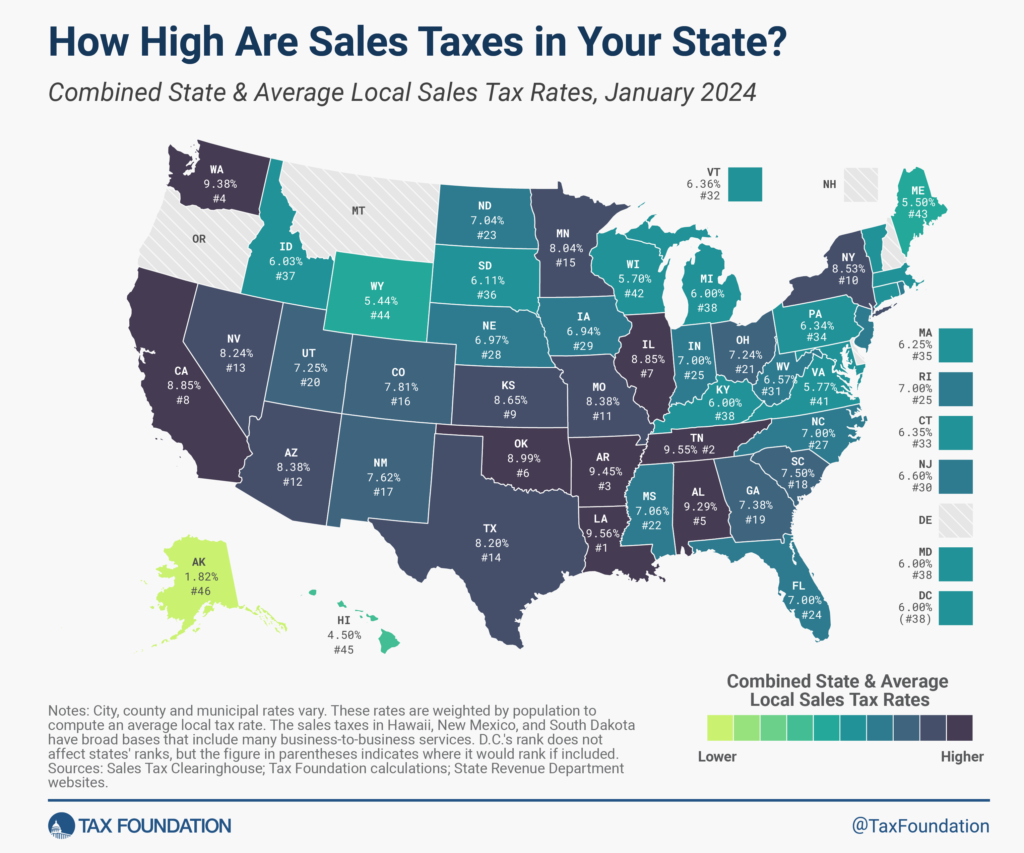

Sales taxes in the US are set by individual states. On top of the state taxes, local taxes are also levied by local authorities such as city, municipality or county. The combined state and local sales taxes vary by state. The following map shows the current rates as of Jan, 2024 according to The Tax Foundation:

Click to enlarge

Source: State and Local Sales Tax Rates, 2024, by Jared Walczak, Tax Foundation

Not all the states collect sales taxes. Only forty five states and the District of Columbia (DC) collect taxes. Louisiana tops the list at 9.56% followed by Tennessee and Arkansas. The five states that do not charge sales taxes are Alaska, Delaware, Montana, New Hampshire, and Oregon.

The full article at the above link has more interesting details.