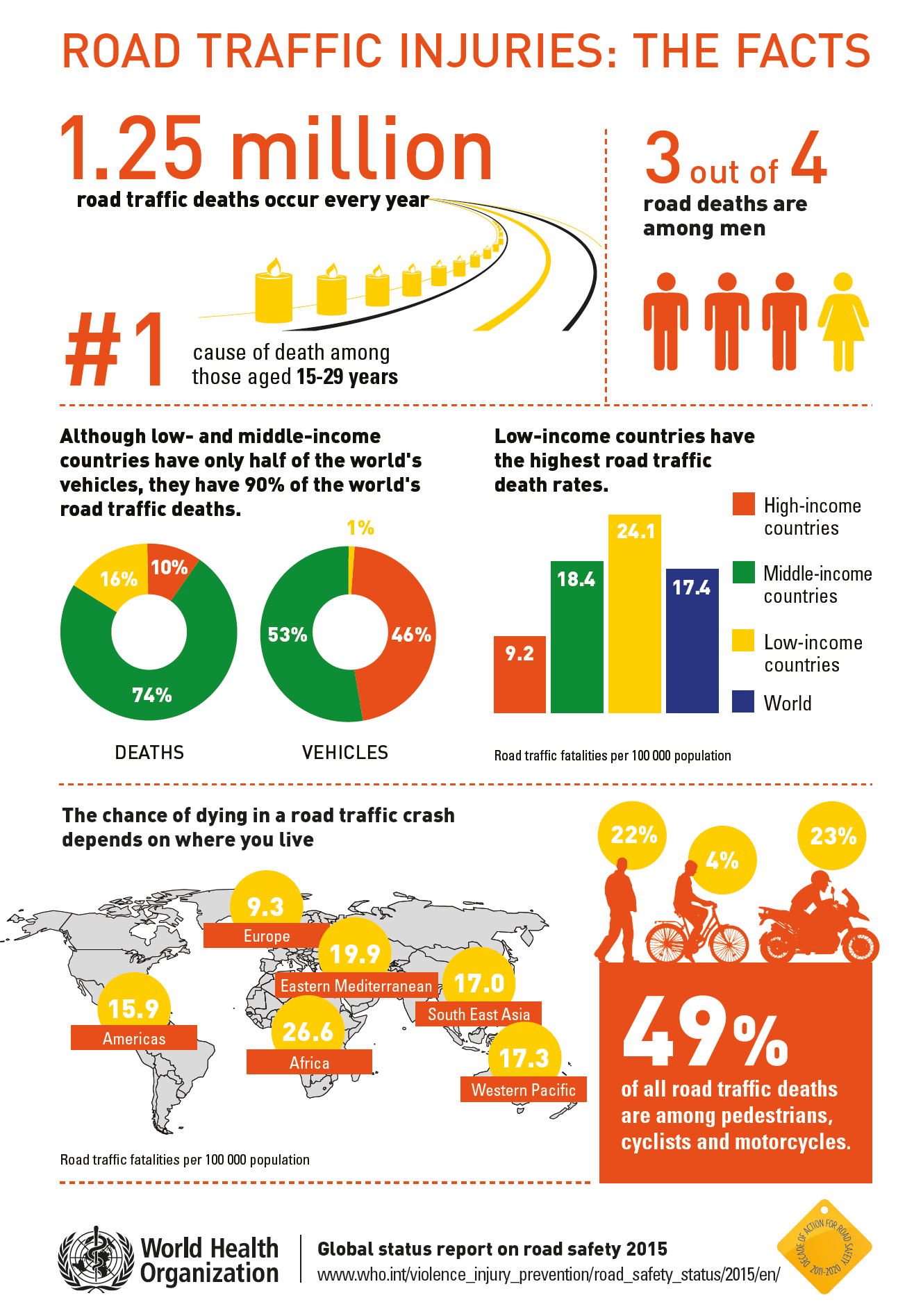

Some 1.25 million people die in road accidents according to the WHO. Developing and Frontier countries have much higher traffic road death rates than the developed world. High speed and lack or enforcement of road safety laws are some of the factors that lead to unnecessary death and injuries in those countries.

Click to enlarge

Source: Global status report on road safety 2015, WHO