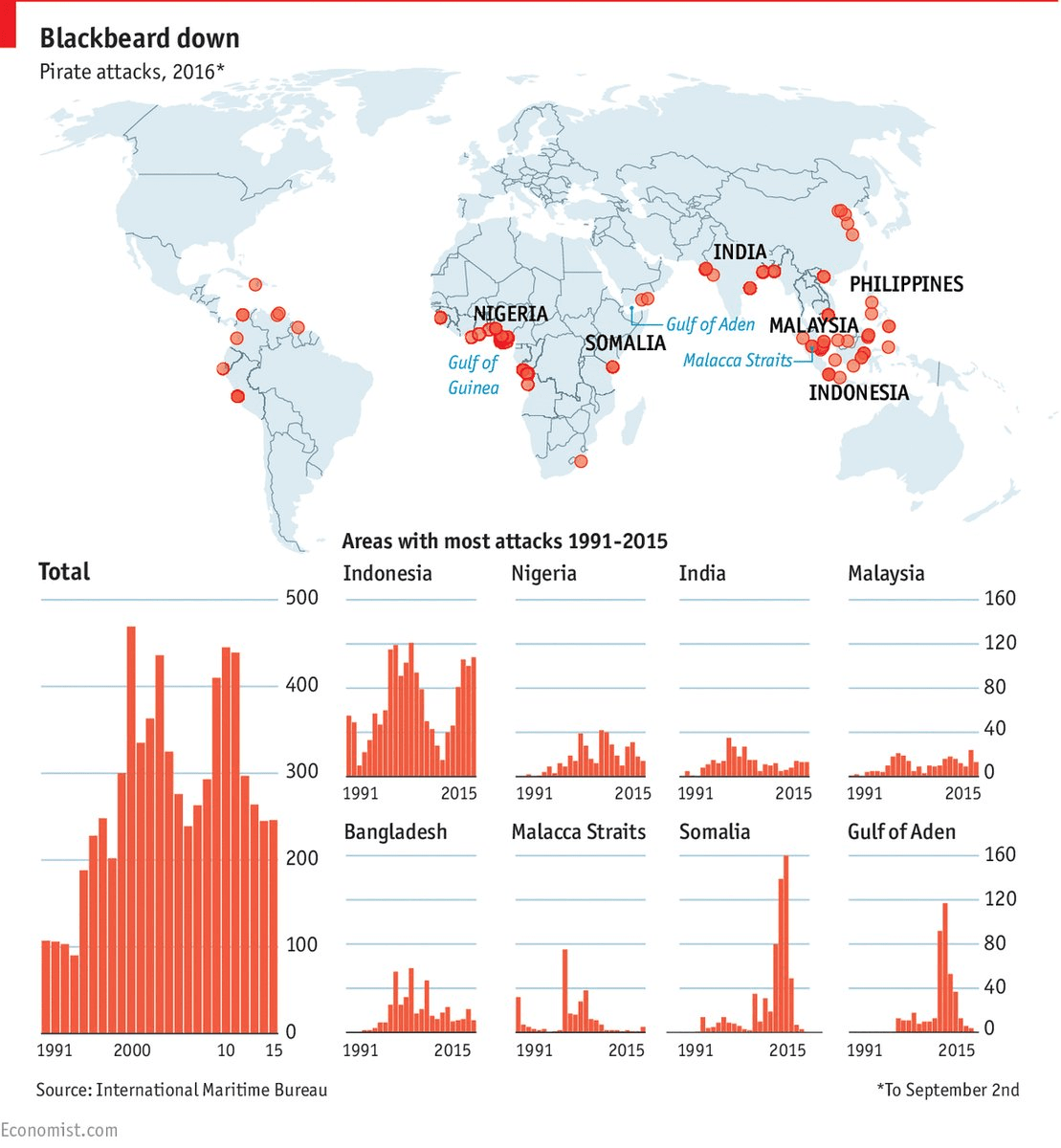

Piracy on the high seas is mainly an issue in the Southern Hemisphere. According to The Economist Nigeria has now overtaken Somalia as the major Piracy hotspot.

The chart below shows the major piracy hotpots around the globe and attacks from 1991-2015:

Click to enlarge

Source: The Economist via Twitter