The astonishing growth of social media in recent years has not only changed how we communicate with one another but also changed the dynamics of disruption. Social media influencers with millions of followers for example, can launch a product and disrupt an established player selling the same product. By selling the same product at a lower price or a higher price these new entrants can grab market share from the big companies. Last year, Prime energy drink that was launched by influencers Logan Paul from the US and Olajide “KSI” Olatunji, who is from the United Kingdom became popular especially in the UK. The craze for the drink led to soaring prices and some even imported from the US.

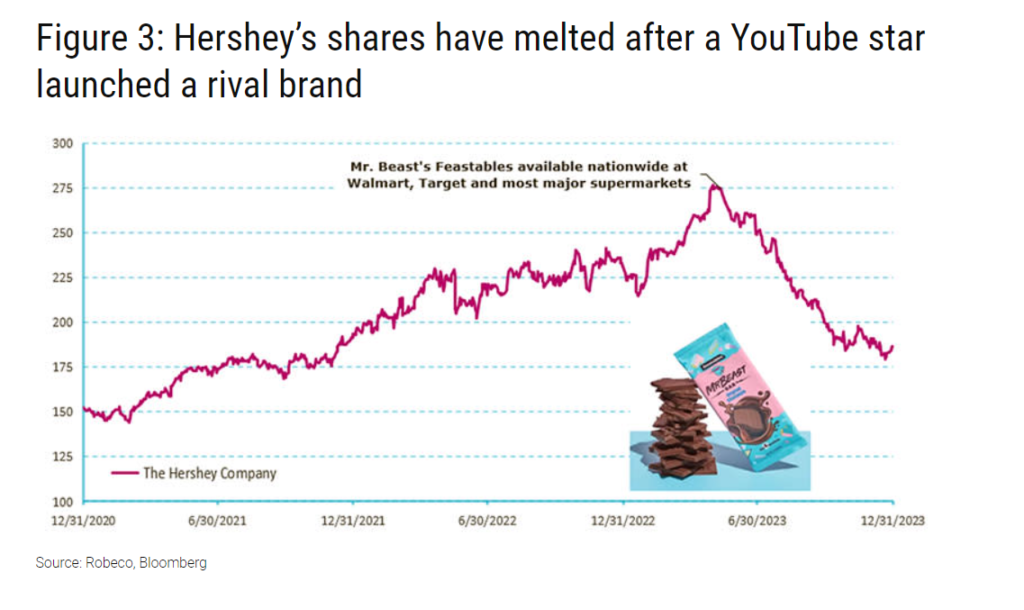

I recently came across an article where another social media influencer has disrupted the American candy giant Hershey Co (HSY). The following chart shows the impact of influencer Mr.Bean’s Feastables on Hershey’s stock price:

Click to enlarge

Source: Inflation and market dynamics, Robeco

In May 2023, Hershey closed at over $276 per share. Since then the stock has fallen to as low as $182. Yesterday it closed at $193.72.

Though the full decline in stock prices cannot be attributed to the influencer it still shows the power of influencers and their ability to take on multi-billion dollar giants.

Disclosure: No positions