Many developed European banks have been in a state of suspended animation for many years now. Though years have passed since the global financial crisis banks in Europe are still unable to recover and return to pre-crisis levels. British banks are no exception as well. Once known for their worldwide reach, excellent service and stable growth, major British bank today are a bad joke. British bank stocks have let down investors for years and years and there seems to be no light at the end of the tunnel. While banks in UK, followed their American peers in their operations, they failed to cleanup their balance sheets and raise capital after the crisis hit. A multitude of factors contributed to the slow and continued collapse of British banking including incompetent management, bloated branch numbers and employees, dithering by regulators, too late and high state intervention, inability to cut down expenses and earn profits, etc.

Here is an excerpt from an article on British bank stocks in FE Trustnet:

UK banks are cheap but not attractively-valued given the number of impending headwinds facing the sector, according to a number of star managers.

Neil Woodford, SVM UK Growth’s Margaret Lawson and Liontrust’s Stephen Bailey all warn against holding any of the larger incumbent banks due to a combination of precarious balance sheets, legacy issues and the current ultra-low interest rate environment.

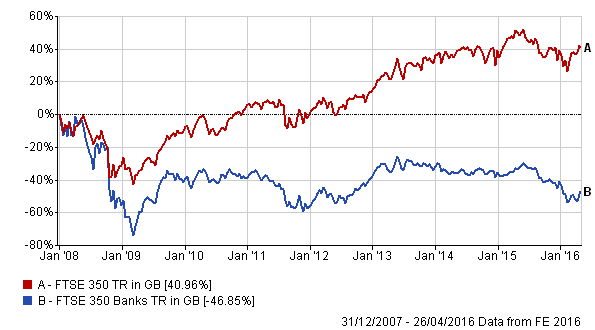

The UK banking sector has had a torrid time post the financial crisis, with the FTSE 350 Banks index underperforming the FTSE 350 by 87.81 percentage points since the start of 2008 with a total loss of 46.85 per cent.

A lack of trust since the crisis combined with a series of misconduct-related fines appears to have taken its toll on the sector, with many investors believing the firms to be opaque, unreliable and vulnerable to further regulatory penalisation.

Seeing as we’re in the midst of an unusually long economic cycle, which has led to toppy valuations across many equities, some deep value investors have been won over by banks’ cheap valuations.

Expecting steady and consistent dividend payments from British banks are still a far from becoming a reality.

Fellow FE Alpha Manager Stephen Bailey says that, while the best opportunities in dividend growth is within the financials sector, this doesn’t include any of the incumbent banks as he deems them to be unattractive and un-investable.

For instance, he points out that RBS has recently had to postpone its first dividend payment, Barclays has halved its dividends, Lloyds has paid a dividend but it was generated from capital as opposed to earnings and HSBC is paying an unfeasibly high dividend despite balance sheet strains.

Source: Should you avoid this attractively-valued sector?, FE Trustnet, April 27, 2016

Of the major UK banks available for trading on the US market, Barclays (BCS) is down about 21% year-to-date and closed today at $10.20.Fellow peer Lloyds (LYG) is trading at just over $4 a share and is down 5% YTD. The Royal Bank of Scotland Group is royal only in its name. Trading at under $8 a share it is nearly 17% so far. Standard Chartered PLC (SCBFF) closed at $8.17 today and HSBC Holdings plc (HSBC) if off by about 14%. A few months ago HSBC started a drama with plans to move its headquarters some place else outside of London. After many months of rumors and drama eventually it decided to stay put. This is an example of how British banks have a tendency to focus on things that are stupid and useless.

Investors looking at European financials can avoid the large-cap British bank stocks for now.

Disclosure: Long LYG