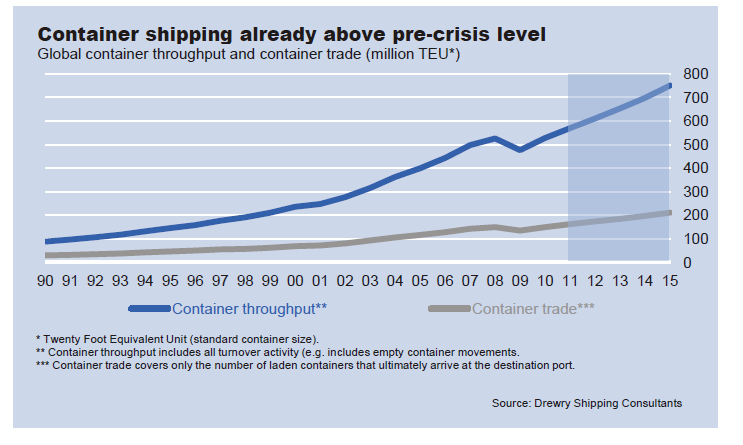

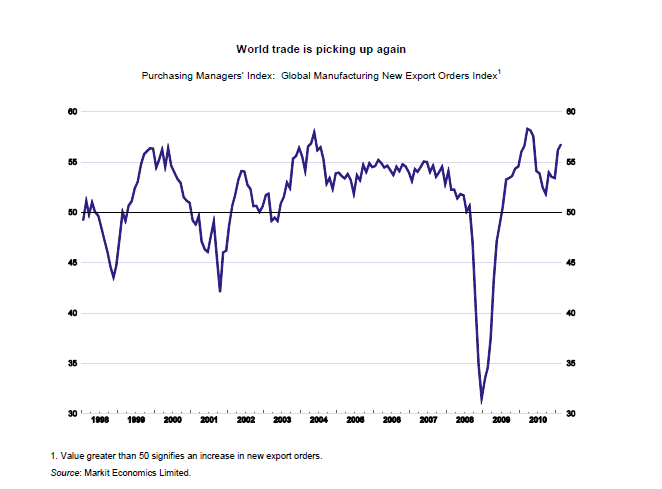

While there are many factors to evaluate global economic growth, one factor that is the most important to look at is world trade. According to the latest data on trade, the global economy is in recovery mode. The following two charts confirm that economic growth is back on track after the terrifying fall during the credit crisis.

1. Global container shipping achieved an impressive turnaround in 2010 growing by 11% and is projected to grow about 7-8% per year thru 2015 according to a report by Deutsche Bank Research. Freight and charter rates have recovered from the depth of the crisis levels as well.

2. According to a OECD Economic Assessment report, world trade is picking up again based on the global manufacturing new export orders index. Excluding Japan, the GDP of G7 countries are projected to grow by 3.2% in Q1 and 2.9% in Q2 of this year.

Source: OECD, Deutsche Bank Research