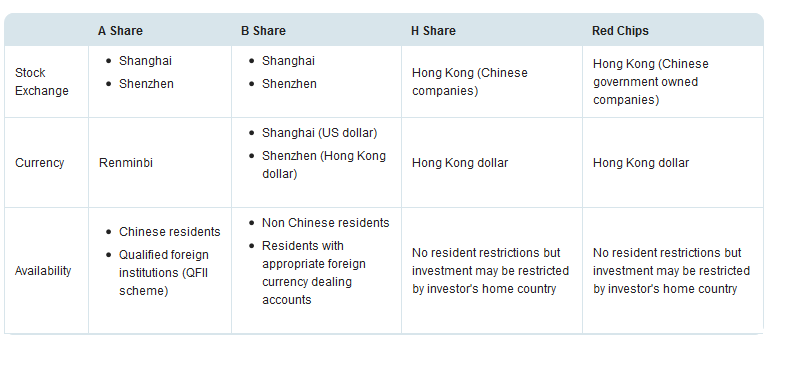

Last month S&P launched a new index called the S&P Emerging Asia 40 Index to provide exposure to the 40 largest and most liquid securities from the emerging markets of China, India, Indonesia, Malaysia, the Philippines and Thailand.The Index offers equal exposure to two distinctive regions: with 20 stocks from China and India and 20 stocks from South East Asia.

For China and India, the index includes liquid stocks trading on the Hong Kong Stock Exchange, the London Stock Exchange, NASDAQ, and/or the NYSE. For the other four countries, local listings are also eligible.

The Constituents of the S&P Emerging Asia 40 Index are listed below:

[TABLE=1031]

Three of India’s largest banks – ICICI Bank(IBN), HDFC Bank Ltd.(HDB) and State Bank of India are in this index.Similarly from China, Bank of China, China Construction Bank and ICBC are included. Indonesia-based Astra International recently split its ADR trading under the ticker PTAIY in the ratio of 5:1.

Disclosure: No positions