Diversification is an important factor to consider when investing in foreign stocks . An investor can diversify based on a specific theme or types of markets such as emerging, frontier, developed, etc. It is better to diversify between different markets and then different countries within those markets. It is not a wise idea to invest all the assets allocated for foreign stocks in one type of market or a theme. Diversification between countries not only reduces many risks but also offers potential to enhance returns as one country’s economy may grow faster than the other.In addition, a few countries may not perform well as projected.

During the global financial crisis of 2008-09, international diversification seemed to be pointless as all markets plunged in lock step.It did not matter if an investor diversified across emerging and developed markets.The benefits of diversification across different markets or even asset classes seemed to be dead. At that time many articles appeared praising the idea of just investing in domestic companies and authors advised readers not to bother with going abroad in search of better investment opportunities. Some even suggested that investing in foreign markets was not necessary as many American companies earn a substantial part of their earnings from abroad.Those suggestions couldn’t be more wrong when considering returns in the long term.

In this post let me show the benefits of international diversification using the S&P 500 against select emerging and developed indices.

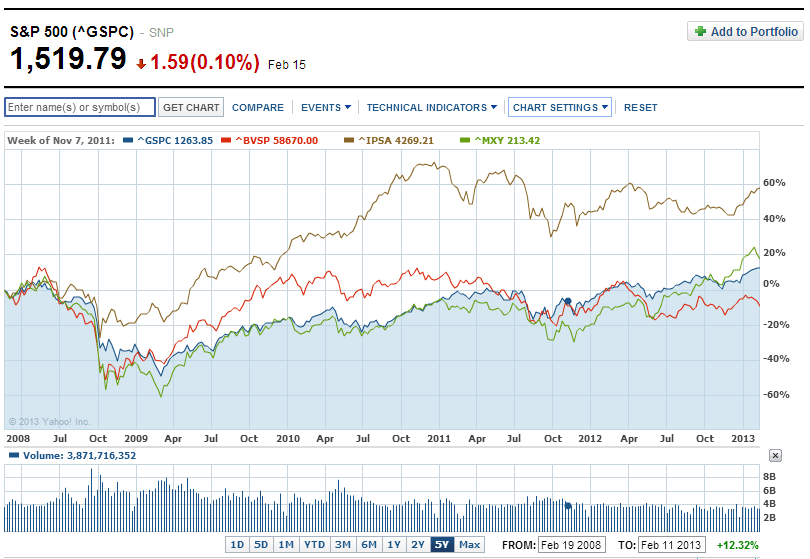

a)The following chart shows the 5-year returns of S&P 500 against the benchmark indices of three large Latin American economies:

Click to enlarge

Chile’s IPSA index (brown) outperformed the S&P 500(blue) by a wide margin in the past five years. Brazil’s Bovespa(red) has lagged not only the U.S. market but also the Chilean and Mexican markets. Once considered a must-own market, Brazil has lost its shine in recent years. Mexico’s IPC index(green) has slightly performed better than the S&p 500. The key takeaway from this review is that certain emerging markets performed differently than U.S. markets and that one can achieve higher returns by diversifying among emerging markets. An investor who invested only in Brazil would have earned lower returns than someone who diversified their emerging markets allocation among Brazil, Chile and Mexico. Hence the benefit of international diversification cannot be understated. An investor who ignored Chile and just stayed with U.S. domestic equities would have missed the excellent returns from Chilean stocks.

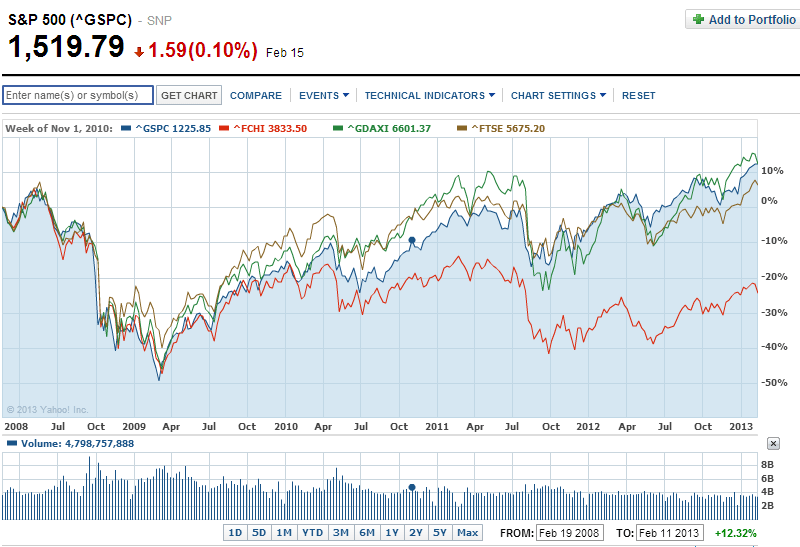

b)The following chart shows the 5-year returns of S&P 500 against select developed European indices:

Germany’s DAX(green) has outperformed the FTSE 100(brown) and CAC 40(red) indices in the period shown. With Europe’s largest economy, Germany was less severely impacted by the European sovereign debt crisis of the past few years relative to other European countries.Compared to Germany, France has performed poorly since the March lows of 2009 due to the European debt crisis and many issues in the domestic economy. It is interesting to note that Germany’s DAX has closely followed the S&P 500. As with the emerging markets example discussed above, an investor with exposure to just French equities would have had lower returns than someone with diversified exposure to France, UK and Germany. This analysis shows that there is considerable differences in the performance of different developed equity markets.

The key takeaway from the above discussion is that the benefits of global diversification is alive and well. Investors should diversify their overseas allocations between many countries and market types. A good split between emerging and developed markets with an added measure of a little frontier market exposure will help juice up the overall returns of a portfolio. Global diversification also reduces the effects of the various risks with investing in foreign countries such as political risk, currency risk, concentration risk, etc.

Source: Yahoo Finance

Related ETFs:

iShares MSCI Germany Index Fund (EWG)

iShares MSCI Brazil Index Fund (EWZ)

SPDR S&P 500 ETF (SPY)

iShares MSCI France Index Fund (EWQ)

iShares MSCI Chile Capped Investable Market Fund(ECH)

iShares MSCI Mexico Capped Investable Market Index Fund (EWW)

iShares MSCI United Kingdom Index Fund (EWU)

Diclosute: No Positions