Countries in the Middle East have deep sectarian religious divisions. Many people in the western world are not aware that Saudi Arabia for example is mostly Sunni Islam while most in Iran follow the Shia faith of Islam.These two groups do not get along very well. Hence Saudi Arabia opposes the spread of Iranian influence and vice versa. Iraq used to be run by its late dictator Saddam Hussain who was a Sunni. When he was toppled power was transferred to a group of Shias. So the Sunnis are unhappy with this arrangement and are fighting the state there.

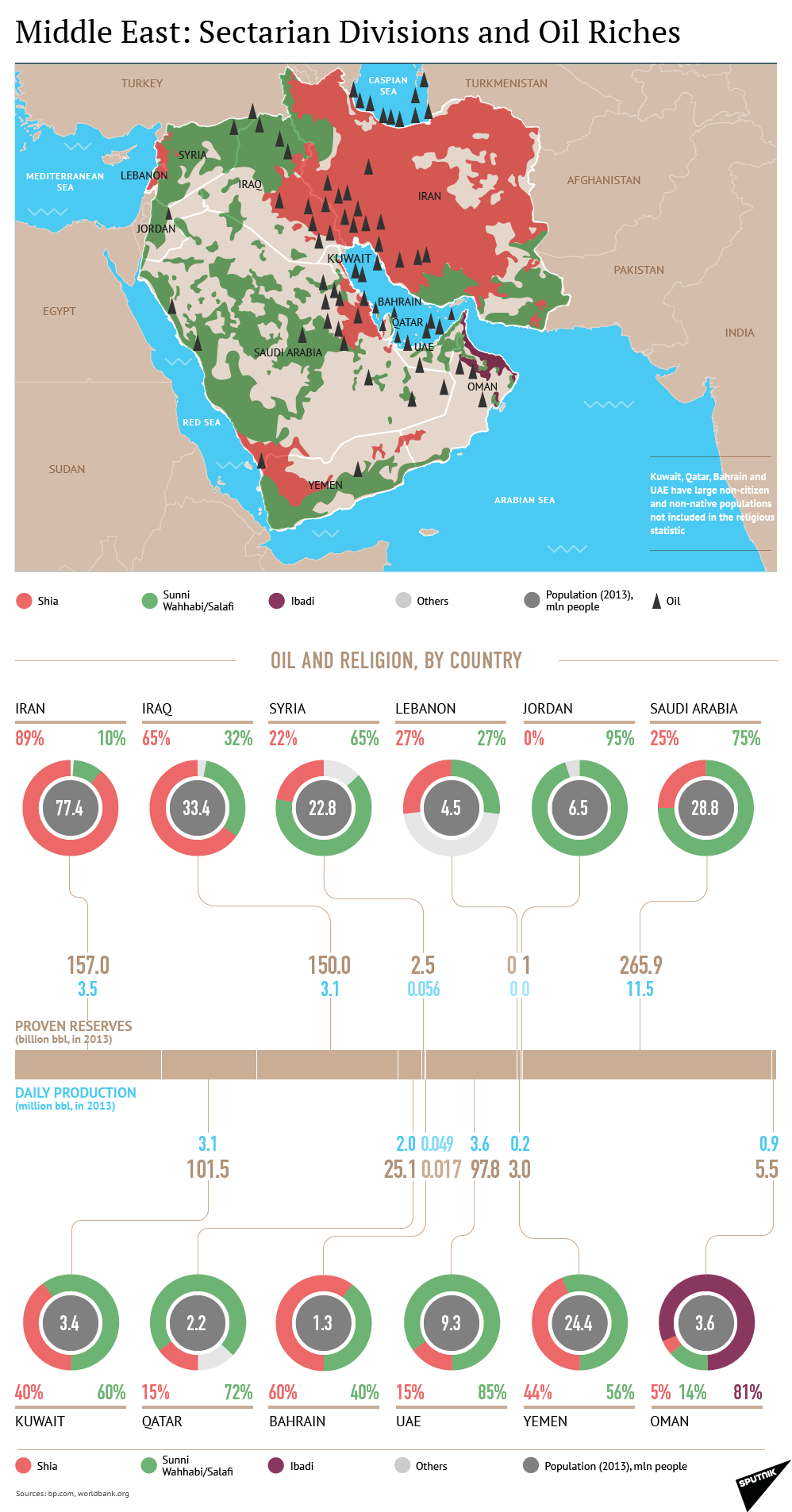

Here is an infographic that shows the religious affiliations and oil wealth by country in the Middle East:

Click to enlarge

Source: Middle East: Sectarian Divisions and Oil Riches, Sputnik

Update (5/10/16):

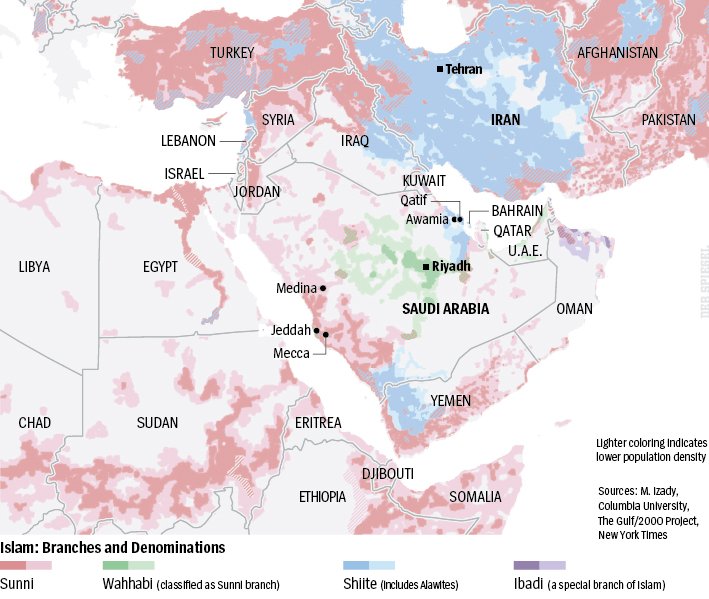

Source: Saudia Arabia and Iran: The Cold War of Islam, Der Speigel