The New York Times published an expose last week on the wealth accumulated by the family of outgoing Chinese Prime minister Wen Jiabao. According to the article, Mr.Wen’s family and relatives control assets worth at least $2.7 billion. Though Mr.Wen comes from an extremely poor family many of his relatives have become very rich. Many other politically connected individuals and party officials have also become wealthy since China moved from a socialist economy to a free-market economy. From a Bloomberg article earlier this year:

The net worth of the 70 richest delegates in China’s National People’s Congress, which opens its annual session on March 5, rose to 565.8 billion yuan ($89.8 billion) in 2011, a gain of $11.5 billion from 2010, according to figures from the Hurun Report, which tracks the country’s wealthy.That compares to the $7.5 billion net worth of all 660 top officials in the three branches of the U.S. government.

China is a one-party country ruled by the Chinese Communist Party(CCP). Though the country follows the capitalist economic model, the political power remains under the firm grip of the CCP. Any attempts by citizens to challenge the CCP is crushed and to-date no other party has survived despite endless talks of a democratic China since the Tiananmen Square protests of 1989.

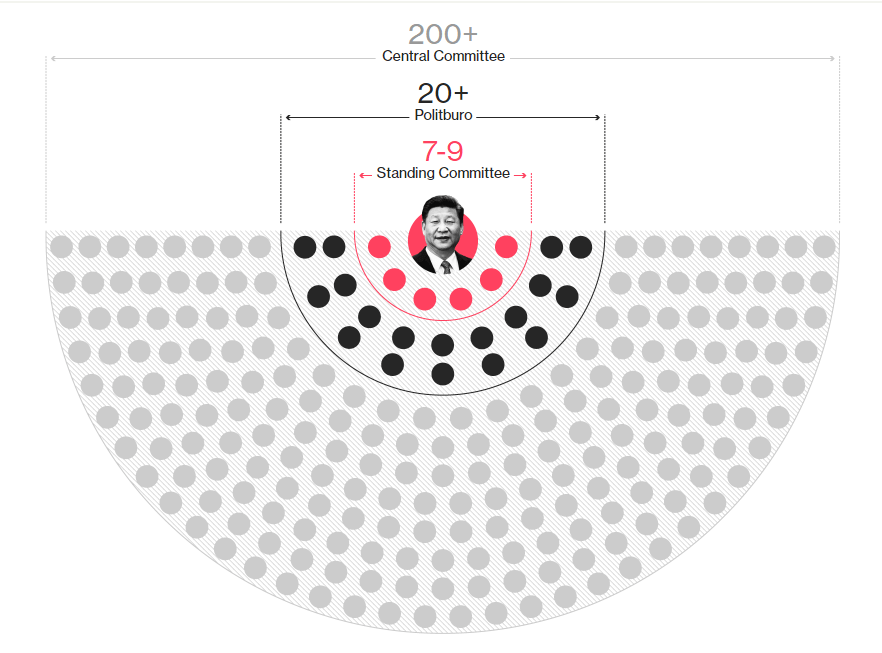

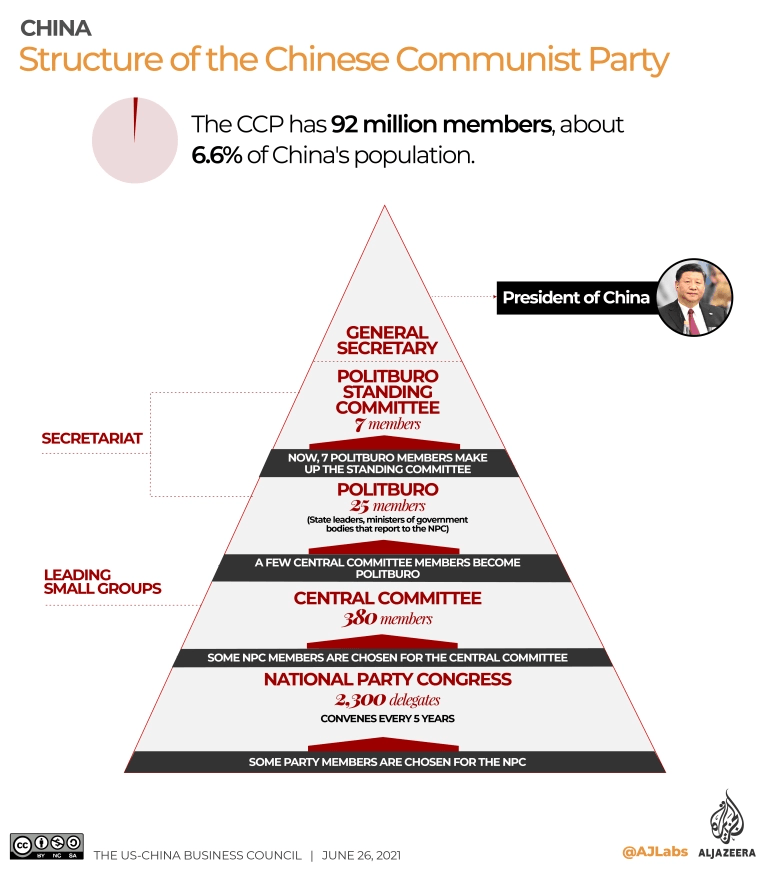

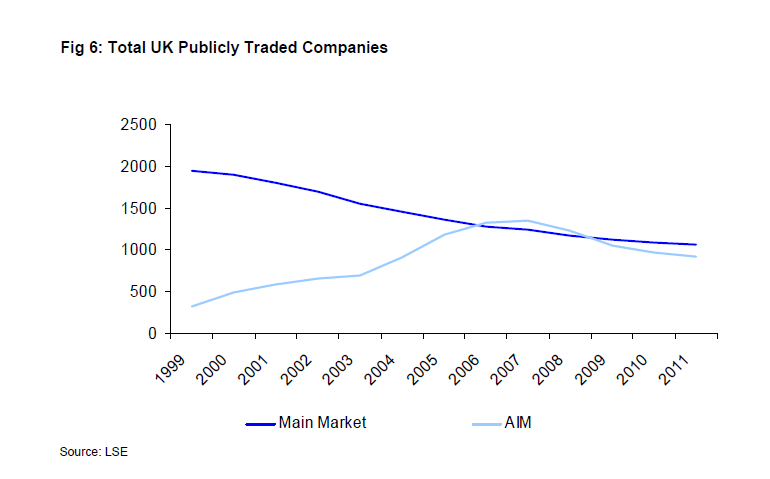

Nobody knows how the members of the CCP are elected. The process remains opaque to say the least. The structure of the CCP is shown in the chart below:

Click to enlarge

Source: The Political Mapping of China’s Tobacco Industry and Anti-Smoking Campaign, The John L. Thornton China Center at Brookings, October 2012

From the Brookings research report:

Chart 3-1 presents the organizational structure of the CCP at the national level, using data on the 17th (current) National Congress of the CCP as an example. The National Congress of the CCP, which convenes for about two weeks once every five years, is the most important political convention in the country. The party congress delegates (currently numbering 2,270) elect the Central Committee (currently 371 members) and the Central Commission for Discipline Inspection (127 members).171 In theory, the Central Committee then elects the general secretary of the CCP, the Politburo Standing Committee (9 members), the Politburo (25 members), the Secretariat (6 members), and the Central Military Commission (11 members). In practice, however, the process is top down rather than bottom up: members of these leading Party organs guide the selection of members of the lower-level leadership bodies such as the Central Committee, which then “approves” the slate of candidates for higher-level positions such as the next Politburo and its Standing Committee. To call the Central Committee’s selection of the Politburo an election is something of a misnomer. Members of the Politburo are actually elected by the outgoing Politburo Standing Committee and a handful of retired top leaders. This largely opaque process involves complicated factional deal-making and compromises.

