“Sell in May and go away” is one of the popular Wall Street strategies. According to this concept, an investors is better-off selling his or her stock holdings in the month of May and then buying back in late in November. When trading volumes are traditionally low during the hot summer months as traders and fund managers head off to the beaches or the golf courses stocks tend to languish go nowhere. In theory, following this strategy an investors can avoid the travails of the direction-less markets. However the strategy has both supporters and haters.

From a 2012 article debunking this theory:

Larry Swedroe, head of research at Buckingham Asset Management, ran the numbers a few years ago using 30-day Treasurys during the off months, and says the strategy is bunk.

He looked at returns through 2007 from six start dates since 1950. “Sell in May” beat “buy and hold” if you started investing in 1960, 1970 and 2000, but not if you started in 1950, 1980 or 1990.

“It’s pure randomness,” Swedroe says. “How would you ever know when to start?”

Then there is the problem with using averages to say anything meaningful about stocks. If you know the average temperature for a month stretching back decades, you can pretty much guess how hot or cold that month will be this year.

But that’s not true with stocks. They move too widely above and below their averages in most years, and in most subsets of years, for those numbers to be used to predict where they’re heading.

Ken Fisher of money manager Fisher Investments says “Sell in May” is “garbage” precisely for this reason. He gives the example of September, which has dropped an average 0.72 percent since 1926. But the month has had many big up and down moves over 85 years. He says if you remove just two of the worst Septembers, stocks break even for the month.

“The average is made up of extremes,” says Fisher, who devotes a chapter skewering “Sell in May” in “Debunkery,” his book on investing myths. “If you steer by averages, you’re going to get thrown off.”

Source: Why ‘Sell In May’ Doesn’t Work, Huffington Post

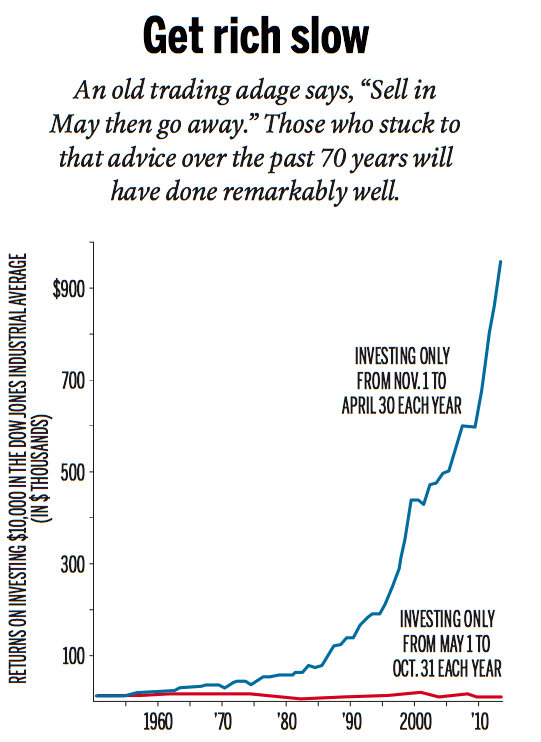

However a recent chart post in Canada’s Maclean’s magazine shows that the strategy does work based on investment returns in the Dow Jones Industrials Average:

Click to enlarge

Source: ‘Sell in May then go away.’ It really works, Maclean’s

While traders may follow this concept most investors can ignore it. It would be foolish for an investor to liquidate the entire portfolio in May and then buy back the same stocks later. Some of the issues that such investors should be aware of include taxes on any capital gains realized, losing out on dividends when stocks are not held, losing the “Qualified” dividends status, trading costs, etc.

The answer to my title question is “Sell in May and go away” may work for traders but not investors. This is especially true for long-term investors who are not swayed by the short-term gyrations of the market.

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Mid-Cap ETF (VO)

- iShares S&P MidCap 400 Index Fund (IJH)

Disclosure: No Positions