Welcome to WordPress. This is your first post. Edit or delete it, then start blogging!

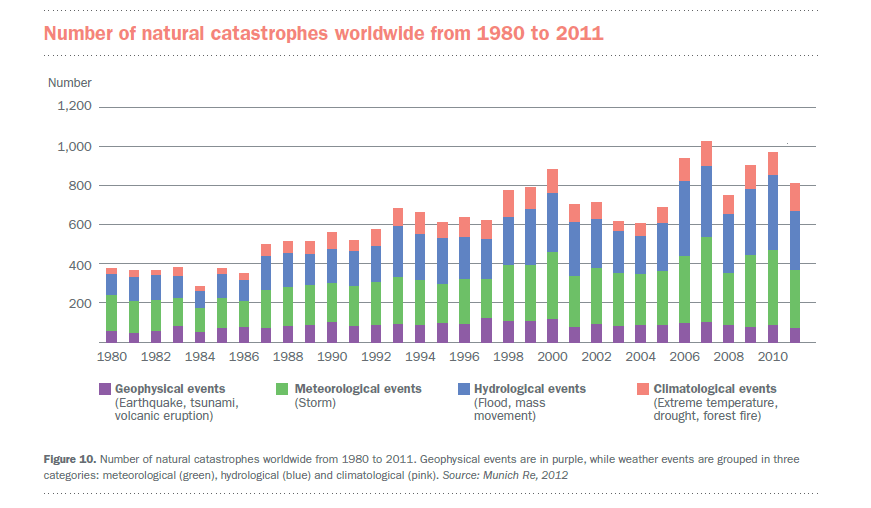

Chart: Natural Catastrophes Worldwide From 1980 to 2011

Germany-based reinsurance company Munich Re (MURGY) maintains the world’s largest database on global catastrophes. The company operates in most countries and earns over half of its disaster insurance premiums from the U.S. In October last Munich Re published a research study on climate changes.

From the report in Der Spiegel:

Whether it’s hurricanes, thunderstorms or tornadoes, extreme weather is big business for insurers. Now German re-insurer Munich Re claims to have found proof that man-made climate change is causing more weather catastrophes in North America. Scientists are outraged.

In late October of last year, superstorm Hurricane Sandy hit the US causing an estimated $25.0 billion in damages and more than 100 deaths. Sandy is the latest natural catastrophe to cause billions in damages.

Globally meteorological and hydrological catastrophic events are increasing since the 1980s. Here is chart showing the count of worldwide natural catastrophes worldwide from 1980 to 2011 :

Click to enlarge

Source: Munich Re

Disclosure: No Positions

Comparing the Performance of Sensex and Bovespa Indices

Last year India’s was one of the best performing emerging markets with the Sensex rising about 26%. Brazil had a lackluster performance with the Bovespa gaining under 8% for the year. Though both are part of the BRIC countries, the economies of Brazil and India differ vastly. For example, India is a major importer of commodities while Brazil is a major exporter. Though domestic consumption is increasing in both countries, the unemployment rate is lower and consumer credit growth is growing at a faster pace in Brazil than in India. It would be interesting to see how these two economies perform this year.

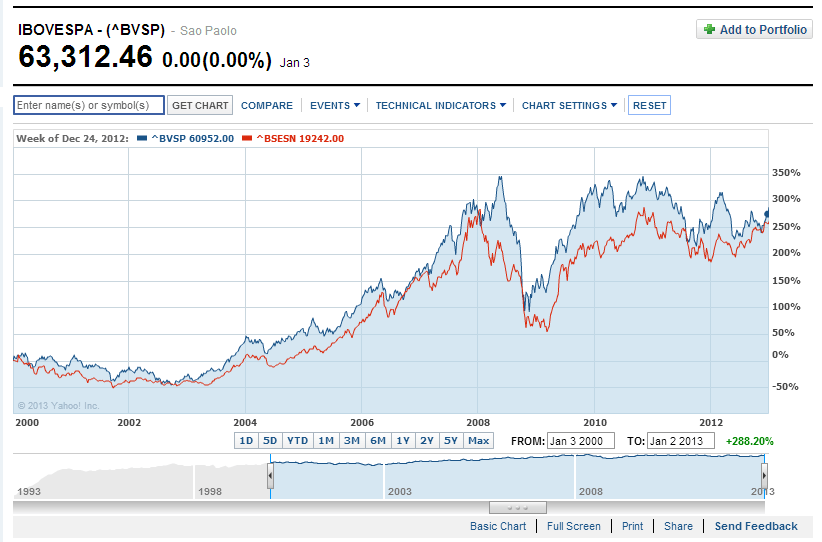

The chart below shows the performance of Bovespa and Sensex since 2000:

