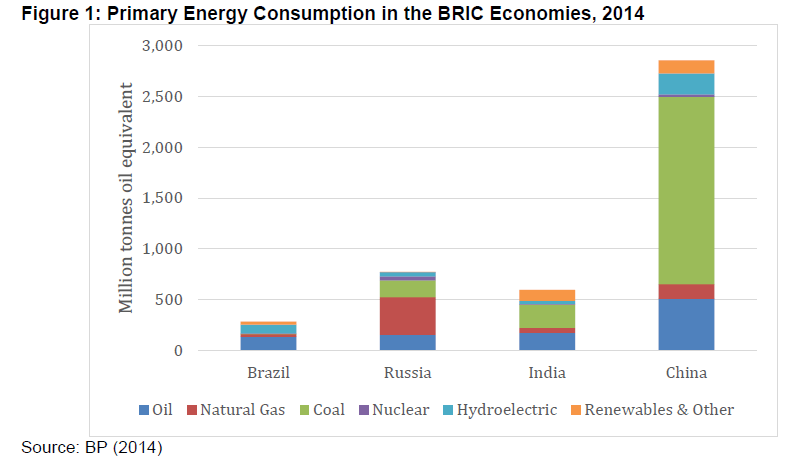

The primary energy sources for the BRIC countries are shown in the chart below:

Click to enlarge

Source: Gasoline and Diesel Pricing Reforms in the BRIC Countries: A Comparison of Policy and Outcomes, The Oxford Institute for Energy Studies, University of Oxford

In Russia, China and India oil is the second most important energy source. In Brazil it is the most important energy source. Though China has the highest primary energy consumption, in per capita terms Russia has the highest energy consumption since the population of Russia is small compared to China which has the highest population in the world.

Coal is the top source of energy consumption in India and China. Oil is only the second important energy source. Russia depends most on natural gas followed by oil.

Russia is a net exporter of oil while Brazil is self-sufficient as its production almost equals consumption.China and India are both net importers of oil. Hence the decline in oil prices in the past few months is most beneficial to these countries than Brazil or Russia.