Exchange-Traded Funds(ETFs) have soared in popularity in recent years. Today the ETF industry is huge and competes strongly against mutual funds.One can find ETFs of all shapes and sizes and ETFs are available to practically cover any asset class, region, sector, etc. In fact, the alphabetical soup of ETF available on the market can be intimidating for some investors. Despite the tremendous growth of this asset class there are plenty of pitfalls of owning them especially when compared to stocks. In this post let us discuss some of the advantages and disadvntages of ETFs over stocks.

Due to the wide avaialbility and depth of the ETF market, some financial advisors even suggest holding an all-ETF portfolio. This is not a wise strategy for a variety of reasons including some of the onesdiscussed below.

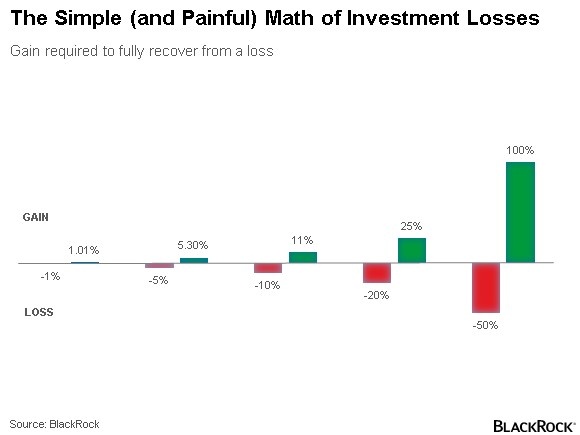

1. ETFs have many advantages including Transparency, Flexibility, Greater scrutiny and Versatility according to State Street Global Advisers’ Jo McCaffrey. However because they arederivate products they are also much more volatile than stocks or other under-lying assets. Due the recent volatile days, some ETFs including the iShares Core U.S. Value ETF(IUSV) plunged more than then value of the underlying stocks. This problem does exist for the most part with investing directly in stocks.

From an August Journal article:

Monday’s mayhem exposed significant flaws in the new architecture of Wall Street, where stock-linked funds—as much as shares themselves—now trade en masse on U.S. markets.

Many traders reported difficulty buying and selling exchange-traded funds, a popular investment in which baskets of stocks and other assets are packaged to facilitate easy trading. Dozens of ETFs traded at sharp discounts to their net asset value—or their components’ worth—leading to outsize losses for investors who entered sell orders at the depth of the panic.

The article noted a few examples of ETF price volatility that day. Here is one example:

For example, the $2.5 billion Vanguard Consumer Staples Index ETF and the $5.8 billion Vanguard Health Care Index ETF both plunged 32% within the opening minutes of trading. The Vanguard Consumer Staples ETF was halted six times over the course of 37 minutes early in the day, according to trading records. The health-care ETF was halted eight times Monday.

The declines in these and other ETFs were notable in that they exceeded the declines in the prices of their underlying holdings. In the case of the Vanguard Consumer Staples ETF, the value of the underlying holdings in the fund fell only 9%, according to FactSet.

Source: Stock-Market Tumult Exposes Flaws in Modern Markets, Aug 25, 2015, WSJ

2.Investing in ETFs involves fees paid to the provider.Even though this fee may be extremely small for some funds, they are still fees that eat away part of returns. Investing in stocks does not involve any recurring fees other than the one time trade commission for buying.

