China and India rank the first and second in terms of population.Each country is home to more than one billion people. While India is a democratic country with a multitude of political parties China is a communist country with only the communist party allowed to exist.

The economic system in China is unique and is called as “Market Socialism” which is a mixture of capitalism and socialism. While China allows private enterprises the state plays a major role in the regulation of the market.

India and China have two of the largest and fastest growing markets among the emerging countries. However China is ahead of India economically and India is playing catch up. Frederic Neuman of HSBC wrote in an article in FT beyondbrics that India has done well so far but has more work to do. From the article:

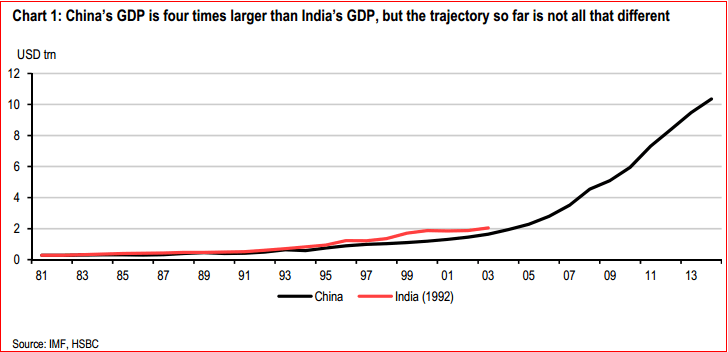

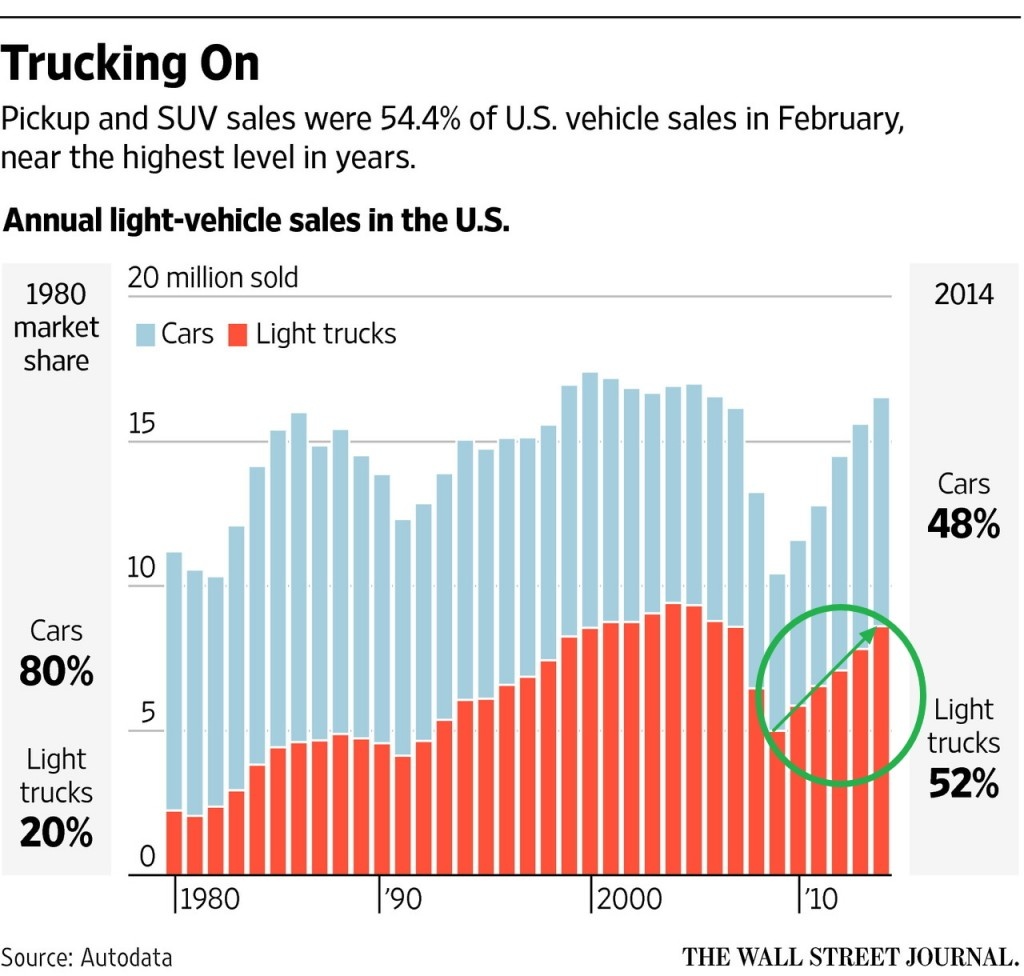

Click to enlarge

Chart 1 (above) makes an easy comparison. It shows the size of the Chinese and Indian economies in trillions of US dollars (the former is over four times as large as the latter). But here’s the twist: we date the respective lines from when officials adopted reforms in earnest (China in the early 1980s, India only in the early 1990s). Note two things. First, India is actually a little ahead of China at the same stage of the development process. Two, in truth, this counts for little because the main “growth spurt” only came thereafter. In other words: India will need to pick up speed in the coming years, ideally raising growth to double digits. Challenging stuff.

Source: Guest post: can India repeat China’s ascent?, Jan 19, 2015, FT beyondbrics

From a related article in Fidelity UK:

Perhaps one of the most exciting things about India right now is the ambition of the government. It’s thinking big, in terms of infrastructure development and all manner of business reforms.

Take plans to fast-track the regeneration of the country’s vast inland waterways network. The rejuvenation could create vast numbers of jobs, bring trade to poorly linked towns and raise the competitiveness of companies. This is appealing in a country renowned for its overloaded road and rail networks. New inland routes for cargo ships have been mooted as well as new ports and floating hotels1.

The pro-business government’s problem, of course, is age-old and that’s its ability to press reforms and infrastructure programmes through a democratic parliamentary system. It’s a difficulty shared with Japan but not so much China.

Source: How fast can India grow? by Graham Smith, Fidelity UK