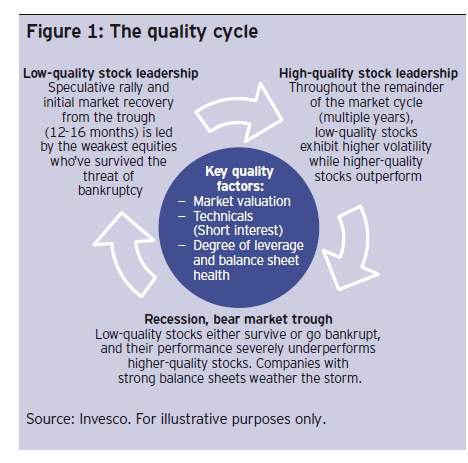

Investors waiting to return to equities may want to consider the quality cycle, according to an article in the Risk and Reward report published by Invesco Perpetual of UK.

Bear markets and recessions are usually followed by “junk rallies” in which low-quality stocks take the lead and their outperform high-quality peers. These speculative rallies can last 12-14 months or even longer. For example, from the lows of March 2009 stocks rallied over 70% through March 2010 which can be considered as a “relief rally”. This rally leveled off by summer as the low-quality stocks had fallen out of favor and the “easy money” has already been made. High quality blue chips took the market leadership only to face lower earnings forecast and economic issues.

Equities Quality Cycle

Click to enlarge

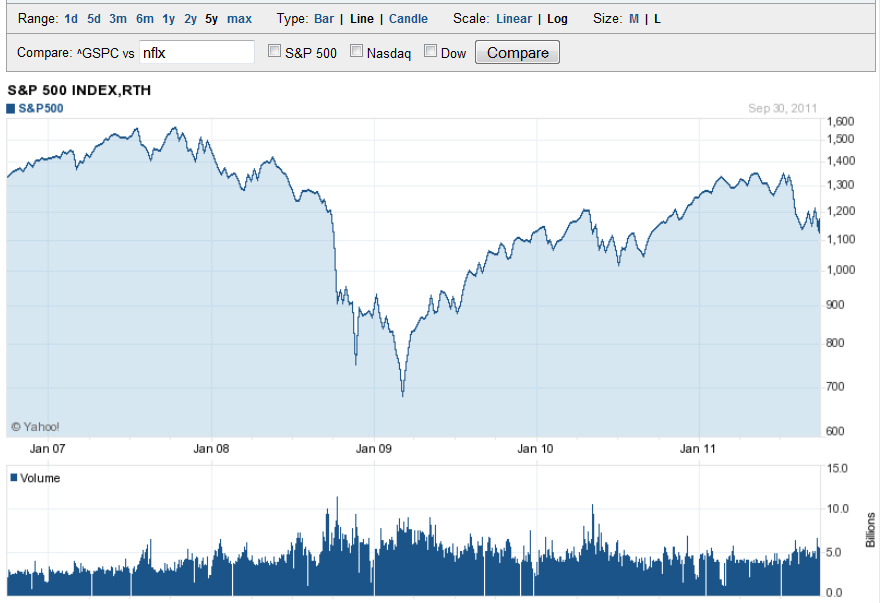

5-year performance of S&P 500:

From April 2010 through April this year, we had another rally which also fizzled as shown in the graph above. On September 30th, the Economic Cycle Research Institute announced that “the U.S. economy is indeed tipping into a new recession. And there’s nothing that policy makers can do to head it off. ” With the EU facing many unsolved issues and the US economy entering into a recession, equities may decline further in the coming months.

Related ETFs:

SPDR S&P 500 ETF (SPY)

SPDR DJ Euro STOXX 50 ETF (FEZ)

Disclosure: No Positions