Fifth Plenum of the 17th Central Committee of the Communist Party of China (CPC),October 2010

Photo Courtesy: Chinanews.com

Related:

- China’s Private Party (The Wall Street Journal)

- Chinese Communist Party (CCP) (Wikipedia)

- Billions in Hidden Riches for Family of Chinese Leader (The New York Times)

- The Party: The Secret World of China’s Communist Rulers a book by Richard McGregor

- Chinese man jailed for trying to form opposition party (The Guardian, UK)

- How CCP Controls China

- How China is Ruled (BBC)

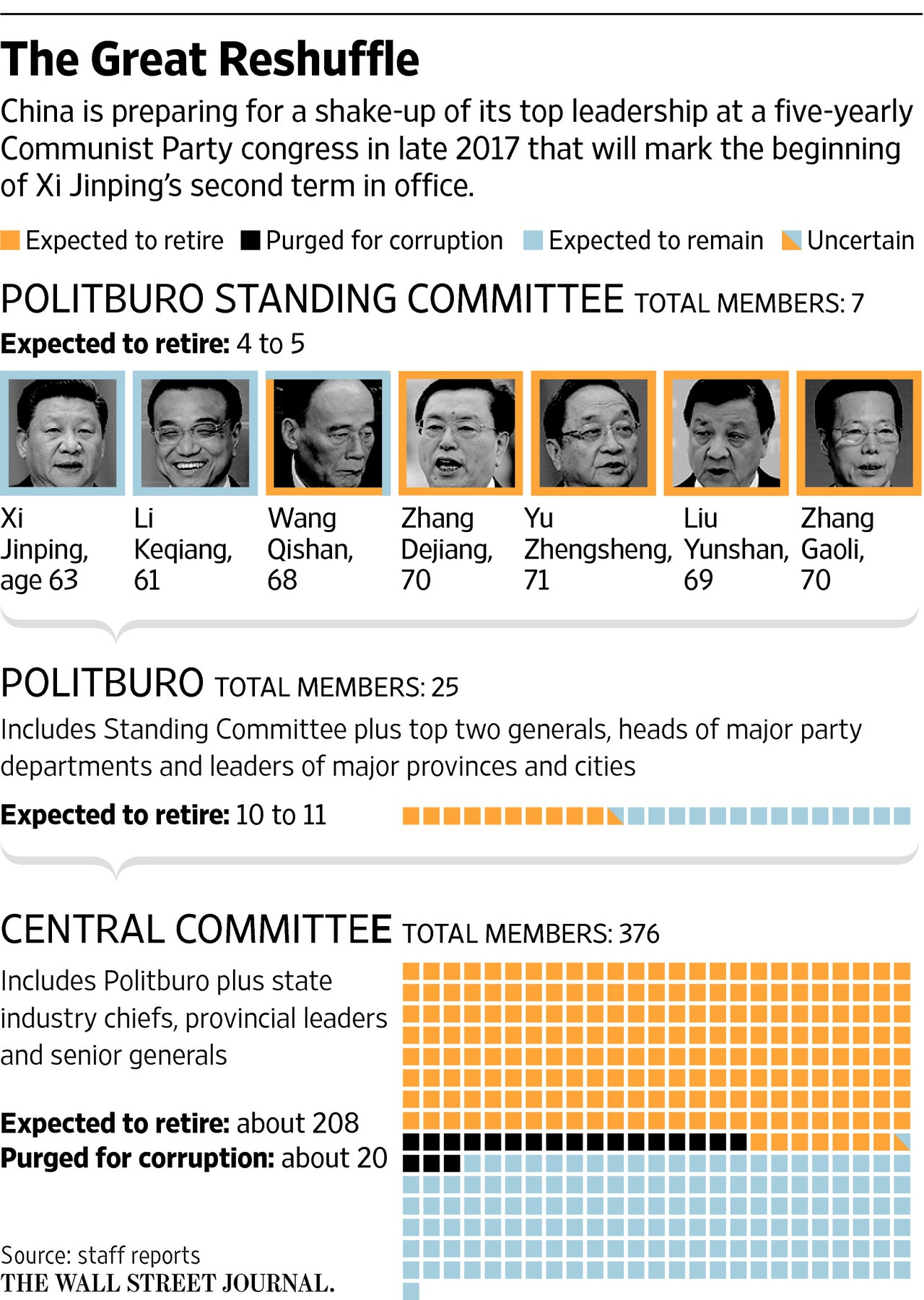

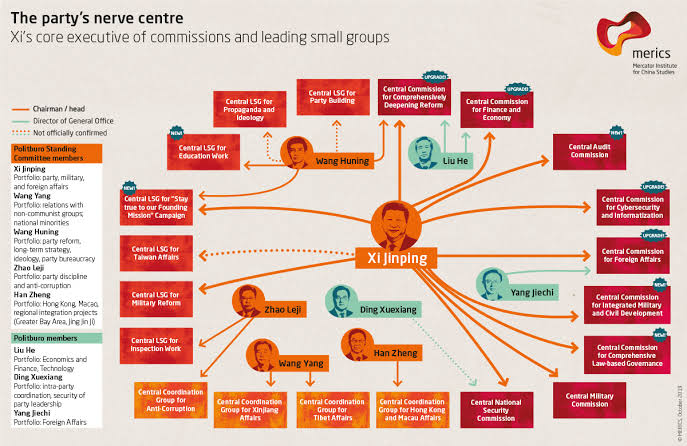

- China Communist Part Politburo Structure:

Click to enlarge

Source: Xi’s Power Play Foreshadows Historic Transformation of How China Is Ruled, WSJ, Dec 26, 2016

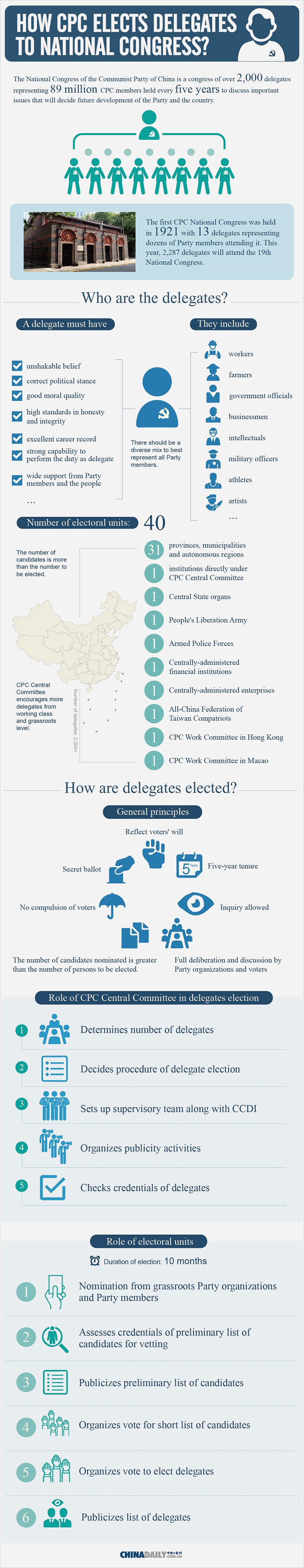

How CPC Elects Delegates to the National Congress:

