The equity markets of major European economies have lagged the performance of the U.S. market so far this year. The year-to-date returns of the main European markets as of Sept 22nd are listed below:

UK’s FTSE 100: 0.4%

France’s CAC 40: 3.4%

Spain’s IBEX 35: 10.4%

Germany’s DAX: 2.1%

U.S. stocks have performed very well relatively with the S&P 500 up 7.9% as of Sept 22, 2014.

A few years ago Europe went thru a series of crises mainly affecting Greece, Spain, Ireland, Iceland and Portugal. Dire predictions of the collapse of the European Union, the Euro, social unrest, permanent recession, etc. did not occur. The many bailouts of the ECB and quick policy reforms implemented by by respective governments have helped countries recover from the depth of the crisis. While Europe was able to recover form those crises, in the past few months new issues have hit the EU member countries. These include trade sanctions against Russia, war in Ukraine, Scotland referendum, etc. Structural problems like high unemployment still persist in Greece, Italy and other countries. But overall European economies are recovering and European firms are growing again. Cash-rich German companies for instance are acquiring other firms including some in North America in order to take advantage of growth opportunities.

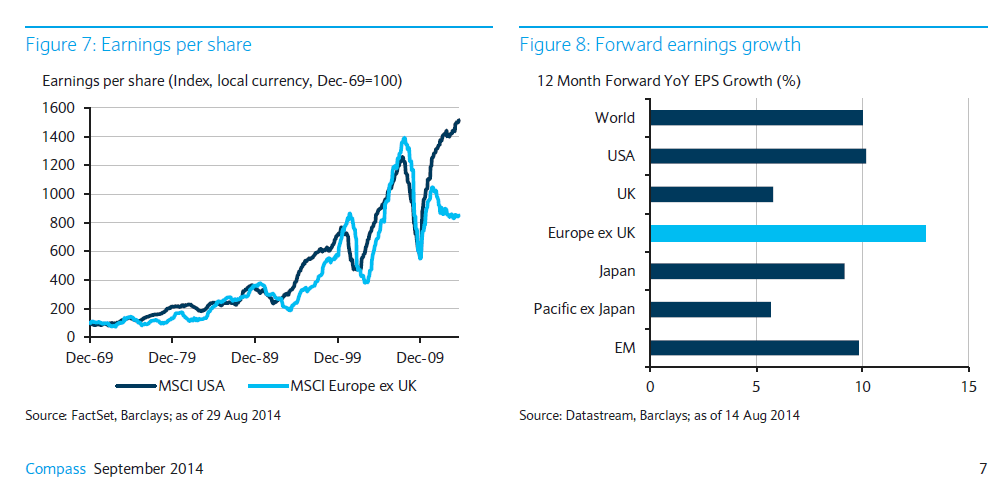

Though U.S. stocks have outperformed European stocks until now, European companies have better growth prospects moving forward than their American peers according to are report by Barclays.

From the report:

“Earnings upside

A large part of this story relates to the greater relative upside for European corporate earnings relative to their developed market peers. (Figure 7) This is a function of the banks’ plight, and the more geographically constrained mid- and small-cap universe. As both the European and global economies continue to improve, we likely will see European corporate earnings benefit. (Figure 8)Click to enlarge

The case for European equities is finely balanced. Incoming economic data remains uninspiring at best, and the prospects for further sanctions against Russia are unlikely to be helpful. However, gradually thawing domestic credit markets, a process helped by the ECB’s various measures, alongside a brisker global economy, are among the reasons that suggest European equities remain attractive.”

Source: Compass, September 2014, Barclays

Ten European stocks outside of the U.K. are listed below for consideration:

1.Company: Siemens AG (SIEGY)

Current Dividend Yield: 3.33%

Sector: Industrial Conglomerates

Country: Germany

2.Company:Air Liquide (AIQUY)

Current Dividend Yield: 2.50%

Sector: Chemicals

Country: France

3.Company: Danone SA (DANOY)

Current Dividend Yield: 2.88%

Sector:Food Products

Country: France

4.Company: Edp Energias De Portugal SA (EDPFY)

Current Dividend Yield: 5.66%

Sector: Electric Utilities

Country: Portugal

5.Company: Nestle SA (NSRGY)

Current Dividend Yield: 3.23%

Sector: Food Products

Country: Switzerland

6.Company: BASF SE (BASFY)

Current Dividend Yield: 3.81%

Sector: Chemicals

Country: Germany

7.Company: Allianz SE (AZSEY)

Current Dividend Yield: 4.14%

Sector:Insurance

Country: Germany

8.Company: AXA Group (AXAHY)

Current Dividend Yield: 4.39%

Sector: Insurance

Country: France

9.Company: Telefonica SA (TEF)

Current Dividend Yield: 3.50%

Sector: Telecom

Country: Spain

10.Company:Eni SpA (E)

Current Dividend Yield: 6.28%

Sector:Oil, Gas & Consumable Fuels

Country: Italy

Note: Dividend yields noted above are as of Sept 23, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long AXAHY