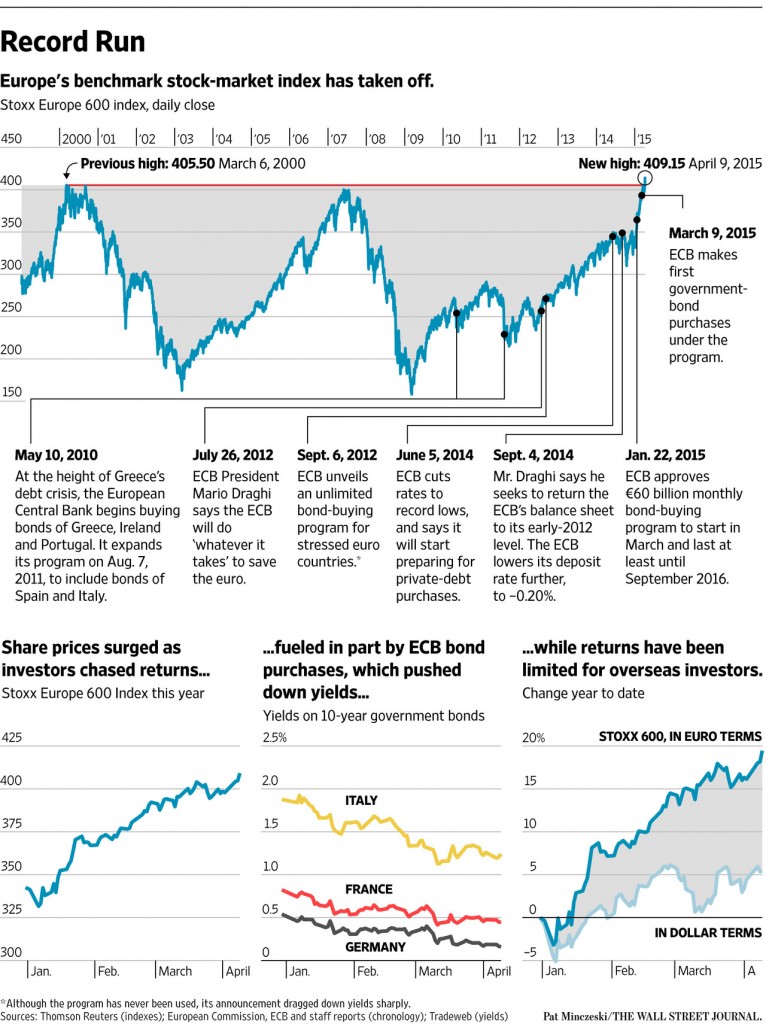

European stocks have soared so far this year. The STOXX® Europe 600 index is up 20.55% year-to-date and closed at 412.93 on Friday. On April 9th, the index reached a new record as shown in the chart below. The Stoxx 600 is similar to the S&P 500 benchmark index for the U.S. market.

Click to enlarge

Source: European Stocks Set New Record, The Wall Street Journal, April 9, 2015

From the above Journal article:

The latest leg of the rally has been fueled by the European Central Bank’s efforts to stimulate the lackluster eurozone economy by buying bonds. The program, which mirrors the measures taken by the Federal Reserve in recent years, has crushed the returns available for new bond buyers. As stocks rallied on Thursday, Germany’s 10-year government-bond yield sank to an all-time low of 0.14%.

Depressed bond yields push investors into riskier assets such as equities. At the same time, the bruised eurozone economy is showing signs of life, while the U.S. recovery has weakened. The result: A wave of cash has flowed into Europe’s stock markets.

“A few months ago, this was unthinkable. Nobody wanted to buy Europe. Now, everything has changed,” said Luca Paolini, chief strategist at Pictet Asset Management, which manages $437 billion of assets and favors European stocks relative to U.S. markets in its portfolios.

It is not surprising that European equities are outperforming their U.S. peers this year. I wrote a few articles last year discussing why European stocks were attractive. You can find two of those here and here.

