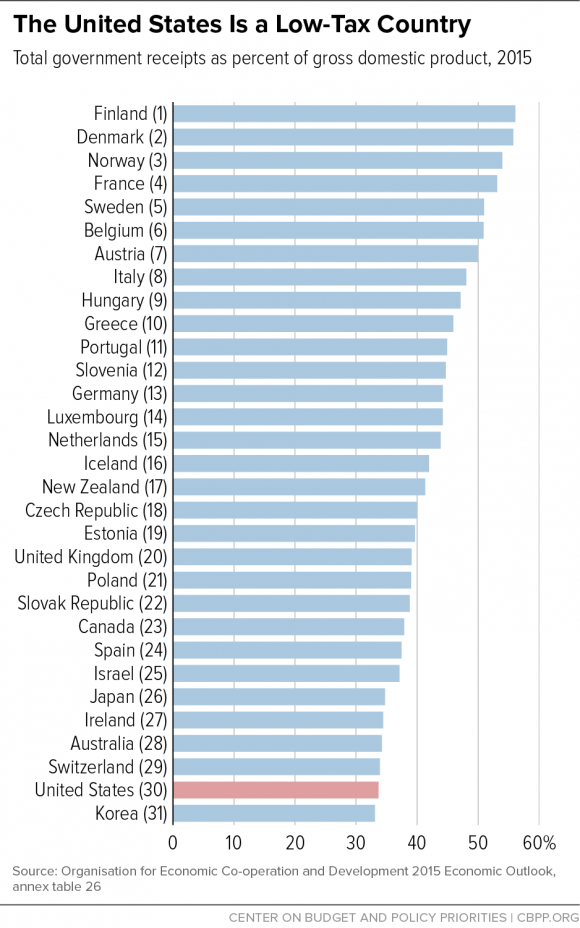

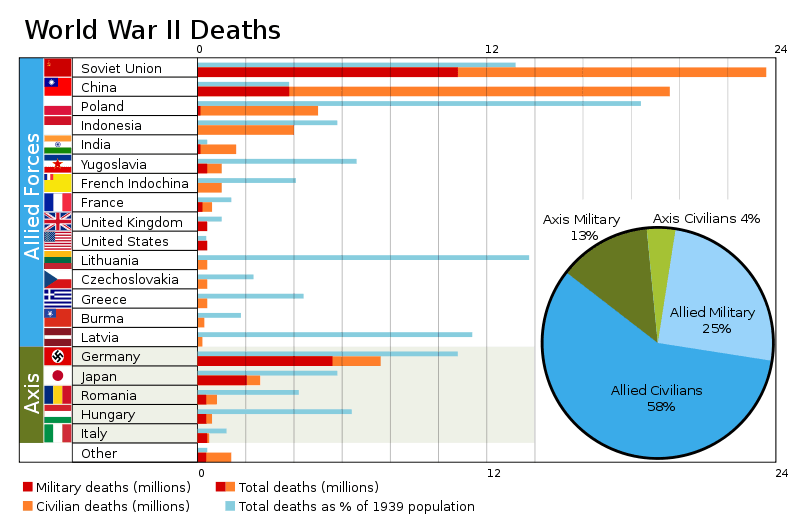

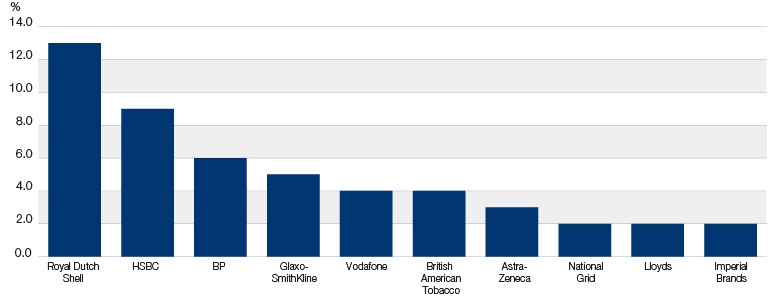

Dividend paid out by British firms are unevenly distributed with a few large players accounting for a large portion of the dividends paid out. Traditionally the British dividend landscape is dominated by firms in certain sectors such as mining, oil, utilities, tobacco, consumer staples and telecom.

In fact, according to a research report by Schroder’s the top 10 payers account for just under half of the total dividends of the UK market. This shows the scale of concentration in the British market.

Click to enlarge

Source: What are the prospects for dividends in the UK?, Schroder’s

The takeaway here is that income investors looking for British dividend stocks should focus on some of the large-cap dividend payers due to the high concentration of dividends paid. The British banking sector can be avoided at this time. But others like Astra Zeneca(AZN), Vodafone(VOD), etc. are excellent dividend stocks for the long-term investor.

Disclosure: No Positions

While Smith and Woodford were agreed on banks, they also share a fondness for tobacco stocks.Imperial Brands (

While Smith and Woodford were agreed on banks, they also share a fondness for tobacco stocks.Imperial Brands (