and equities took off ending the year with double-digit returns for the S&P 500.

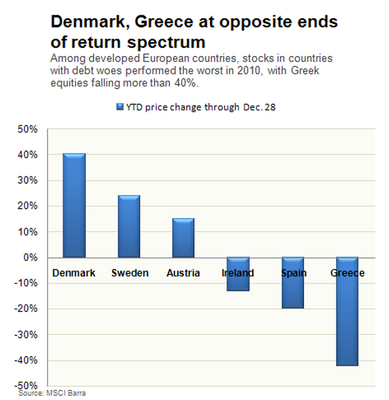

2. Equity markets of countries with low or no debt woes performed well when compared to countries with significant debt problems as confirmed by the chart below:

Source:Pensions & Investments

3. Despite the constant focus towards all things China, Chinese stocks actually ended the year in the red. The Shanghai Composite Index fell 14% for the year while other emerging markets like India and Russia were up by double digits. So investors have to be cautious investing in red-hot destinations like China even though on the surface all analysis provided a convincing story.

4. While the Japanese economy is one of the biggest in the world and the country is home to many world-class companies, any investments in the equity market there is not a wise strategy. Japanese stocks have gained no traction since the collapse from their peaks attained many years ago.

5. Among the BRIC countries, Brazil was the second worst performer after China with a return of just 1% on the Bovespa Index.

6. All the PIIGS countries yielded negative returns for the year.

7. Small countries with medium-size markets such as Chile, Argentina, Philippines, Colombia, Malaysia, etc. produced higher returns than countries like India and China.