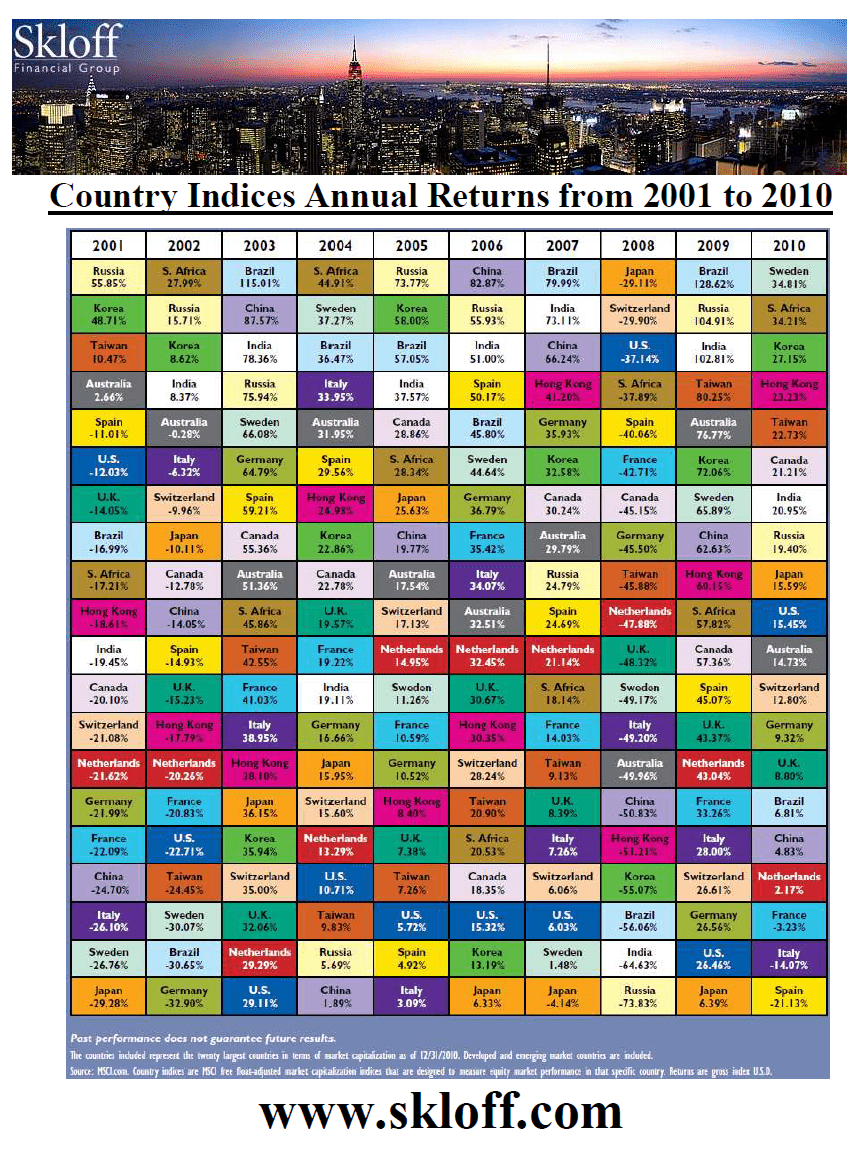

The Global Finance magazine has published its annual ranking of the world’s biggest banks for this year based on total assets the end of 2010.

The top 50 banks hold assets of just over $61 Trillion. China’s banks continue to grow in size. This year, ICBC, China’s biggest bank entered the top 10 ranks by taking the 9th place.

| Rank | Bank | Country | Total Assets ($m) | Statement Date |

| 1 | BNP Paribas | France | 2,669,906 | 12/31/10 |

| 2 | Deutsche Bank | Germany | 2,546,272 | 12/31/10 |

| 3 | HSBC Holdings | United Kingdom | 2,454,689 | 12/31/10 |

| 4 | Barclays | United Kingdom | 2,331,943 | 12/31/10 |

| 5 | The Royal Bank of Scotland Group | United Kingdom | 2,275,479 | 12/31/10 |

| 6 | Bank of America | United States | 2,268,347 | 12/31/10 |

| 7 | Crédit Agricole | France | 2,129,248 | 12/31/10 |

| 8 | JPMorgan Chase | United States | 2,117,605 | 12/31/10 |

| 9 | Industrial & Commercial Bank of China (ICBC) | China | 2,032,131 | 12/31/10 |

