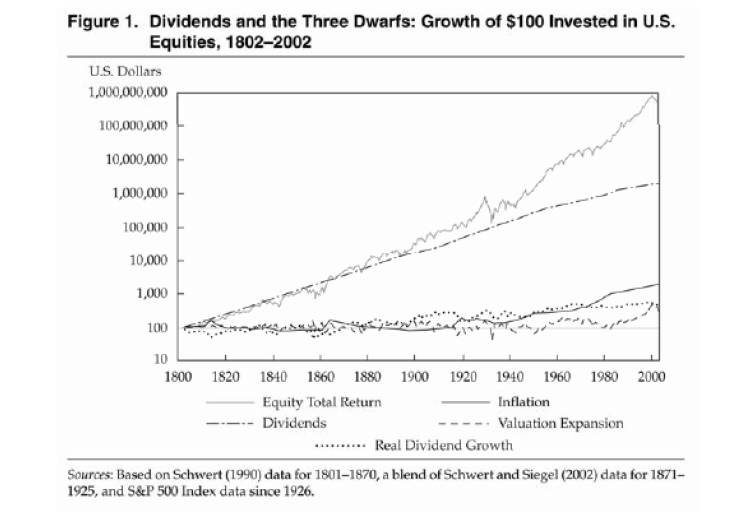

There are many reasons to invest in dividend-paying stocks.One of reasons is dividends form the largest portion of the total return on an investment. This is especially true when stocks are held for the long-term. The following chart shows that “the contribution to total return for each of the components of equity returns for the period 1802 to 2002. The total annualized return for the period of 7.9% consisted of a 5% return from dividends, a 1.4% return from inflation, a 0.6% return from rising valuation levels, and a 0.8% return from real growth in dividends.”

Click to enlarge

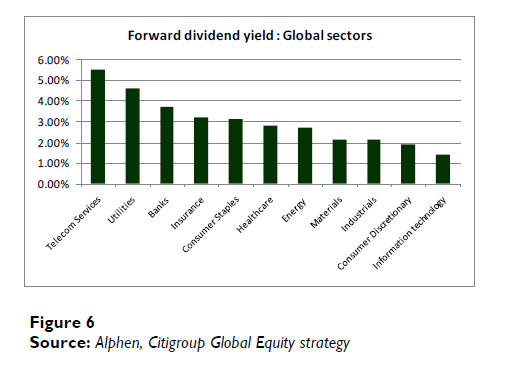

Which sectors have the highest dividend yields?

Source: Alphen Angle, PSG Alphen Asset Manangement

Ten dividend-paying high quality stocks to consider are listed below:

1.Company: Westpac Banking Corp (WBK)

Current Dividend Yield: 6.07%

Sector: Banking

Country: Australia

2.Company: Royal Bank Of Canada (RY)

Current Dividend Yield: 3.48%

Sector: Banking

Country: Canada

3.Company:National Grid PLC (NGG)

Current Dividend Yield: 4.41%

Sector: Electric Utilities

Country: UK

4.Company: Nextera Energy Inc (NEE)

Current Dividend Yield: 4.02%

Sector: Electric Utilities

Country: USA

5.Company: Telecom Italia SpA (TI)

Current Dividend Yield: 4.06

Sector: Telecom

Country: Italy

6.Company: Banco Santander Chile (SAN)

Current Dividend Yield: Banking

Sector: 3.25%

Country: Chile

7.Company: Telefonica SA (TEF)

Current Dividend Yield: 7.17%

Sector: Telecom

Country:Spain

8.Company: RWE AG (RWEOY)

Current Dividend Yield: 6.89%

Sector: Electric Utilities

Country: Germany

9.Company: CPFL Energia SA (CPL)

Current Dividend Yield: 7.28%

Sector: Electric Utilities

Country: Brazil

10.Company: Gdf Suez SA (GDFZY)

Current Dividend Yield: 5.53%

Sector: Gas Utilities

Country: France

Note: Dividend yield noted is as of market close Feb 25, 2011

Disclosure: Long NEE, RY, GDFZY