South Africa is the most developed country in the African continent. With a population of about 48.0 million the country is rich in many mineral resources including gold, diamonds and platinum. The economy’s size is about $555.0 billion and mining is the largest industry. Investors looking to gain exposure to Africa are better off starting with South Africa.

The CIA’s World Factbook states the following on the state of South Africa’s economy:

Growth was robust from 2004 to 2007 as South Africa reaped the benefits of macroeconomic stability and a global commodities boom but began to slow in the second half of 2007 due to an electricity crisis and the subsequent global financial crisis’ impact on commodity prices and demand. GDP fell nearly 2% in 2009 but recovered in 2010-11. Unemployment remains high and outdated infrastructure has constrained growth. State power supplier Eskom encountered problems with aging plants and meeting electricity demand necessitating “load-shedding” cuts in 2007 and 2008 to residents and businesses in the major cities. Daunting economic problems remain from the apartheid era – especially poverty, lack of economic empowerment among the disadvantaged groups, and a shortage of public transportation. South Africa’s economic policy is fiscally conservative focusing on controlling inflation and attaining a budget surplus. The current government largely follows these prudent policies but must contend with the impact of the global crisis and is facing growing pressure from special interest groups to use state-owned enterprises to deliver basic services to low-income areas and to increase job growth.

Though mining is the major sector in the country, I am not a big fan of investing in mining stocks simply because investing in commodities involves extremely high risks and they can be highly volatile. Hence commodity stocks are not for the faint-hearted especially those trying to invest their hard-earned money or investors trying to earn income in the form of dividends. For example, after reaching record-high prices recently, silver fell 30% in just 6 days. Investing in commodities such as silver, gold and diamonds makes sense only when one takes the physical delivery.

However banking is one South African sector that is attractive but is often ignored by international investors.The four biggest banks in the country are FirstRand, Absa, Standard Bank and Nedbank accounting for 85% of the total banking assets. Some of the reasons to invest in South African banking stocks include:

- The banking sector is highly regulated in South Africa.

- The sluggish domestic economy is forcing banks to grow in other parts of Africa and some smaller lenders are increasing unsecured consumer lending.

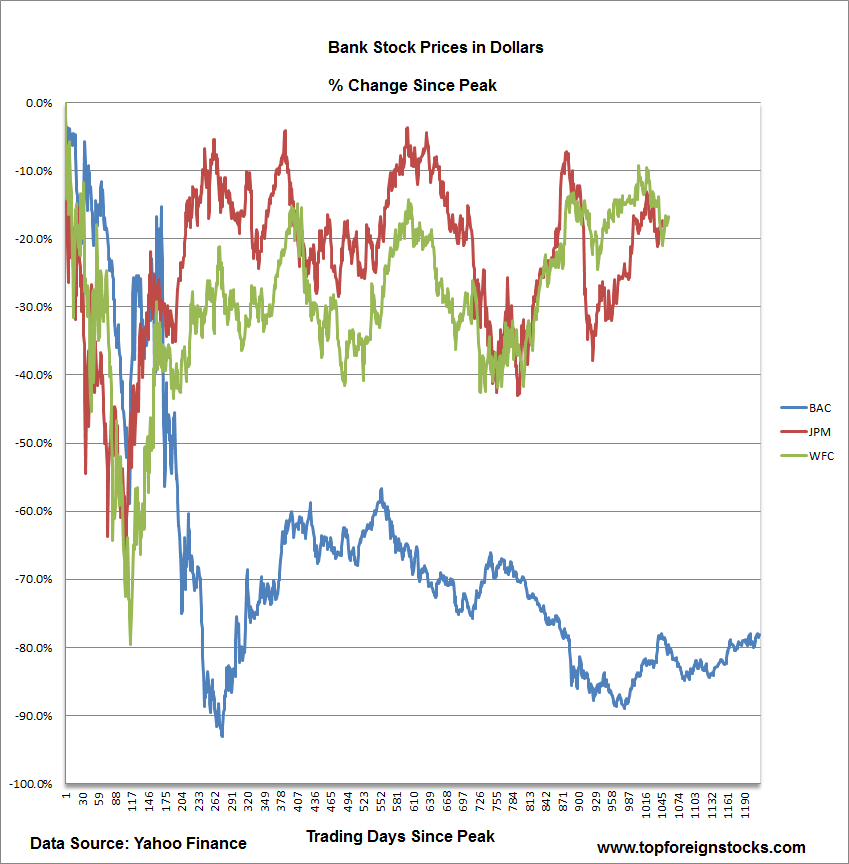

- South African banks remained strong during the global financial crisis when many developed banks were on the verge of complete collapse.

- The World Economic Forum recently ranked South Africa’s banking industry as the second safest in the world.

- The country’s banks are poised to implement the Basel III requirements quickly and smoothly.

- Most of the South African banks have capital adequacy ratios of at least 13% which is higher than the minimum requirements set by the Bank of International Settlement’s Basel standards.

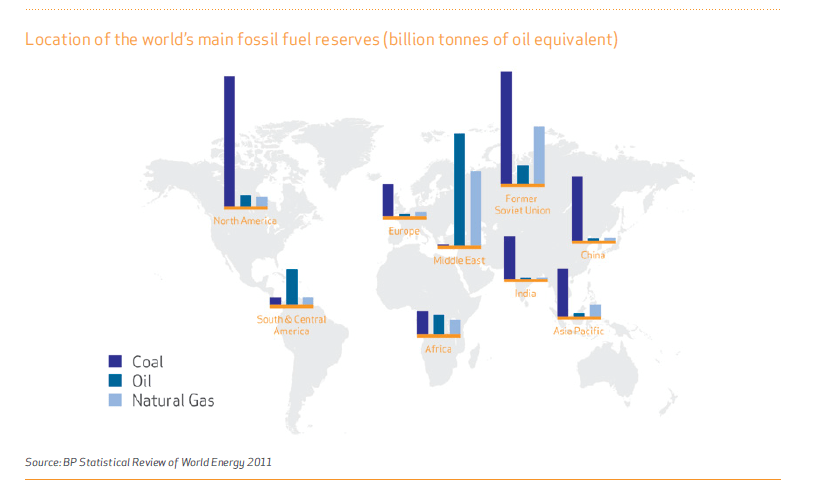

- South African banks are expanding in other African countries in the retail market. In the commercial market, they are increasing their services to South African companies that are the biggest investors on the continent except in the oil and gas sector . For example, Standard Bank has licenses to operate in 17 sub-Saharan countries and Nedbank has a partnership with Togo-based Ecobank which has presence in 32 countries. Absa is considering merging its retail operations with that of Barclays, its major shareholder and thus gain a foothold in Kenya, Tanzania and Ghana. FirstRand has been aggressively expanding in Africa though its investment banking arm, Rand Merchant Bank.

- The big four banks primarily focus on high earners in the personal unsecured lending market as opposed to poorer South Africans.

- Since the South African economy is projected to grow about by 3% for the next two years, banks’ Return on Equity(ROE) may reach 20% instead of 25% when the economy was booming. The 20% ROE is much higher than the ROE levels of most European and US banks.

Source: Are South African banks still a safe bet?, The Banker

The easiest way to invest in South African banks is via the iShares MSCI South Africa Index ETF (EZA). The fund was launched in 2003 and has an asset base of 493.0 million and. Financials account for about one-fourth of the portfolio and all the four banks mentioned above are part of the fund.

Three of the biggest banks trading on the OTC markets are listed below:

FirstRand Ltd. trades under the ticker FANDF.

Disclosure: Long NDBKY