- Health stocks: beyond politics (Fidelity)

- Emerging-Market Small Caps: A Distinct Growth Opportunity (Franklin Templeton)

- Five things investors need to worry about for the rest of 2016 (Financial Post)

- The great American make-work programme (FT Alphaville)

- Germany’s massive CA surplus set to decline (DB Research)

- Dividend sustainability: companies cannot squeeze the lemon forever (Money Observer)

- Top earners: Why did the 1% get so rich? (OECD Observer)

- Gold is still a good hedge when volatility rises (Blackrock Blog)

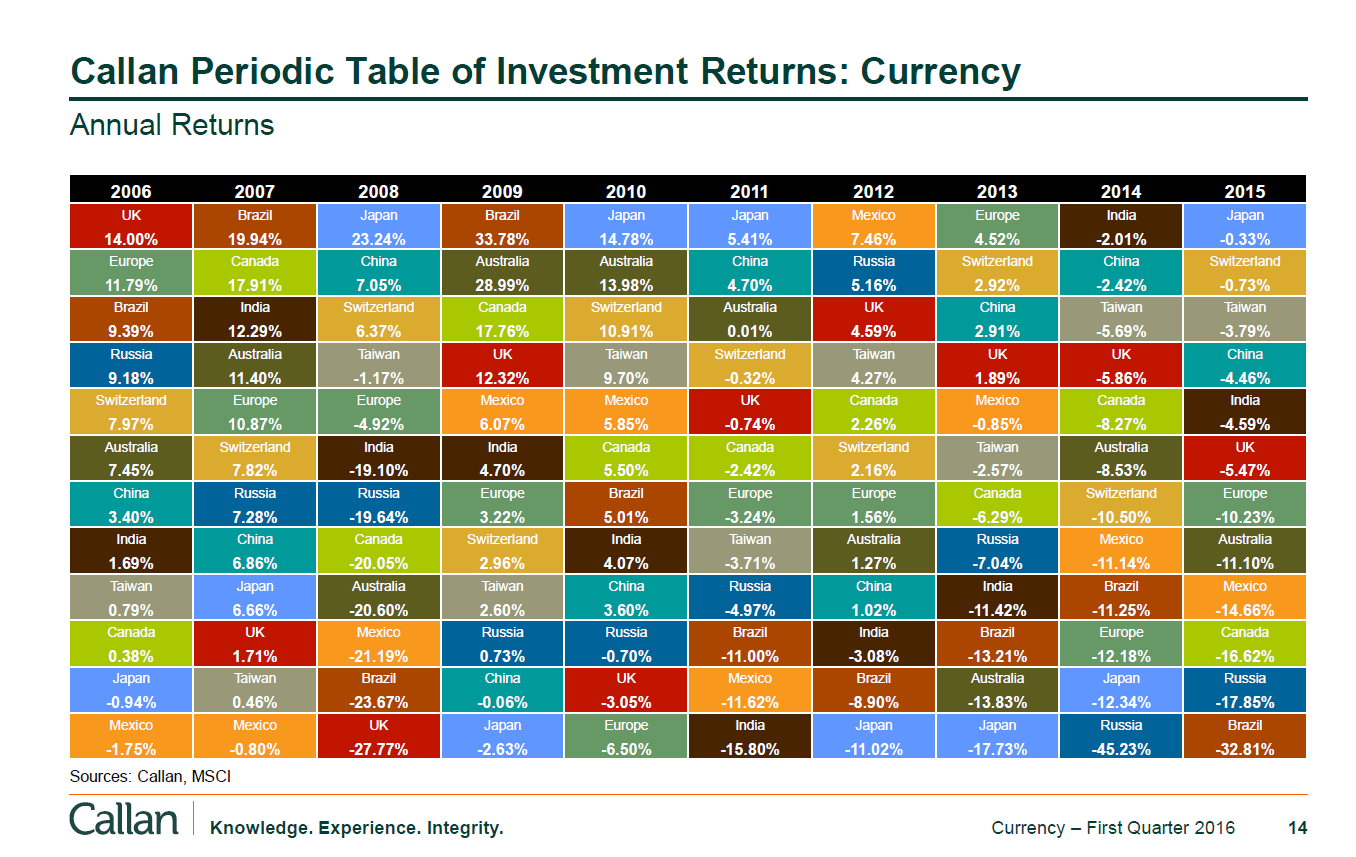

Click to enlarge