Click to enlarge

Source: China Daily

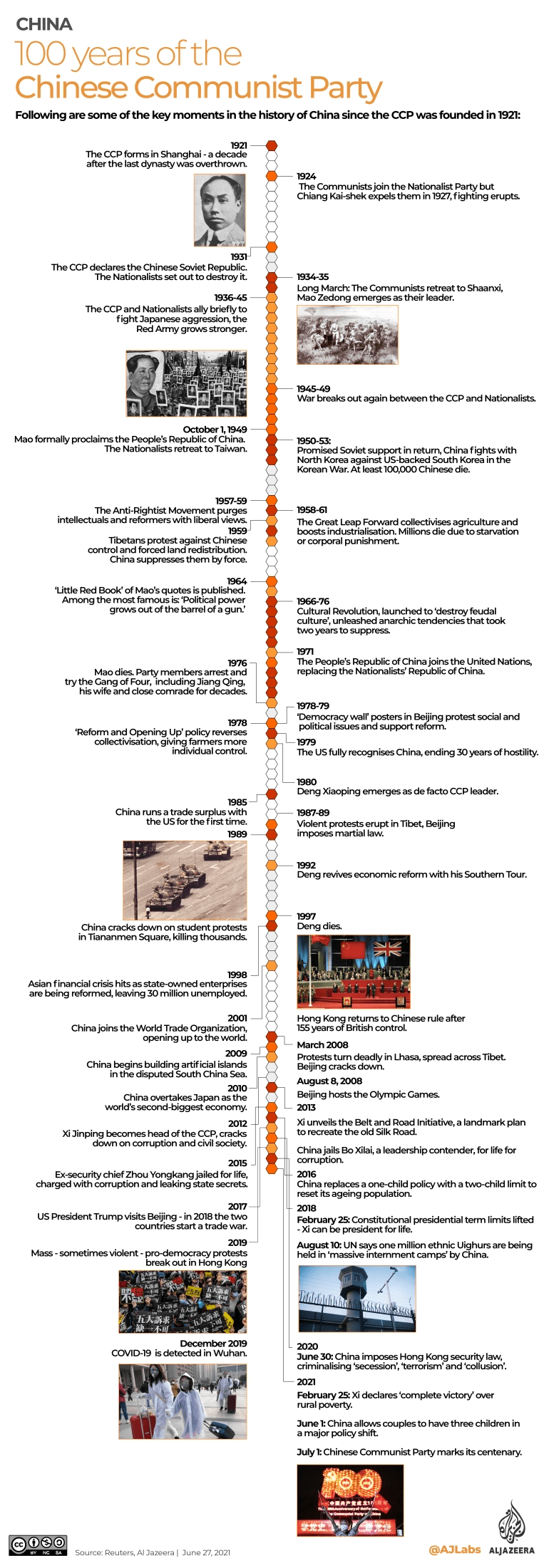

Updates(9/5/22):

100 Years of Chinese Communist Party: Infographic

Click to enlarge

The Structure of the Chinese Communist Party:

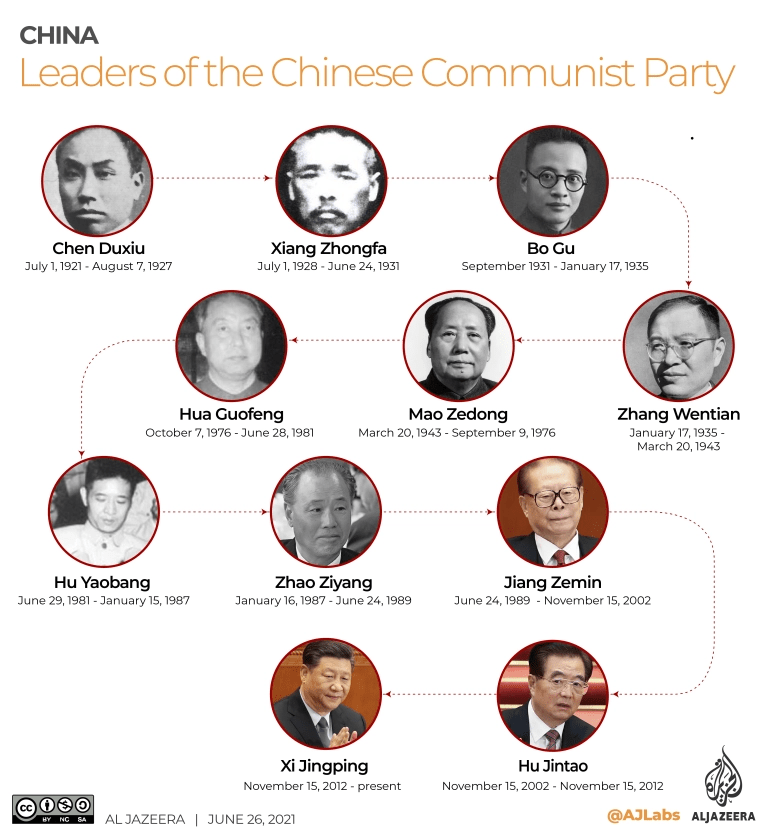

The Leaders of Chinese Communist Party since Founding:

Source: Infographic: 100 years of China’s Communist Party, Aljazeera

Chinese Communist Party System – Nerve Center:

Source: RR Power School

Chinese Communist Party Politburo – Fan of Power:

Source: Merics