Five long years have passed since the global financial crisis hit equity markets worldwide. One of the worst affected sectors was banking.Though the U.S. banking sector has stabilized in the past couple of years only some of the banking stocks have recovered. Many bank stocks are nowhere near the pre-crisis levels and some have totally disappeared. The number of bank failures has declined from previous years but still 50 banks have failed so far this year.

Among the thousands of banks in the country that struggled during the crisis, the U.S. gave preference in protecting the large banks by handing out billions in bailout funds. As a result most of the larger banks have survived intact and the so-called four too-big-too-fail (TBTF) “super banks” actually became much bigger in size laying the foundation for a more severe crisis in the future.

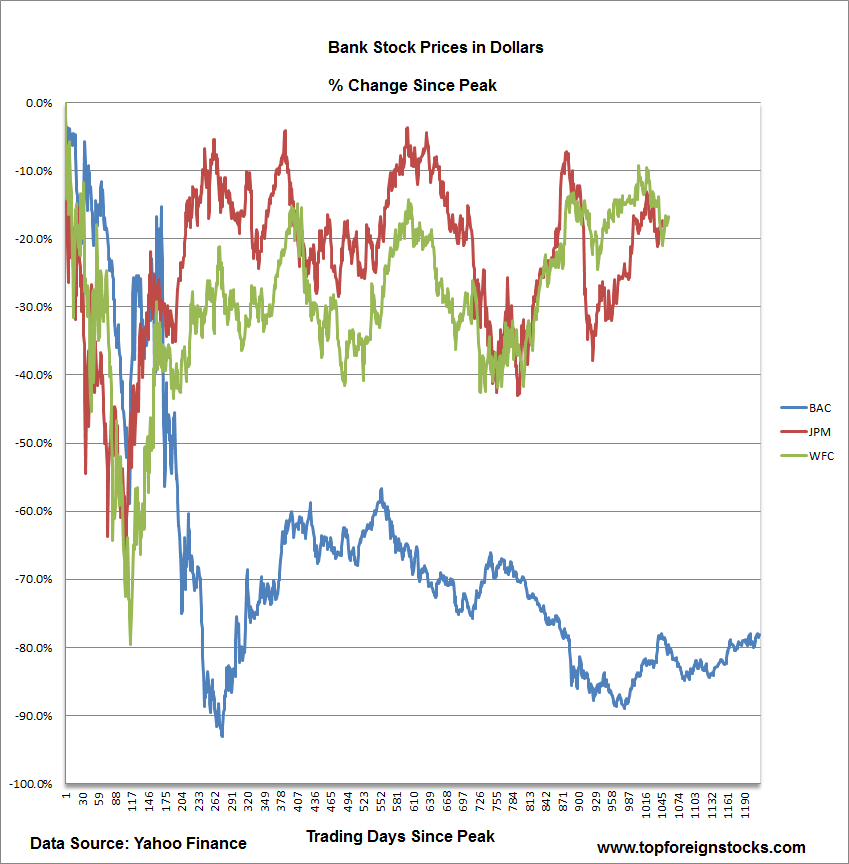

The following chart shows the equity performance of the three super-banks – Bank of America(BAC), JPMorgan Chase(JPM) and Wells Fargo(WFC) – from their peaks reached before the financial crisis:

Click to enlarge

JPMorgan Chase and Wells Fargo have recovered strongly compared to Bank of America with both less than 20% from their peaks. Bank of America is the worst performer with its stock price still off 78.1% from the peak.

Bank of America reached a low of $3.14 on 3/5/2009.Yesterday it closed at $9.86 but the peak was $45.03. From a dividend perspective, these banks now pay lower dividends than before the financial crisis. For example, BAC paid $0.64 in dividends for the 3rd quarter of 2008. Currently it pays a name-sake dividend of just $0.01 per quarter. The plunge in dividend amount shows that the bank has a still long way to go before making any meaningful dividend payments. JPMorgan Chase paid $0.30 in dividends for the 3rd quarter compared to $0.38 at its peak. Wells Fargo last paid a dividend of $0.22 relative to $0.34 per quarter in early 2009.

Disclosure: No Positions