Compared to the S&P’s 2.3% growth year-to-date, the returns of major European indices are much higher as listed below:

- France’s CAC 40: 22.6%

- Germany’s DAX Index: 26.2%

- Spain’s IBEX35 Index: 14.3%

- UK’s FTSE 100: 8.0%

The table below shows the year-to-date returns of European exchange-listed ADRs:

| Company | Ticker | Stock price as of April 9, 2015 | Year-to-date Change | Industry | Country |

|---|---|---|---|---|---|

| Amarin | AMRN | $2.59 | 164.29% | Pharma. & Biotech. | United Kingdom |

| Abengoa | ABGB | $17.97 | 65.17% | Alternative Energy | Spain |

| Forward Pharma | FWP | $32.04 | 53.82% | Pharma. & Biotech. | Denmark |

| Edap | EDAP | $3.37 | 44.64% | HealthCareEquip.&Ser | France |

| Sequans Communications | SQNS | $1.68 | 41.18% | Tech.Hardware&Equip. | France |

| VimpelCom - Com | VIP | $5.70 | 36.36% | Mobile Telecom. | The Netherlands |

| GW Pharmaceuticals | GWPH | $91.32 | 34.93% | Pharma. & Biotech. | United Kingdom |

| Novo Nordisk | NVO | $55.94 | 32.18% | Pharma. & Biotech. | Denmark |

| Delhaize | DEG | $23.59 | 30.19% | Food &Drug Retailers | Belgium |

| STMicroelectronics | STM | $9.44 | 26.37% | Tech.Hardware&Equip. | Italy |

| Innocoll AG | INNL | $7.30 | 22.90% | Pharma. & Biotech. | Germany |

| Luxottica | LUX | $64.53 | 18.47% | Personal Goods | Italy |

| Shire | SHPG | $248.77 | 17.05% | Pharma. & Biotech. | United Kingdom |

| Fresenius Medical Care | FMS | $43.39 | 16.83% | HealthCareEquip.&Ser | Germany |

| Pearson | PSO | $21.55 | 16.80% | Media | United Kingdom |

| UBS | UBS | $19.22 | 16.27% | Banks | Switzerland |

| ING Groep | ING | $14.99 | 15.57% | Life Insurance | The Netherlands |

| Sanofi | SNY | $52.35 | 14.78% | Pharma. & Biotech. | France |

| Fly Leasing | FLY | $15.02 | 14.22% | IndustrialTransport. | Ireland |

| Alcatel-Lucent | ALU | $4.04 | 13.80% | Tech.Hardware&Equip. | France |

| WPP | WPPGY | $117.77 | 13.13% | Media | United Kingdom |

| GlaxoSmithKline | GSK | $48.23 | 12.85% | Pharma. & Biotech. | United Kingdom |

| voxeljet AG | VJET | $9.15 | 12.68% | Tech.Hardware&Equip. | Germany |

| CGG | CGG | $6.63 | 12.37% | Oil & Gas Producers | France |

| Novartis | NVS | $103.58 | 11.79% | Pharma. & Biotech. | Switzerland |

| AB InBev | BUD | $125.09 | 11.37% | Beverages | Belgium |

| Telecom Italia | TI | $11.71 | 11.10% | Fixed Line Telecom. | Italy |

| ARM | ARMH | $51.42 | 11.06% | Tech.Hardware&Equip. | United Kingdom |

| Unilever | UN | $43.24 | 10.76% | Food Producers | The Netherlands |

| Credit Suisse | CS | $27.70 | 10.45% | Banks | Switzerland |

| CRH | CRH | $26.46 | 10.20% | Construct.&Materials | Ireland |

| Syngenta | SYT | $70.67 | 10.01% | Chemicals | Switzerland |

| ASM International | ASMI | $46.61 | 10.01% | Tech.Hardware&Equip. | The Netherlands |

