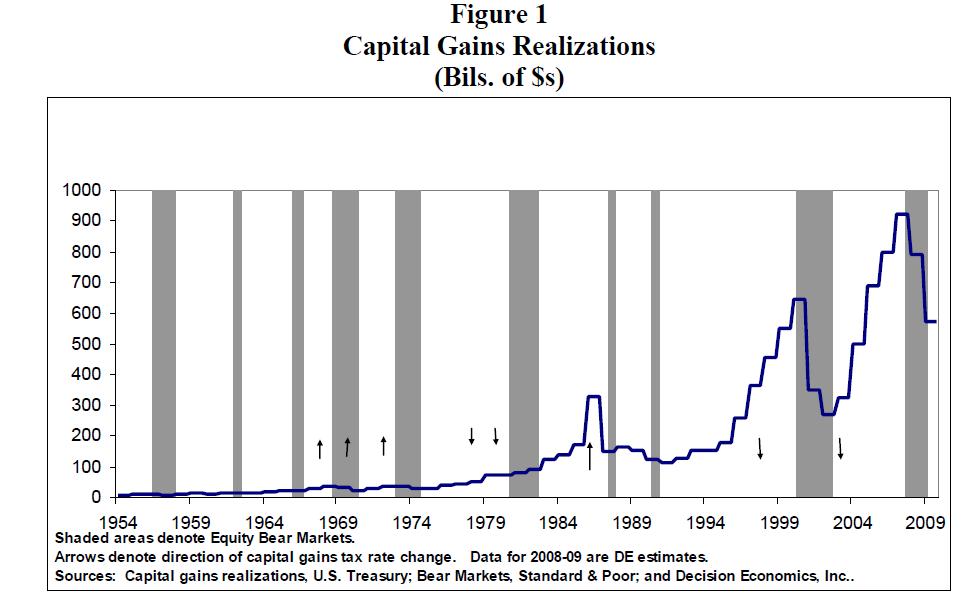

The chart below shows the history of capital gains realizations since 1954:

Click to enlarge

Capital gains realizations significantly move up-or-down depending on bull or bear markets. They also rise or decline significantly after changes in capital gains tax rates.Strong rises or declines in capital gains realizations have often occurred not long after the tax rate has been changed.

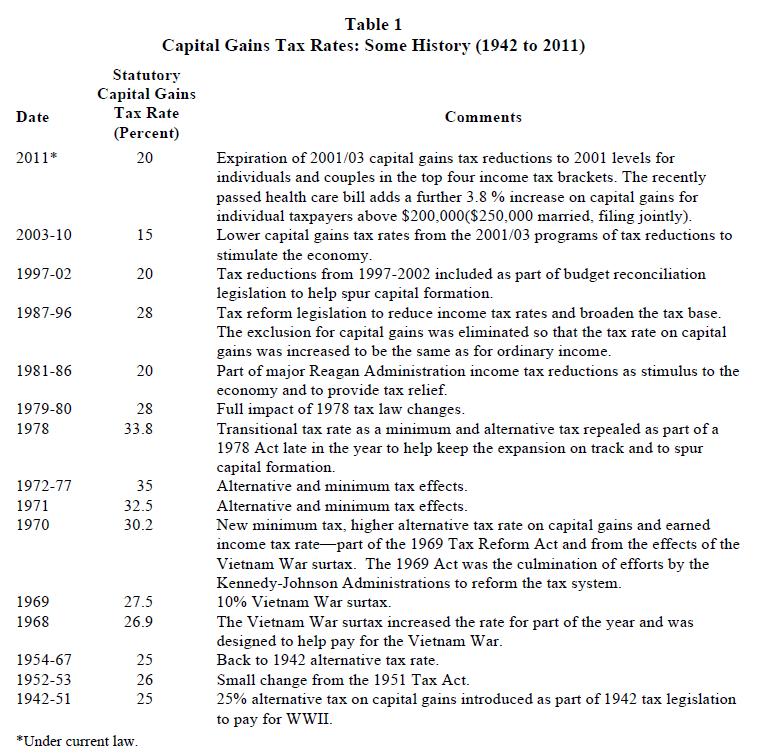

The table below shows the history of changes in US statutory capital gains taxes from 1942 to 2011. The statutory tax rate has varied between 15% and 45% during the period.

Click to enlarge

Source: Capital Gains Taxes and the Economy, ACCF

According to a research paper titled “Capital Gains Taxes and the Economy” prepared by Decision Economics, Inc for the American Council for Capital Formation: Center for Policy Research:

Reducing the capital gains tax rate to 0% increases growth in real GDP by a little over 0.23 percentage points per year. Jobs increase by an average of 1,322,000 per annum.The unemployment rate drops 0.7 percent at its lowest point. And, productivity growth improves 0.5 percentage points a year.(emphasis added)