The extreme volatility in the equity markets in the past few weeks are making many investors nervous. Some of them are making the wrong moves based on emotions. Yesterday’s Wall Street Journal had an article discussing how some people are liquidating their equity holdings and moving into cash. From the article titled “Tired of Ups and Downs, Investors Say, ‘Let Me Out!‘”:

Leonard Gerber, a 65-year-old financial planner, has seen plenty of volatile markets during his career. But this one feels different.

Last month, the Syracuse, N.Y., resident cashed in his stock funds—and he has no intention of diving back in anytime soon. “I feel like a deer in headlights,” he says.

Across the country, investors are fleeing the stock market for the safety of cash. On Tuesday the Standard & Poor’s 500-stock index lost as much as 2.2% before a late-day rally sent the index up 2.3% for the session. In the 46 trading days since the beginning of August, the S&P 500 has seen 29 swings of 1% or more.

Tuesday is a “perfect example” of why Mr. Gerber has bailed out. “The market is manic,” he says. “There’s no consistency … and there’s a worrisome amount of volatility.”

The wild action is keeping brokerage firms busy. At Scottrade Inc., trading volume increased 36% on Tuesday afternoon from the day before, which was 30% higher than last week’s average. Principal Financial Group saw call-center volume from investors in work-based retirement plans climb 27% between Friday and Monday.

Making investment decisions based on emotions rarely helps investors. As markets are unpredictable, one cannot move in and out of the market without losing gains. This is especially true for retail investors who do not have the time and resources required to analyze market activity on a daily basis.

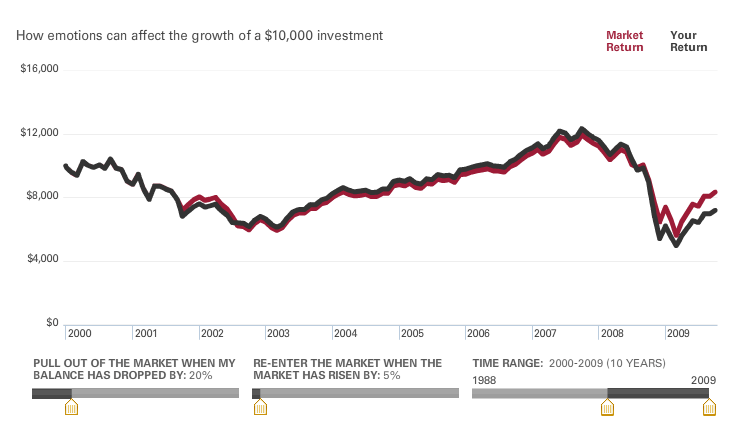

The following graphs show how returns are negatively impacted with emotional investing:

Scenario #1: Getting out of the market when the account balance has dropped by 20% and re-entering the market when the market has risen by 5%:

Scenario #2: Getting out of the market when the account balance has dropped by 20% and re-entering the market when the market has risen by 15%:

Click to enlarge

Note: The illustration above is a hypothetical example based on total daily returns for the Standard & Poor’s 500 Index for the period noted. It does not account for any investment costs such as commissions, or bid/ask spreads.

Source: The truth about emotion, The Vanguard Group

Last month many foreign markets entered bear market territory with stocks falling 20% or more. This has created excellent opportunities for long-term investors. Some of the high-quality European stocks are particularly attractive at current levels. Ten such foreign stocks paying dividends of more than 3% are listed below for investors to consider:

1.Company: Empresa Nacional de Electricidad SA (EOC)

Current Dividend Yield: 7.88%

Sector:Electric Utilities

Country: Chile

2.Company: Nestle (NSRGY)

Current Dividend Yield: 3.85%

Sector:Beverages (Nonalcoholic)

Country: Switzerland

3.Company: Tesco plc (TSCDY)

Current Dividend Yield: 4.02%

Sector:Retail (Grocery)

Country: UK

4.Company: Akzo Nobel NV (AKZOY)

Current Dividend Yield: 4.62%

Sector:Chemical Manufacturing

Country: The Netherlands

5.Company: Novartis (NVS)

Current Dividend Yield: 4.26%

Sector:Major Drugs

Country: Switzerland

6.Company: Eni SpA (E)

Current Dividend Yield: 8.30%

Sector:Oil & Gas – Integrated

Country: Italy

7.Company:ABB Ltd (ABB)

Current Dividend Yield: 4.09%

Sector:Electronic Instrumentation & Controls

Country: Switzerland

8.Company:Alumina Ltd (AWC)

Current Dividend Yield: 4.94%

Sector:Metal Mining

Country: Australia

9.Company:TransCanada Corp (TRP)

Current Dividend Yield: 4.16%

Sector:Natural Gas Utilities

Country: Canada

10.Company:Aviva PLC (AV)

Current Dividend Yield: 9.61%

Sector:Insurance (Life)

Country: UK

Disclosure: Long ABB