| Aviva | AV | $16.35 | 9.73% | Life Insurance | United Kingdom |

| Carnival | CUK | $49.28 | 9.54% | Travel & Leisure | United Kingdom |

| Prudential | PUK | $50.41 | 9.18% | Life Insurance | United Kingdom |

| BP | BP | $41.54 | 8.97% | Oil & Gas Producers | United Kingdom |

| Statoil | STO | $19.02 | 8.01% | Oil & Gas Producers | Norway |

| Banco Bilbao Vizcaya Argentaria | BBVA | $10.11 | 7.67% | Banks | Spain |

| BT Group | BT | $66.51 | 7.29% | Fixed Line Telecom. | United Kingdom |

| Aegon | AEG | $8.04 | 7.20% | Life Insurance | The Netherlands |

| Reed Elsevier | ENL | $50.95 | 6.95% | Media | The Netherlands |

| Telefonaktiebolaget LM Ericsson | ERIC | $12.86 | 6.28% | Tech.Hardware&Equip. | Sweden |

| Unilever | UL | $42.87 | 5.90% | Food Producers | United Kingdom |

| Randgold Resources | GOLD | $71.19 | 5.61% | Mining | Jersey |

| SAP | SAP | $73.18 | 5.07% | Software&ComputerSvc | Germany |

| Logitech | LOGI | $13.95 | 3.87% | Tech.Hardware&Equip. | Switzerland |

| Amec Foster Wheeler PLC | AMFW | $13.40 | 3.55% | Construct.&Materials | United Kingdom |

| Eni | E | $36.07 | 3.32% | Oil & Gas Producers | Italy |

| Criteo | CRTO | $41.57 | 2.85% | Software&ComputerSvc | France |

| Nokia | NOK | $8.06 | 2.54% | Tech.Hardware&Equip. | Finland |

| Flamel Technologies | FLML | $17.55 | 2.45% | Pharma. & Biotech. | France |

| Trinity Biotech | TRIB | $17.84 | 1.88% | HealthCareEquip.&Ser | Ireland |

| ABB | ABB | $21.54 | 1.84% | Industrial Engineer. | Switzerland |

| Grifols | GRFS | $34.60 | 1.79% | Pharma. & Biotech. | Spain |

| Reed Elsevier PLC | RUK | $69.18 | 1.66% | Media | United Kingdom |

| InterContinental Hotels | IHG | $40.59 | 1.35% | Travel & Leisure | United Kingdom |

| Barclays Bank | BCS | $15.14 | 0.87% | Banks | United Kingdom |

| British American Tobacco | BTI | $108.67 | 0.79% | Tobacco | United Kingdom |

| Lloyds Banking Group | LYG | $4.67 | 0.65% | Banks | United Kingdom |

| TOTAL | TOT | $51.41 | 0.41% | Oil & Gas Producers | France |

| Koninklijke Philips Electronics | PHG | $29.10 | 0.34% | Leisure Goods | The Netherlands |

| BHP Billiton | BBL | $43.06 | 0.14% | Mining | United Kingdom |

| Diageo | DEO | $113.80 | -0.25% | Beverages | United Kingdom |

| National Westminster Bank | N/A | $26.00 | -0.46% | Banks | United Kingdom |

| AstraZeneca | AZN | $69.91 | -0.67% | Pharma. & Biotech. | United Kingdom |

| Telefonica | TEF | $14.11 | -0.70% | Fixed Line Telecom. | Spain |

| Vodafone Group | VOD | $33.53 | -1.87% | Mobile Telecom. | United Kingdom |

| DBV Technologies S.A. | DBVT | $26.58 | -1.99% | Pharma. & Biotech. | France |

| CSR | CSRE | $51.33 | -2.53% | Electron.&ElectricEq | United Kingdom |

| Orange | ORAN | $16.40 | -3.07% | Fixed Line Telecom. | France |

| Smith & Nephew | SNN | $34.98 | -4.79% | HealthCareEquip.&Ser | United Kingdom |

| HSBC | HSBC | $44.69 | -5.38% | Banks | United Kingdom |

| National Grid | NGG | $66.41 | -6.01% | Gas,H20&Multiutility | United Kingdom |

| ASML | ASML | $100.02 | -7.24% | Tech.Hardware&Equip. | The Netherlands |

| Ryanair | RYAAY | $66.10 | -7.25% | Travel & Leisure | Ireland |

| Rio Tinto | RIO | $41.45 | -10.01% | Mining | United Kingdom |

| Royal Dutch Shell - A Shares | RDS.A | $59.73 | -10.78% | Oil & Gas Producers | United Kingdom |

