The elevator industry is highly concentrated with just four companies accounting for two-thirds of the global market. The these companies are:

- Otis, part of United Technologies of the USA

- Kone of Finland

- ThyssenKrupp, part of the conglomerate by the same name of Germany

- Schindler of Switzerland

Some of these firms can be considered as the world’s top “least popular” transportation companies. They can be considered as least popular since not many people think of elevator makers as transportation companies. However in reality they offer a form of transportation that is simply vertical or horizontal in a fixed location such as a high rise building or an airport or a mall. These companies offer a service that is so important yet mostly under appreciated by people. For example, Schindler moves 1 billion people per day according to their site. To put this figure in perspective, the total world population now is about 7.86 billion.

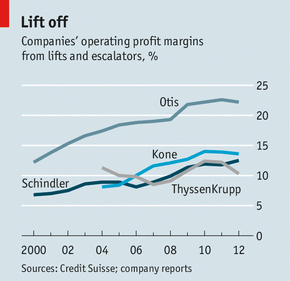

From an investment point of view, elevator makers are attractive for long-term investment since they operate in a highly specialized industry and have high profit margins.

From an article titled The lift business – Top floor, please in The Economist earlier this year:

People live more vertically than ever before. An estimated 70m the world over—more than the entire population of Britain—move to cities every year. Many live in blocks of flats or work in high-rise offices. Nearly all use escalators (which the big four also make) from time to time. Few can be bothered to take the stairs.

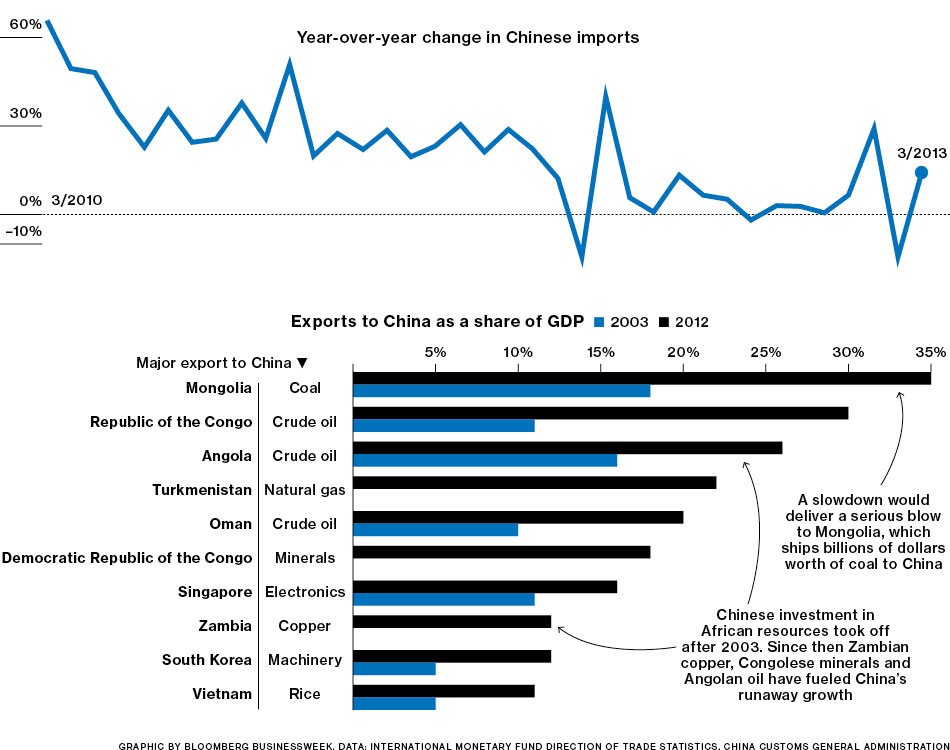

Jürgen Tinggren, Schindler’s boss, talks of a “second planet” of new consumers who are discovering the elation of elevation. Global demand for new lifts has gone from 300,000 a decade ago to nearly 700,000 this year. China, where two-thirds of new units are installed, accounts for much of the rise. Annual revenues are climbing steadily: the Freedonia Group, a consultancy, thinks they will have doubled to $90 billion in the decade to 2015.

The secret to the industry’s whopping margins, however, is maintenance. People hate getting stuck in lifts. So they pay $2,000-5,000 a year to keep each one running smoothly. Since 11m machines are already in operation, many needing only a quick look-over and a dollop of grease every few months, this is a nice business. Margins are 25-35%, compared with 10% for new equipment. Revenue from maintenance is far more stable than that from installations, which are affected by the ups and downs of the economy.

Here is a brief overview of the top elevator companies:

1. Based in Connecticut, U.S. Otis is one of the six units of United Technologies Corporation (UTC), a major defense and aerospace giant. Last year United Technologies’ s total revenue was about $59.7 billion. Currently the stock has a 2.20% dividend yield.

2. Kone trades on the OTC market under the ticker KNYJY. The company has a market capitalization of about $18.0 billion and the current dividend yield is 2.75%. The stock is rarely traded on the OTC market.

3. The German conglomerate ThyssenKrupp AG trades under the ticker TYEKF on the OTC market. It is one of the world’s largest steel producers.

4. Based in Ebikon, Switzerland, Schindler shares on the SIX Swiss Exchange.On Friday it closed at CHF 137.10 per share. In the past year the stock is up by over 25%. The Schindler and Bonnard families control 70.1% of the voting rights of the share capital. Schindler Holding AG is highly illiquid on the OTC market with the ticker SHLAF.

Note: Dividend yields noted are as of May 17, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions