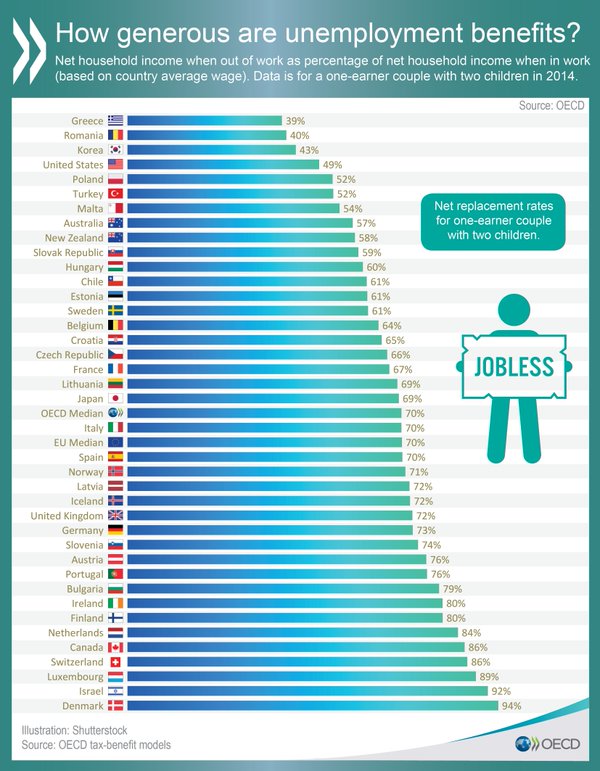

Unemployment benefits paid out to unemployed workers vary across OECD countries. Generally countries with socialist form of governments pay generous benefits to the unemployed in order to ensure they do not become destitute and are able to maintain their standard of living. However in order to be afford to liberal benefits these countries tax their citizens heavily in the form of social insurance, income tax, value-added tax(VAT), etc.

Unemployment benefits paid out to households across OECD countries based are shown in the following graphic:

Click to enlarge

Source: OECD

Denmark tops the ranking by paying 94% of household income that a family earned when in work. Canada also pays generously for a household meeting the criteria shown in the chart above.

Of the OECD countries, the US ranks the fourth lowest in terms of unemployment benefit payments. Only South Korea, Romania and Greece are worse than the US. The US rate is lower than the OECD median rate of 70%. One advantage of keeping unemployment benefits low and strict is that it forces the unemployed to find jobs sooner leading to a more productive and vibrant economy. Liberal unemployment benefits can sometimes be abused by some people. For instance, in some small towns in the UK a couple with two children get paid more in unemployment and social benefits than if they worked at a local restaurant or a grocery store. In such cases, they forgo the need to look for jobs and live a comfortable life as dependents of the state. Far from living a humble life with basic human needs, these people have things like the latest smartphones, flat-panel TVs, internet, family minivans, nice house, etc.