One of the ways to gain exposure to emerging markets is to invest in developed world companies that have a significant presence in emerging markets. Among the developed world companies, many large-cap European firms have big operations in emerging markets and derive a large portion of their revenue from those markets. Hence by investing in these European companies one can gain from the growth in emerging markets while avoiding the many risks of investing directly in emerging companies. Some of the risks associated with companies based in emerging markets include: lack of transparency, high state ownership or majority ownership by powerful wealthy families, lack of global diversification, etc.

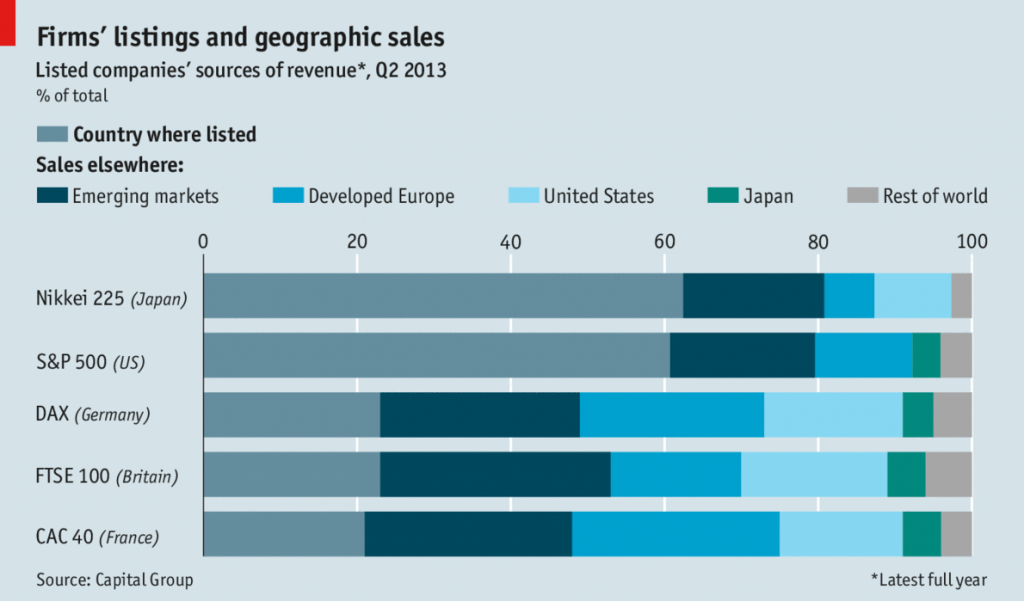

In addition to emerging market exposure, large European firms also offer exposure to other developed Europe, USA, Rest of the world and of course their domestic markets. According to a recent article in The Economist magazine firms in the benchmark indices of the UK (FTSE 100), France (CAC 40) and Germany(DAX) generate less than a quarter of their sales from their home markets.

Click to enlarge

Source: Firms’ listings and geographic sales, The Economist

From The Economist article:

Less than a quarter of the sales of companies in Britain’s FTSE 100 index are in Britain, according to Capital Group, an asset-management firm. Emerging markets and America account for 30% and 19% of sales, respectively. Germany’s and France’s main stockmarket indices show a similar phenomenon. Only seven companies in the FTSE 100 have “complete exposure” to the British economy, the firm says.

British, French and German blue chip firms earn about similar percentage of sales relative to the total sales from the US market. However their revenue from emerging countries is much higher than from the US. It is interesting that firms in the S&P 500 index generate about 60% of their revenue from the domestic market and their revenue from emerging markets is lower than their European peers. Similar to the S&P 500 firms, major Japanese firms also depend on their home market for most of their revenue. Hence investors looking to diversify globally can consider adding blue chip British, French and German stocks.

Ten constituents in the FTSE 100, CAC 40 and DAX indices are listed below with their current dividend yields for consideration:

1.Company: Diageo PLC (DEO)

Current Dividend Yield: 2.35%

Sector: Beverages

Country: UK

2.Company: AstraZeneca PLC (AZN)

Current Dividend Yield: 4.80%

Sector: Pharmaceuticals

Country: UK

3.Company: Vodafone Group PLC (VOD)

Current Dividend Yield: 4.15%

Sector: Wireless Telcom

Country: UK

4.Company: British American Tobacco PLC (BTI)

Current Dividend Yield: 4.14%

Sector:Tobacco

Country: UK

5.Company: Total SA (TOT)

Current Dividend Yield: 4.39%

Sector:Oil, Gas & Consumable Fuels

Country: France

6.Company: Lafarge SA (LFRGY)

Current Dividend Yield: 1.75%

Sector:Construction Materials

Country: France

7.Company: Sanofi (SNY)

Current Dividend Yield: 2.93%

Sector: Pharmaceuticals

Country: France

8.Company: Danone SA (DANOY)

Current Dividend Yield: 2.73%

Sector:Food Products

Country: France

9.Company: BASF SE (BASFY)

Current Dividend Yield: 2.38%

Sector:Chemicals

Country: Germany

10.Company: Siemens AG (SI)

Current Dividend Yield: 2.23%

Sector:Industrial Conglomerates

Country: Germany

Note: Dividend yields noted are as of Dec 24, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions