When a baby is born, parents usually take time off to care of the newborn. In addition to mothers, fathers also take leave to spend time with the baby.

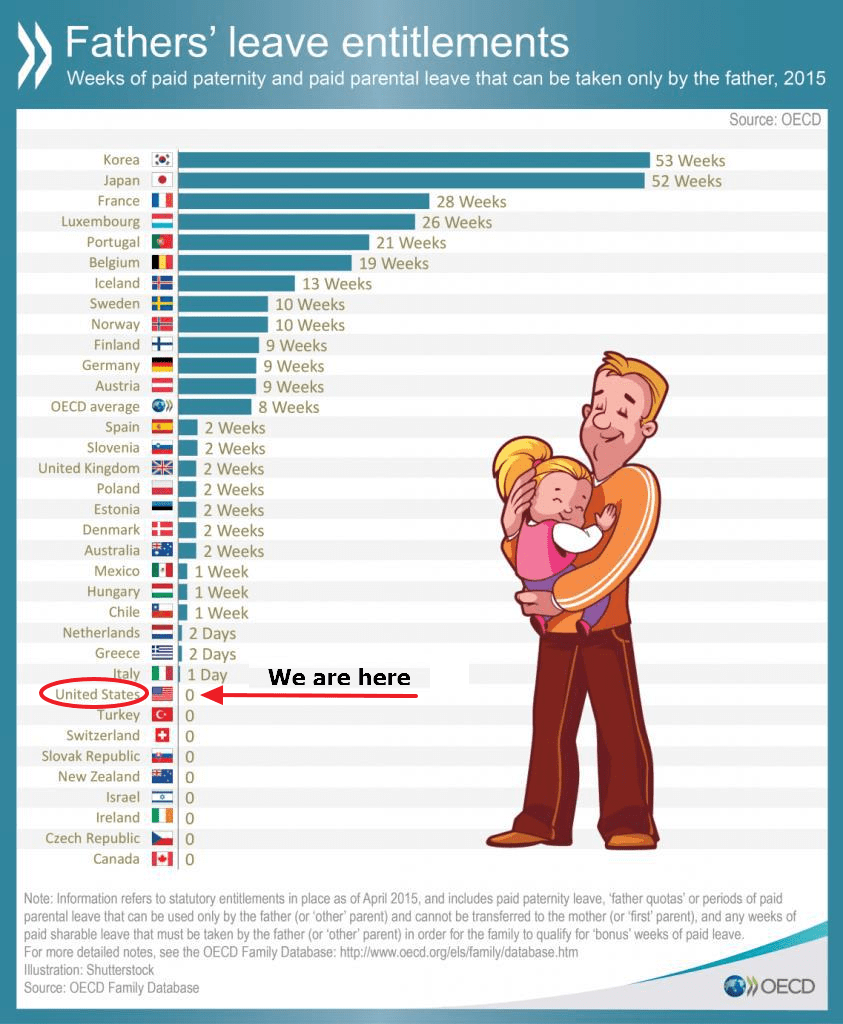

However paid parental leave for fathers by law tend to vary between countries. The following chart shows the Paid Paternity Leave for fathers by Country 2015:

Click to enlarge

Source: International Women’s Day: What fathers can do for gender equality, OECD Insights Blog. Mar 9, 2016

A few takeaways:

- The US gives no paid paternal leave for fathers. This is not shocking since even most mothers are not entitled to paid leave by law to take care of a newborn.

- South Korea and Japan offer a full year of paid leave for fathers but most men seem to make use of them.

- It is not just the amount of time off that is offered is important. The percentage of salary paid during the leave also matters. In this regard, Iceland and Sweden offer liberal amounts with paid salary at over 60 per cent of last earnings.