| Banco Santander | SAN | $7.32 | -12.12% | Banks | Spain |

| ArcelorMittal | MT | $9.59 | -13.06% | Indust.Metals&Mining | Luxembourg |

| Royal Dutch Shell - B Shares | RDS.B | $60.40 | -13.17% | Oil & Gas Producers | United Kingdom |

| Luxfer | LXFR | $12.91 | -13.53% | Indust.Metals&Mining | United Kingdom |

| Royal Bank of Scotland | RBS | $10.25 | -15.36% | Banks | United Kingdom |

| National Bank of Greece | NBG | $1.28 | -28.49% | Banks | Greece |

| Materialise | MTLS | $6.67 | -29.94% | Tech.Hardware&Equip. | Belgium |

| Aixtron | AIXG | $7.60 | -32.20% | Tech.Hardware&Equip. | Germany |

| Celsus Therapeutics Plc | CLTX | $0.69 | -85.63% | Pharma. & Biotech. | United Kingdom |

Source: BNY Mellon

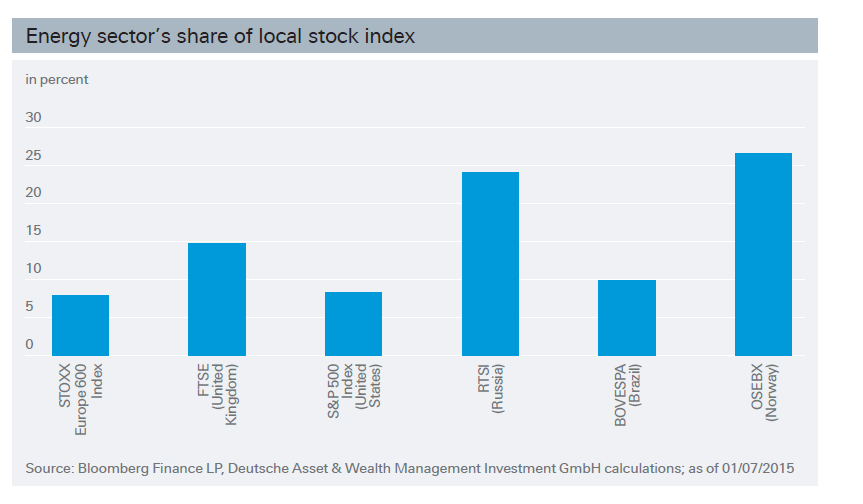

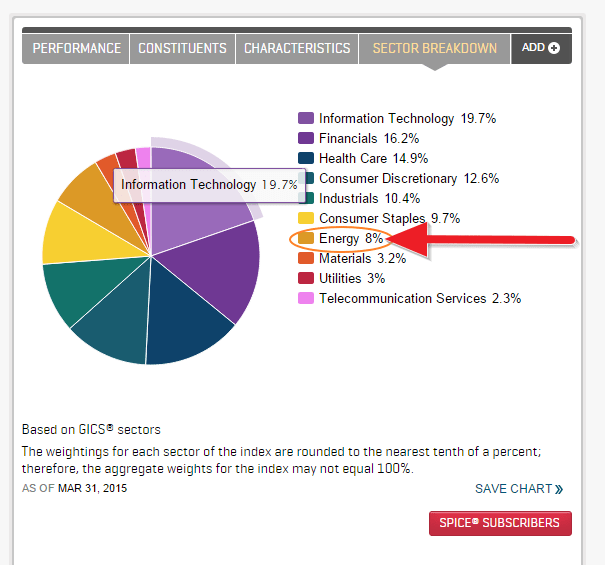

Though European equities have rallied strongly there is still room to run as the economy recovers. However the easy money has already been made. So further growth in equity prices will be staggered. Investors looking to invest in Europe have to take a deep dive and identify opportunities that are under-valued at current levels. One sector that investors can hunt for bargains is the oil sector. Other than the oil firms themselves plenty of options exist in the infrastructure and services space within the oil industry.Many high-quality firms have seen their stock prices cut in half or more in recent months due to the fall in oil prices. However as the price of oil recovers and European economies pick up steam these firms should recover.

Railway Station in N.Wales