A few days ago Barry posted a chart titled Who benefits from a higher minimum wage?. Obviously everyone except the labor doing the minimum wage benefits from this. For example, American farmers employing minimum wage workers to pick strawberries and other work profit handsomely from keeping the minimum wage at very low rates.This is on top of the billions that are handed out to farmers in subsidies. Another example would be corporations and ultimately the owners of corporations also benefit from minimum wage. Higher wages would lead to lower profits and that is against the purpose of a corporation’s existence.

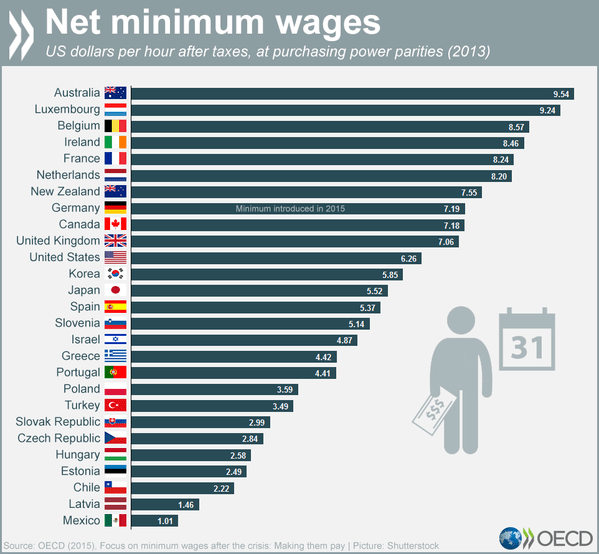

I came across an interesting chart that shows the net minimum wages of workers in OECD countries:

Click to enlarge

Some notable points:

- Australia has the highest minimum wages among OECD countries.

- With a Federal minimum wage of $7.25 per hour the U.S. ranks 11th in the list.

- Mexico has the lowest after tax minimum wage at just $1 per hour.

- In the U.S. a worker needs to work 50 hours per week to escape poverty while in Australia the same worker needs to only 6 hours per week to escape poverty.