| 10 | Citigroup | United States | 1,913,902 | 12/31/10 |

| 11 | Mizuho Financial Group | Japan | 1,890,220 | 03/31/11 |

| 12 | Bank of Tokyo-Mitsubishi UFJ | Japan | 1,687,313 | 03/31/10 |

| 13 | ING Group | Netherlands | 1,666,368 | 12/31/10 |

| 14 | China Construction Bank | China | 1,632,261 | 12/31/10 |

| 15 | Banco Santander | Spain | 1,626,805 | 12/31/10 |

| 16 | Bank of China | China | 1,579,346 | 12/31/10 |

| 17 | Agricultural Bank of China* | China | 1,568,722 | 12/31/10 |

| 18 | Lloyds Banking Group | United Kingdom | 1,552,245 | 12/31/10 |

| 19 | Société Générale | France | 1,512,657 | 12/31/10 |

| 20 | UBS | Switzerland | 1,401,924 | 12/31/10 |

| 21 | Groupe BPCE | France | 1,400,911 | 12/31/10 |

| 22 | Wells Fargo | United States | 1,258,128 | 12/31/10 |

| 23 | Sumitomo Mitsui Banking Corporation | Japan | 1,247,053 | 03/31/10 |

| 24 | UniCredit | Italy | 1,241,967 | 12/31/10 |

| 25 | Credit Suisse Group | Switzerland | 1,098,345 | 12/31/10 |

| 26 | Commerzbank | Germany | 1,007,882 | 12/31/10 |

| 27 | Goldman Sachs Group | United States | 911,332 | 12/31/10 |

| 28 | Intesa Sanpaolo | Italy | 880,221 | 12/31/10 |

| 29 | Rabobank Group | Netherlands | 871,908 | 12/31/10 |

| 30 | Norinchukin Bank** | Japan | 844,431 | 09/30/10 |

| 31 | China Development Bank | China | 771,729 | 12/31/10 |

| 32 | Nordea Bank | Sweden | 776,108 | 12/31/10 |

| 33 | Dexia | Belgium | 757,262 | 12/31/10 |

| 34 | Banco Bilbao Vizcaya Argentaria (BBVA) | Spain | 738,560 | 12/31/10 |

| 35 | Royal Bank of Canada (RBC)* | Canada | 713,646 | 12/31/10 |

| 36 | National Australia Bank* | Australia | 664,174 | 12/31/10 |

| 37 | Commonwealth Bank of Australia | Australia | 660,205 | 12/31/10 |

| 38 | Toronto-Dominion Bank (TD) | Canada | 608,113 | 12/31/10 |

| 39 | Westpac Banking Corporation* | Australia | 598,647 | 12/31/10 |

| 40 | Bank of Communications | China | 596,655 | 12/31/10 |

| 41 | KfW | Germany | 590,269 | 12/31/10 |

| 42 | Danske Bank | Denmark | 572,547 | 12/31/10 |

| 43 | Scotiabank (Bank of Nova Scotia) | Canada | 516,939 | 12/31/10 |

| 44 | Standard Chartered | United Kingdom | 516,542 | 12/31/10 |

| 45 | Australia & New Zealand Banking Group (ANZ) | Australia | 514,857 | 09/30/10 |

| 46 | DZ Bank | Germany | 512,378 | 12/31/10 |

| 47 | ABN Amro* | Netherlands | 509,249 | 12/31/10 |

| 48 | Banque Fédérative du Crédit Mutuel (BFCM) | France | 501,422 | 12/31/10 |

| 49 | Landesbank Baden-Württemberg (LBBW) | Germany | 500,285 | 12/31/10 |

| 50 | Banco do Brasil | Brazil | 481,179 | 12/31/10 |

Source: Fitch Ratings except

* Moody’s Investors Service

** Norinchukin Bank

Source: Global Finance

Three of the four U.S. super-banks are in the top ten. With the exception of ICBC, the rest of the top 10 are either European or American banks. None of the banks from Russia and India made it to this list.

Disclosure: Long many banks in the above list