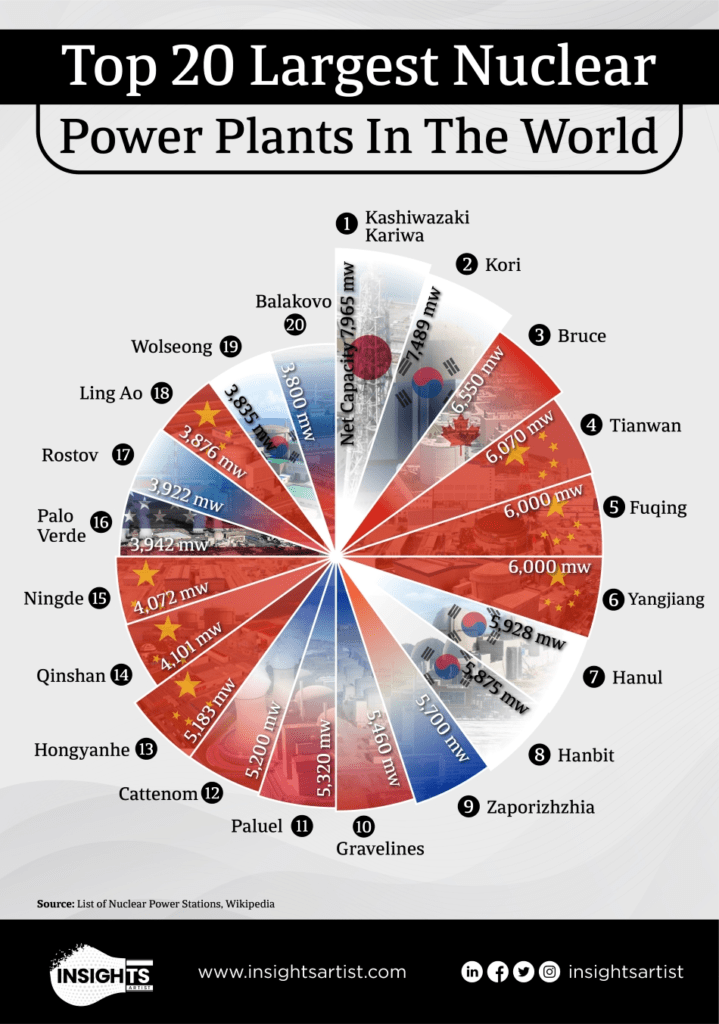

Have you ever wondered where the largest nuclear power plants in the world are located? The following infographic provides the answer. The world’s largest nuclear plant in terms of net electrical power rating is The Kashiwazaki-Kariwa Nuclear Power Plant in Japan with a net capacity of 7,965 mw. The Zaporizhzhia Nuclear Power Plant in Ukraine is the largest in Europe and the 9th largest in the world. As of March 2022, it is under Russian control. China has the most plants in the top 20 list.

Click to enlarge

Source: InsightArtist.