Click to enlarge

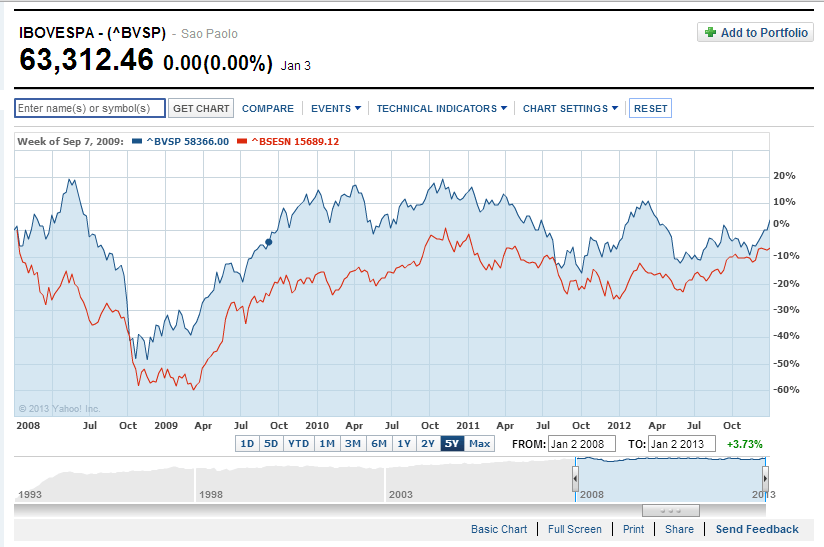

In the past 5 years Brazil’s Bovespa has outperformed the Sensex:

Source: Yahoo Finance

Mexico outperformed both Brazil and Chile last year since the Mexican economy is more connected to the US economy than the economies of Brazil and Chile. Mexico’s IPC index reached a new record high this year.

Related ETFs:

WisdomTree India Earnings (EPI)

PowerShares India (PIN)

iShares S&P India Nifty 50 (INDY)

EGShares Brazil Infrastructure ETF (BRXX)

iShares MSCI Brazil Index (EWZ)

Disclosure: No Positions

First-Ever OTC ADR Index Launched

BNY Mellon and OTC Markets Group joined forces together and launched the first-ever OTC ADR Index last month. From the OTC Markets Newsletter:

Today, a wide variety of ADRs — more than 1,400 — trade on the OTCQX®, OTCQB® and OTC Pink®marketplaces, a fivefold increase from just 10 years ago. In the first nine months of 2012, 251 new OTC ADR programs were established. This includes companies in every industry from almost every country across the globe.

To highlight all the great ADRs trading on our marketplaces, this month we partnered with BNY Mellon, the global leader in investment management and investment services, to launch the OTCM ADR Index, the first-ever index of ADRs traded on the OTCQB, OTCQB and OTC Pink marketplaces.

The Index, which can be found under the ticker symbol “OTCDR” on most data terminals, is designed to benchmark the fast-growing and diverse number of ADR investment opportunities available to investors through their U.S. brokers. It is comprised of 535 large-cap international companies traded on our marketplaces. In all, 38 countries are represented across 10 industries.

The number of stocks trading on the OTC markets is growing every year as more foreign companies move to list there and more smaller domestic firms start trading publicly.For example, from Jan 2, 2013 India’s Mahanagar Telephone Nigam Limited moved to the OTCQX market from the NYSE.Currently it trades under the ticker MTENY. As of November 30, 2012 the premier market known as the OTCQX market has 401 listed and the OTCQB and OTC Pink markets had 3,349 and 2,449 companies listed. About 1,600+ dividend-paying companies trade on these markets.

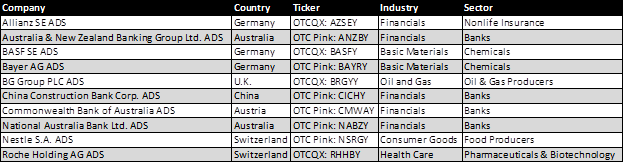

The Top 10 Components of the OTCM ADR Index are listed below:

Source: OTC Markets Newsletter

The launch of this index is a positive development for OTC Markets as more investors would become aware of some of the top foreign companies such as the above ten trading in the markets. Already there is talk of an ETF getting launched based on this index according to an article in the ETF Strategy site.

Disclosure: No Positions

Invest in Infrastructure Stocks

What are the advantages of investing in the infrastructure industry?

High barriers to entry;

Economies of scale (e.g., high fixed, low variable costs)

Inelastic demand for services (giving pricing power)

Low operating cost and high target operating margins; and

Long duration (e.g., concessions of 25 years, leases of 99 years)

Second, here is the value proposition:

Attractive returns

Low sensitivity to swings in the economy and markets

Low correlation of returns with other asset classes

Long-term, stable and predictable cash flows

Good inflation hedge

Low default rates; and

Socially responsible investing.

Source: Canadian Investment Review

Here are five foreign infrastructure stocks to consider:

1.Company: Vinci SA (VCISY)

Current Dividend Yield: 4.58%

Country: France

2.Company: Chicago Bridge and Iron Company NV (CBI)

Current Dividend Yield: 0.42%

Country: The Netherlands

3.Company: Hochtief AG (HOCFY)

Current Dividend Yield: N/A

Country: Germany

4.Company:Skanska AB (SKSBY)

Current Dividend Yield: 5.57%

Country: Sweden

5.Company: JGC Corp (JGC)

Current Dividend Yield: 1.51%

Country: Japan

Related ETF:

First Trust ISE Global Engineering and Construction Index Fund (FLM)

Disclosure: Long VCISY