Economist Jim O’Neill of Goldman Sachs coined the term “BRICs” in November 2001 to identify the core set of emerging markets at that time. These countries – Brazil, Russia, India and China – did not have many things in common other than all being emerging countries. For example, in terms of political systems Brazil and India follow democracy, China follows communism with a capitalist economic system and Russia is not yet democratic though it claims to be a democracy. Similarly Brazil and Russia are rich in many natural resources while China and India have limited natural resources and import most of the commodities needed for growth. Population wise, China and India have two of the world’s largest populations while Brazil and Russia’s population is relatively small.

Despite all the differences between these countries, the BRIC markets took off from 2001. From an article in the FT beyondbrics blog:

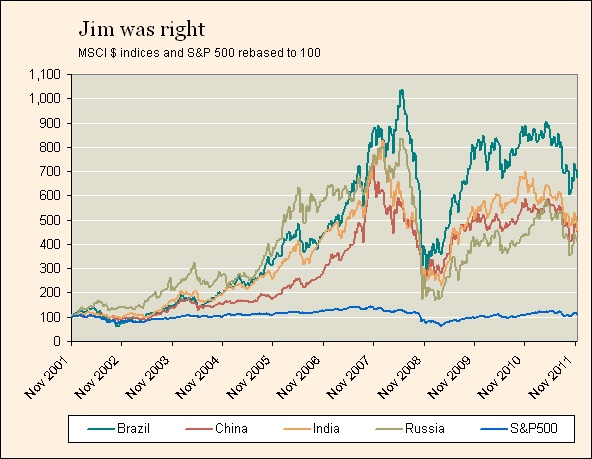

In investment terms, it paid off spectacularly. In the ten years since O’Neill launched the Brics in November 2001, the MSCI indices for the four Brics all comfortably outperformed the S&P 500. An investment of $100 in each of the four Brics,would have been worth $674 in Brazil, $451 in China, $459 in India and $414 in Russia. An investment in the S&P500 over the same years would have made just $112. See chart below.

Click to enlarge

Source: Goodbye Mr Bric, FT beyondbrcis

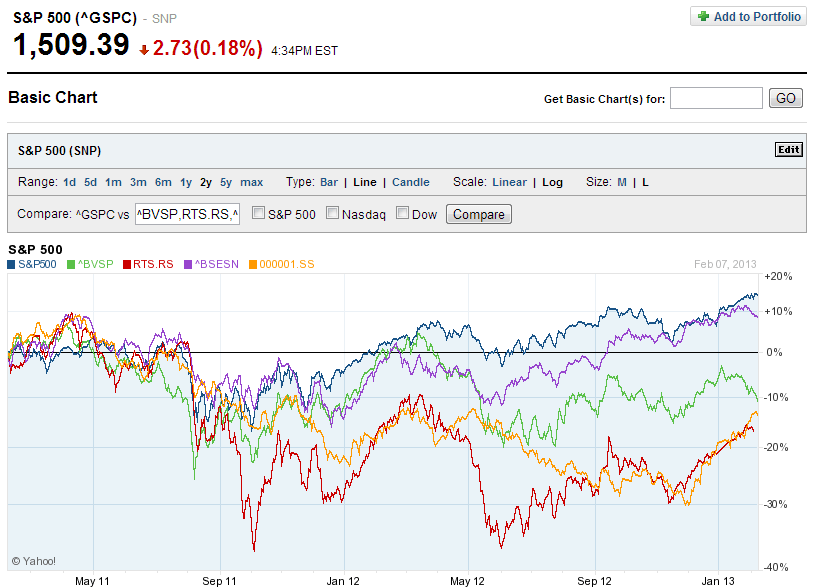

However the BRICs have lagged the S&P 500 in recent years as shown in the chart below:

Source: Yahoo Finance

Brazil’s Bovespa index is in the negative territory so far this year compared to the other BRIC benchmark indices and the S&P 500. It remains to be seen if the BRICs will outperform the S&P 500 this decade. Global investors will be eagerly watching the performance of the BRICs as their economies continue to expand although at a slower pace than before.

Related ETFs:

iShares MSCI Brazil Index (EWZ)

Market Vectors Russia ETF (RSX)

iShares FTSE/Xinhua China 25 Index Fund (FXI)

PowerShares India (PIN)

iShares S&P India Nifty 50 (INDY)

Disclosure: No Positions

Investment management firms manager assets for individuals, institutions, charities, pension funds and others. These firms provide a full range of services from asset management to wealth advisory to everything in between. Investment managers have strong business models and investment in their stocks are worth considering for the following reasons:

Investment management firms manager assets for individuals, institutions, charities, pension funds and others. These firms provide a full range of services from asset management to wealth advisory to everything in between. Investment managers have strong business models and investment in their stocks are worth considering for the following reasons: A well diversified portfolio should include some portion of the assets in utilities. Companies operating in this sector include electric utilities, gas utilities, power distributors, producers and multi-utilities.

A well diversified portfolio should include some portion of the assets in utilities. Companies operating in this sector include electric utilities, gas utilities, power distributors, producers and multi-utilities. The $80.0 billion dollar U.S. beer market is highly concentrated with few companies sharing the market. Recently the U.S. Justice Department has filed a suit trying to block Belgium-based Anheuser-Busch InBev’s $20.3 billion takeover of Grupo Modelo of Mexico. The department argues that the merger would stifle competition and hurt consumers.

The $80.0 billion dollar U.S. beer market is highly concentrated with few companies sharing the market. Recently the U.S. Justice Department has filed a suit trying to block Belgium-based Anheuser-Busch InBev’s $20.3 billion takeover of Grupo Modelo of Mexico. The department argues that the merger would stifle competition and hurt consumers.