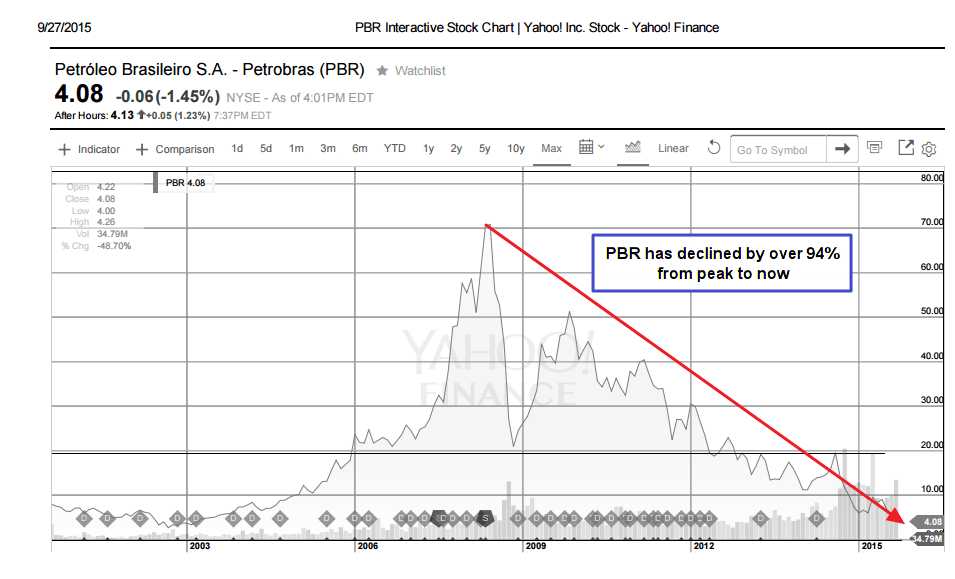

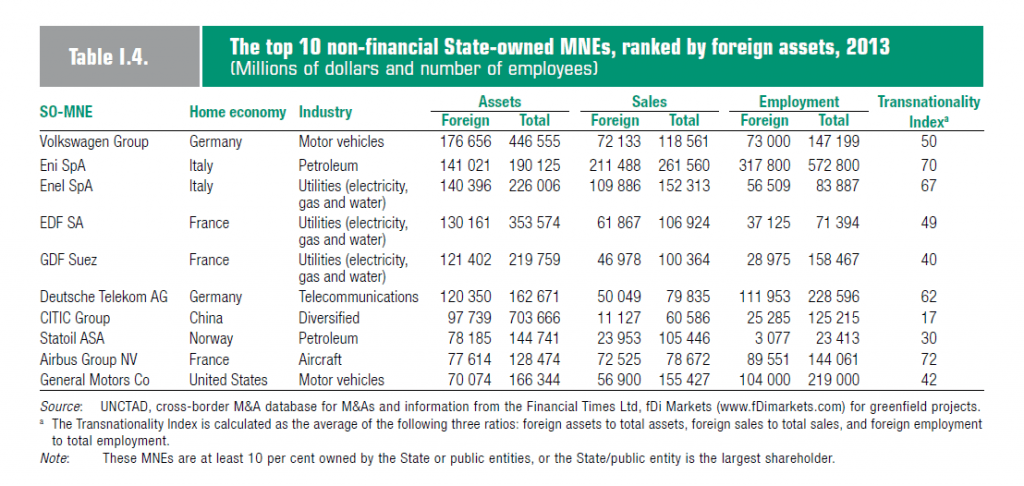

3. Some of the ETFs may not be well diversified and may have heavy concentration in certain sector or stocks. For instance, some country-specific ETFs have concentrated allocations to financials. Buying this ETF exposes an investor to high risk should financials tank. When selecting and buying stocks this problem can be avoided. With ETFs one cannot eliminate this risk since the fund’s positions are determined and selected by the fund managers.

4.If an ETF is not profitable for a provider to operate, the fund will be closed and the liquidated cash returned to fund investors. This is not an issue with equities since an individual investor can hold the equiity as long as he wants.

5.With stocks, when a company increases dividend the shareholder receives the higher dividend. This may not occurt with ETFs meaning even if the stocks held in the fund increase their dividends the fund itself may not increase the dividends paid out to fund holders. Other events that occur with holding equities such as company spinoffs, merger and takeovers, etc. are much more favorable for direct equity holders than ETF investors.

In summary, ETFs are suitable for some situations but not in all. Ideas such as building a portfolio using only ETFs should be avoided at all cost. Though ETFs can be traded all day unlike a mutual fund, investors do not invest in ETFs to trade. Traders are in the business of trading stocks, ETFs and all other products thats out there because it is their job. For most retial investors, holding a portfolio of widely diversified stocks and using ETFs to fill gaps will suffice.

Disclosure: No Positions