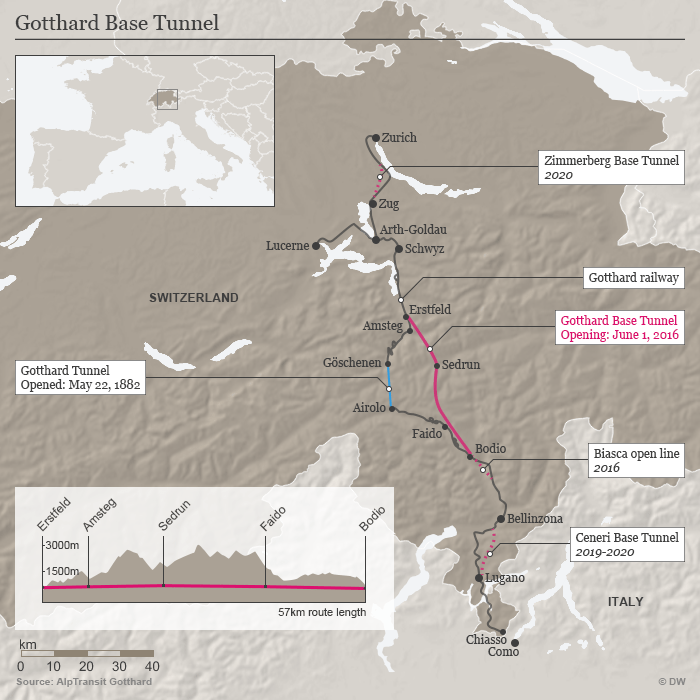

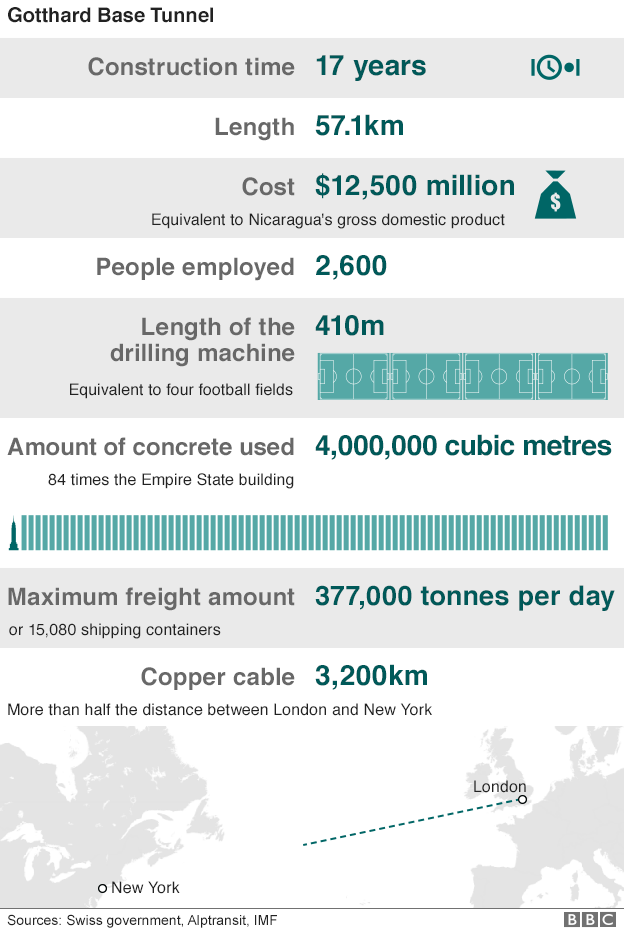

The Gotthard Base Tunnel (GBT) under the Alps in Switzerland is the world’s deepest and longest train tunnel. Tunneling began in 2002 and the 35-mile tunnel was opened in June, 2016. The entire project cost the Swiss $12.2 billion. The GBT would allow some 2oo to 250 freight trains daily to move freight from Northern to Southern Europe and vice versa. In addition passenger trains would also use the tunnel .

Here are maps of the tunnel:

Click to enlarge

Documentary Video:

Another short video:

Sources:

Exploring the world’s deepest and longest train tunnel, DW

Gotthard tunnel: World’s longest and deepest rail tunnel opens in Switzerland, BBC

Gotthard Base Tunnel (GBT), Official Site

The Science Channel

World’s longest rail tunnel opens through Swiss Alps (PHOTOS, VIDEOS), RT